Over-Arching Sovereign Debt Crisis

Economics / Global Debt Crisis Feb 23, 2010 - 02:37 PM GMTBy: Jim_Willie_CB

Neither the US financial press nor the US bank leaders take the sovereign debt crisis seriously. Even the USCongress seems totally unaware of the growing global intolerance for government debt out of control. The issue is rollover of short-term debt, size of the overall debt burden, borrowing costs to sustain the debt, annual deficits that accumulate further debt, and size of debt versus economic size. The United States projects a certain degree of arrogance that foreigner must continue to finance the USGovt debt at a time when the evidence gathers on loud suspicious activity in the USTreasury auctions.

Neither the US financial press nor the US bank leaders take the sovereign debt crisis seriously. Even the USCongress seems totally unaware of the growing global intolerance for government debt out of control. The issue is rollover of short-term debt, size of the overall debt burden, borrowing costs to sustain the debt, annual deficits that accumulate further debt, and size of debt versus economic size. The United States projects a certain degree of arrogance that foreigner must continue to finance the USGovt debt at a time when the evidence gathers on loud suspicious activity in the USTreasury auctions.

The US travels down a road to debt default also, as the mask of corrupt USTBond management is removed. The plight of Europe will strike the United States and United Kingdom, as contagion is ripe. The claim of containment incites laughter. The Euro currency has finally begun to stabilize, which will make all the more apparent a global bull market in the Gold price. The Gold price in almost every major currency is rising. In the US$ it will be last.

US TREASURY AUCTION BID RESULTS

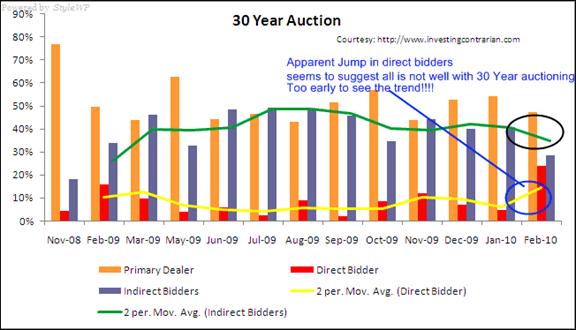

Analysts have noticed the drop-off in Indirect Bids, which means central banks participate less. Analysts have noticed the lack of identification of Direct Bids, which means the USGovt is lying through their teeth as they monetize the debt. Analysts have noticed the new ledger item called Household as bidder, which reeks of accounting fraud in creation of a catch-all category. The USFed and USDept Treasury can no longer hide their enormous monetization of USGovt debt. Some reports mention that bond professionals are extremely anxious about the results of recent USTreasury auction. A huge jump in the Direct bidders took 24% of the auction supply. The apparent lack of transparency behind this group has increased speculation that the USFed could be directly buying its own auctions, so as to prevent both an auction failure and a sudden rise in yields. Safe haven, my foot!

Indirect bidders is widely viewed as the most important category. It defines the success or failure of the auction, since foreign central banks are entered from this category. A 30-year bond auction came in with a pathetic 28% bid as Indirect, far below the 36 to 40% levels seen across year 2009. This is worth watching for establishment of trend before billboard alarms (AMBER ALERT) are made. The Direct bid ratio (in yellow) looks fishy. The USFed & USDept Treasury would use this category to attempt to hide the elephant in the living room, calling it an extra oversized sofa. Failure to identify these mythical bidders will fuel speculation of devious concealment of monetization, far greater than the official Quantitative Easing programs that are heralded as coming to an end in mid-March. The ugliest deception is the usage of the Household category to pretend that Fannie Mae and its fat gang of sewage treatment managers are actually buying USTreasurys. Press networks are oblivious to the con game. See past Hat Trick Letter member reports for details, fully cited and analyzed.

A napkin argument is relevant here. The foreign accumulation of new USTreasury debt is tiny compared to what USTBond debt is issued and auctioned. Nobody seems to be capable of primary school mathematics, once graduation to Wall Street and USGovt service is achieved. If new debt is five times what foreigners are buying, then after factoring the domestic bond fund absence like PIMCO (they hate bonds nowadays), one can quickly conclude that the USFed/Treasury tarnished tagteam are monetizing 60% to 80% of all new debt issuance. Isolation is here, but must be more fully recognized.

USTREASURY DEFAULT RUMBLINGS

The Greek tragedy has an American conclusion. It is written in stone, but US leaders and the US population are blinded by a generation of dominance and privilege, turned hegemony. Like a tsunami, the tragedy will strike the WashingtonDC shores and rip its financial seawalls. A sequence is at work, with Southern Europe next in line, then England, finally the United States. The financial foundation data demands it. The denials ignore reality. The isolation of the USGovt debt finance machinery, and exposure of its abused Printing Pre$$ assure a default event, or at least a path to such a default. It will probably not be recognized any more than the 911 coup d'etat over eight years ago by the security establishment.

Little do the US bankers and leaders seem aware, but the Greek crisis will circle the globe and strike America. The initial gong was Dubai, actually with a prelude in Iceland that smacked both British and Dutch banks. Dubai hit home, since it meant the credit crisis had struck again, the problem not resolved. In fact, nothing has been resolved, as all things debt related are greater in magnitude and suffering from worse leverage. The PIIGS nations of Europe are all soon to be swept away and forced to suffer the shame of debt default, a return to former domestic currencies, and steep currency devaluations, amidst considerable contract adjustments. The sovereign debt crisis will be be confined to the smaller European nations. It will spread to the United Kingdom and the United States, the greatest debt and bond offenders. They have abused debt in sustenance of financial asset bubbles kept aloft in grandiose juggling acts.

They have abused debt to preserve relics of an empire long faded. What we see is a fiscal crisis of the Western world. The faulty foundation for the Euro currency and EU economies is the crux of the current problem under the microscope, since no mechanism exists for a bailout of any government by the European Union, other member states, or the European Central Bank. Short of withdrawing (or being expelled) from the European Union, the only options for Greece are to reduce the deficit, default on government debt, or receive a bailout. No decision will be quickly or easily reached. As stated before, German leaders will pretend to offer assistance, attach difficult conditions for aid, and walk away when not met. They want expulsion and an end to $300 billion in annual welfare for wrecked nations carried in the South, a grand impairment to the German savings and standard of living.

The flaws of chronic government deficits, expanding government functions, and fractional banking have resulted in what Niall Ferguson of the Financial Times calls the fractal geometry of debt. Most Western economies are vulnerable, including the largest, as contagion is ripe. The Keynesian approach has very possibly run its course, without recognition by those who continue to pull its debt levers and expect similar effects as seen 20 years ago.

For two years, the Hat Trick Letter has claimed a painful systemic cycle is in progress in a global restructure of monetary and banking systems. Governments find themselves helpless to promote growth, as the hallowed multipliers are out of gear altogether. Stimulus rings hollow. Globalization has rendered the older industrialized economies vulnerable, with their higher wages, pollution control costs, and regulatory burdens. The increasingly common practice of pushing sovereign debt to short-term scheduled rollovers has begun to backfire. Clinton & Rubin started that trend, now in backfire mode.

Debt default, just like for businesses, tends to occur when debt rollover cannot be refinanced. As the crisis intensifies inside Europe, the USDollar rises. Funds are in migration away from the Euro currency wherever possible. The rising US$ exchange rate actually weakens the prospects for a USEconomic recovery, where re-industrialization is urgently needed. That is correct. The US must rebuild its factories and promote export businesses, a reform nobody in the USCongress or Wall Street dare mention. The higher US$ exchange rates translate to a double edged sword, higher export prices from the US producers and higher cost structures to the foreign economies. See the commodity index in Euro terms. The bankers and politicians in Europe must halt the Euro decline, or else face rising systemic costs across the European Union economy. The stimulus for exporters with a lower Euro has a backfire to control, with costs. Their price inflation at all levels is rising fast. Watch the Euro stabilize.

RECOGNITION OF HIGH US DEBT RISK

USGovt debt is a disaster, not the least a safe haven. The new 2010 budget is projected even by White House estimates to exceed 100% of GDP within two years. The long-run projections of the US Congressional Budget Office suggest that the US will never again run a balanced budget, as in NEVER. Both this year and last year, the federal deficit is near 10% of GDP, the size of the national economy and new standard measure of limited tolerance. Heavy debt burdens, in addition to diverse insolvency (in households, federal, banks, and trade) create a tremendous drag on economic growth.

Two main forces prevent higher USTreasury Bond yields. Purchases of USTreasury and USAgency Mortgage Bonds by the USFed and USDept Treasury in major monetization operations is the domestic solution. Purchases of the same bonds by Chinese, Japanese, British, and OPEC nations is the foreign solution. With the mid-March plan to halt the USGovt official Quantitative Easing program, and the outright sales by the Chinese of USTreasurys, the ISOLATION HAS BEGUN. The risk stands squarely with the USDollar. JPMorgan will secretly continue to buy USTBonds and control long-term rates the usual way, by force, by usage of Interest Rate Swaps, their secret weapon. Not only USTreasurys in a bubble, they are the most corrupted market.

Last week Moodys Investors Service warned that the Aaa credit rating of the USGovt should not be taken for granted. The premier rating will come under pressure in the future unless additional measures are taken to reduce chronic budget deficits. Niall Ferguson wonders about the clarion call by Larry Summers, who asked the quintessential question before he returned to work for the Obama Admin. Summers appropriately asked, "How long can the world's biggest borrower remain the world's biggest power?" Upon reflection, the sovereign debt crisis of the West has begun in Greece, the birthplace of Western civilization. Soon it will traverse the channel to Great Britain, the home of the last great Empire. The crisis will reach the last bastion of Western power, on the other side of the Atlantic. The United States will face a steady stream of powerful shocks to its sprawling Empire, supported in recent years by deep bond fraud and military aggression, not a good combination. The global reserve currency will not prevent the credit crisis from hitting USGovt debt. My forecast is for a technical USTreasury default, without full recoginition, even while the USGovt is given a triple-A rating out of largesse mixed with intimidation. Refer to coerced debt forgiveness.

Taleb advises a short of USTreasurys. He points to a broken USGovt fiscal condition, reckless bank leadership, and a situation actually worse than a year ago (not better). Nassim Taleb, author of "The Black Swan" advises the entire planet earth should invest against the USTreasury Bonds, and to anticipate their decline. He was specific, that as long as Bernanke is USFed Chairman and Lawrence Summers is White House economic adviser, the Obama Admin will conduct policy in a manner to bring a path to ruin for USTreasurys. In the last two years, the USFed and USGovt have lent, spent, or guaranteed $9.66 trillion to lift the USEconomy from the worst recession since the Great Depression, according to data compiled by Bloomberg. The results have hardly even achieved stability. Conditions have deteriorated enough to result in annual $1.5 trillion budget deficits, mostly inherited from the past administration.

Taleb said, “Deficits are like putting dynamite in the hands of children. They can get out of control very quickly. The problem we have in the United States, the level of debt is still very high and being converted to government debt. We are worse off today than we were last year. In the United States and in Europe, you have fewer people employed and a larger amount of debt. Democracies cannot handle austerity measures very well. We are going to have a severe problem." He referred to cutting USGovt spending, without mention of the endless wars and grandiose siphons of funds by Wall Street and the Pentagon. Fiscal spending cuts are to occur in the Second Half, as in year 2012.

The litmus tests of USTreasury deep instability are A) the recognized monetization of USGovt debt, B) the size of the USGovt deficits, and C) the inability for the USEconomy to recover from insolvency. All three tests are in the process of failing here and now, raising attention for eventual default. As a result, Moodys issued a statement on the USGovt debt rating. It should be junk bond B level grade. Some claim that none of the major debt rating agencies will downgrade the USGovt debt. It could happen. Moodys stated, "The ratios of general government debt to GDP and to revenue are deteriorating sharply, and after the crisis they are likely to be higher than the ratios of other Aaa rated countries. If the current upward trend in government debt were to continue and become irreversible, the rating could come under downward pressure. The trend and the outlook would be more important than any particular level of debt." The more likely outcome is a serious decline in the USDollar after a more clear certain path for Europe. A repaired, reformed, renewed smaller Euro currency would be the potential death knell for the USDollar. The European continent will consolidate, an event certain to return attention to crippled USGovt and USEconomic financial conditions.

EURO CURRENCY UNCERTAINTY

The continent of Europe has never been more uncertain in its future in at least three decades. The European Monetary Union had a flawed plan for shared common currency usage, whose failure was forecasted (not by the Jackass) by critics to its architecture upon its birth in 1989. In the last several weeks, the plight of the deeply indebted and broken insolvent Southern European nations has dragged down the Euro currency. Uncertainty abounds on eventual debt rescue for Greece. For hereditary genetic reasons, for national welfare backlash reasons, for systemic design deficiency reasons, the Euro will not face ruin, but instead face consolidation. Germany leads the process, and will force out Greece, then Italy, later Spain & Portugal. Their nationally marked Euro Bonds have been trading at non-German levels for over two years. Such is a clear indication of multiple Euros masquerading as a common currency, inviting arbitrage and breakdown.

The Euro currency chart shows signs of stability. The stochastix have been oversold for two solid months. The price action in the last two weeks seems to loudly indicate stability in the Doji Stars, marked by open and close nearly equal, but with noisy intraweek high and low. The technical traders in the vast FOREX pits have started to cover their massive shorts. The attempt to establish the Euro as the basis of a new carry trade will be interrupted by the Germans, who will let Athens go. The Greeks will not be able to make interest payments. The nasty fact of life is that Greek Govt debt is scattered all over banks in Germany, France, England, and Switzerland. So expect powerful ripple effects to debt default and bond writedowns. A key to watch is riots. The Gold price will rise in US$ terms when the Euro shows signs of a leveling process. One warning signal to keep an eye on is the 20-week moving average crossover of the 50-week moving average. The Doji Stars oppose the MA Crossover, the former hinting of a rally upward, the latter hinting of a continued leg down to the 130 level.

A predictable aberration is evident. Whenever the USTreasurys look like they are on the brink of a meaningful breakdown, a Stock decline occurs, and funds flow heavily into USTreasurys. Last week, the Gold/Euro price chart showed an early breakout. The Gold price in Euro terms should be interrupted when the Euro achieves some stability.

The beginning of a rally in Gold in all currencies seems underway, a movement kicked off by the European debt problems. The Gold breakout in Euro terms is possibly soon to be joined by breakouts of Gold in British Pounds, Gold in Japanese Yen, and Gold in Swiss Francs, with the Gold breakout in USDollars last. When the surge is universal, Gold will be perceived as a currency in full direct competition with the tainted fiat paper currencies! The critical lack of gold bullion in the London metals exchange sets the stage for numerous events shrouded in breakdown, and a broadly rising Gold price.

Do not be fooled by a correction in the Gold price in US$ terms. It is rising across foreign currencies, in an environment of extreme gold bullion shortage. The end of the Q1 gold price correction is near. Many investors sense nothing happening in the gold arena. Not true! The entire foundational structures for the fiat monetary system are crumbling under the financial market floors. The support pillars are fragile and weak if not vanished and missing. The Powerz keep the game going mainly to perpetuate their trillion$ frauds further. Reform and remedy is not their plan. The objective is theft and pillage to the end.

VULNERABLE EUROPEAN BANKS

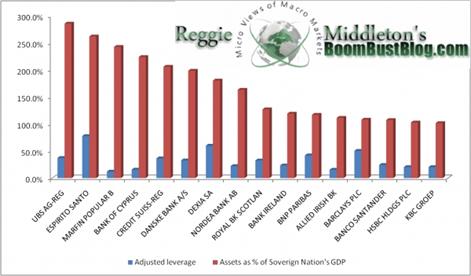

A Pan-European sovereign debt crisis is unfolding, appreciated in Europe, minimized in the United States. After removing mountains of ruined bonds from private banks, government debt risk is extremely acute. A trade took place, transferring risk from big banks to the government balance sheets. In the process, sovereign debt has weakened dangerously even as the debt problem has been amplified. The implicit leverage has effective been increased, but without benefit of the natural firewalls installed at financial institutions. Furthermore, and worse, European banks have an order of magnitude more assets than their economic size. A default cascade comes, as leverage is out of control. A run on private banks is assured. For at least Europe, it is game over as debt is not resolvable and tolerance is nil. The Greek chapter might be a diversion from the core problem soon to erupt. Excess liabilities and leverage make for a witch's brew. The de-leverage process will knock many structures to the ground. Europe has a recent history replete with riots in urban streets, more than anywhere in the western world. Expect riots across all Southern Europe. Instead of a domino effect like what was feared by the Lehman collapse, a domino effect is at risk of slamming sovereign debt on a global basis. The process is beginning. See the mammoth private bank assets, which easily eclipse their national economic sizes. Leverage is enormous in Europe, just like in the United States and England. Notice several Greek banks with adjusted leverage of nearly 90 times, whose assets are nearly 30% of the Greek GDP. Thanks to Reggie Middleton for an excellent graph, and an excellent point to make.

DOOMED SOVEREIGN ALCHEMY

A leading bank analyst believes that ultimately, sovereign alchemy will fail. Egon von Greyerz is manager of the Matterhorn Asset Mgmt fund. He said, "When we look at the world economy today, wherever we turn, we see a wall of risk. And sadly this is an insurmountable wall of risk with risks that are totally unprecedented in history. There has never before been a potentially catastrophic combination of so many virtually bankrupt major sovereign states (US, UK, Spain, Italy Greece, Japan, and many more) and a financial system which is bankrupt but is temporarily kept alive with phony valuations and unlimited money printing. But governments will soon realise that they are not alchemists who can turn printed paper into gold. The consequences of the global financial crisis are potentially catastrophic." He describes an era coming to a close. The era was identified by a grand illusion, that governments through their central bankers could create prosperity from virtually unlimited money creation, vast expansion of debt, and migration away from industry. It will end in disaster. See "Sovereign Alchemy Will Fail" on the Matterhorn website (CLICK HERE).

Von Greyerz makes several key points. Investors have ignored the risks of excessive debt. They have bid up the stock and bond markets, even reduced the important spreads in bonds versus government type. He wrote, "All the so-called experts have declared that it is impossible to identify the problems in the financial system in advance. For example, Greenspan, Bernanke, Geithner, other central bankers, and government officials as well as Blankfein of Goldman Sachs and many bank heads have all stated that they could not see it coming. Either they are lying or they are stupid. Sadly, it is most likely the former... The plight of the US states is just as bad. Out of 50 states, only 4 are expected to have a balanced budget in 2010. Up to 40 states, including California, New York, Florida, Illinois, Michigan, Ohio, North Carolina, and New Jersey, are virtually bankrupt. It took almost 200 years for US Federal debt to reach $1 trillion which it did in 1981. In 2009 the debt increased by $1.9 trillion in just that year to $ 12.4 trillion. In the next ten years the US debt is forecast to reach $ 25 trillion." Debt is accelerating, typical of any bubble. Its finance will be impossible.

The policy choices are all bad, since bankers and politicians (owned by bankers) have backed themselves into the corner. What remains are 'Lose-Lose Options' clearly. Governments must continue to borrow and print money or they can reduce government spending. Each choice leads to ruin. Proposed austerity programs forced upon European nations are better described as Poison Pills, the outcome of which is a death spiral in debts and economic recessions. The travesty is seen with imposed national deficits forced upon Greece, and soon Italy & Spain, below the 3% level. Not one single country within the EU is below the 3% limit versus GDP, not even Germany. And the effect of the austerity programmes will lead to such a major contraction of the economies that tax revenues will collapse, further exacerbating the plight of these countries.

The alternative for governments, within the crumbling European Union and the deteriorating United States, is to print or borrow more money. Against a backdrop of rising deficits, rising unemployment, and persistently insolvent banking systems, they have no choice. The end game will be paved by hyper-inflation, worse than even what is seen today. Von Greyerz wrote, "Both the UK and the US are set upon a course of self-destruction. We will see trillions of pounds and dollars printed in the next few years. But the only buyers of these government securities will be the US and UK governments. The rest of the world will dump their holdings which will result in both the dollar and the pound dropping precipitously and interest rates rising substantially.. The effect of a collapsing currency will be a hyper-inflationary depression. This is the inevitable outcome for the UK and US, and there is sadly no action that the governments of these countries can take to alter this course."

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.