Japan Economy GDP Growth Recovery, Too early to celebrate?

Economics / Japan Economy Feb 17, 2010 - 06:20 AM GMTBy: Fresbee

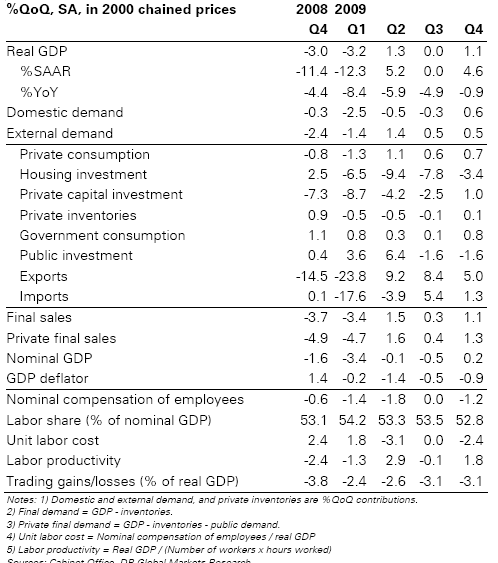

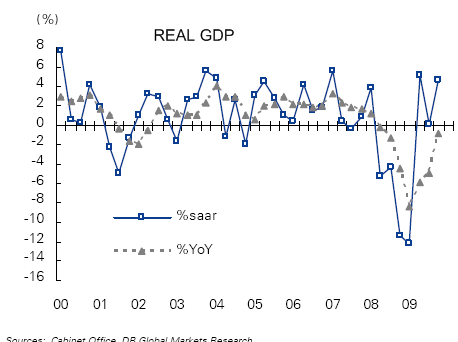

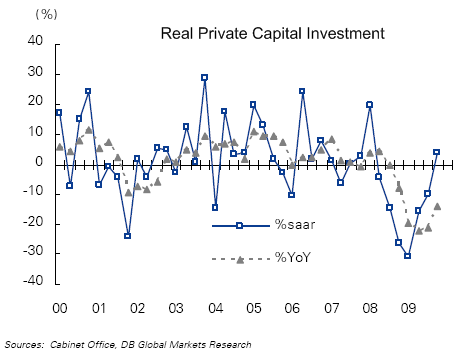

High growth at 1.1% QoQ (4.6% saar) in 4Q 2009 The Japanese economy grew 1.1% QoQ after seasonal adjustment (or 4.6% saar) in 4Q (Oct-Dec) 2009, higher than DB forecast (0.7%; 2.8%). The noteworthy development is that private consumption registered the third consecutive quarterly increase (0.7% QoQ) thanks to fiscal stimulus on the purchase of consumer durables and that private capital investment recovered for the first time in seven quarters (1.0% QoQ).

High growth at 1.1% QoQ (4.6% saar) in 4Q 2009 The Japanese economy grew 1.1% QoQ after seasonal adjustment (or 4.6% saar) in 4Q (Oct-Dec) 2009, higher than DB forecast (0.7%; 2.8%). The noteworthy development is that private consumption registered the third consecutive quarterly increase (0.7% QoQ) thanks to fiscal stimulus on the purchase of consumer durables and that private capital investment recovered for the first time in seven quarters (1.0% QoQ).

Meanwhile, public investment fell 1.6% QoQ for two consecutive quarters, due mainly to the end of front-loaded spending of the FY 2009 budget and the partial cutback of the budget by the DPJ. Exports grew for three consecutive quarters at 5.0% QoQ, but the pace of expansion has been slowing to a more sustainable rate. Nominal GDP rose 0.2% QoQ for the first time in seven quarters. However, both GDP deflator and domestic demand deflator fell 0.9% QoQ, maintaining the declining trend in prices.

Prices are a lagging indicator of the business cycle. It would require sustained economic expansion for the prices not to fall further.

Proactive monetary easing less likely

The Bank of Japan has maintained a cautious stance toward aggressive monetary easing by arguing that quantitative monetary easing is not effective to stimulate economic activity, and that downward forces on prices should fade as economic recovery continues. The GDP statistics for 4Q 2009 would reinforce their view.

We think the probability of proactive monetary easing has further fallen.

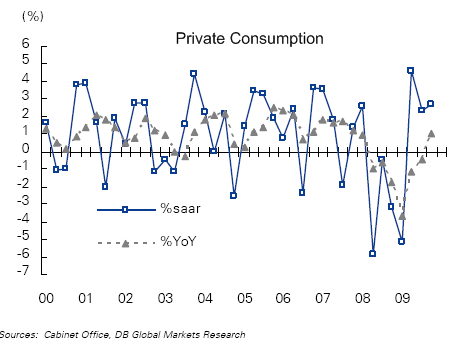

Labor share and unit labor cost fell

The labor share has fallen from 53.5% in 3Q 2009 to 52.8% in 4Q. The unit labor cost has fallen 2.4% QoQ for

three consecutive quarters, while the labor productivity rose 1.8% QoQ. These indicators are all affected by the business cycles and their movement in 4Q seems reasonable in their directions. However, nominal compensation of employees has still fallen by 1.2% QoQ in 4Q for seven consecutive quarters. Compared with the weakness in wages, the changes in the above three indicators look limited. We do not think that labor market adjustment has finished.

While the Japanese economy remains on track for the export-driven recovery, its phase of accelerating recovery appears ending, which should be followed by a cruising-speed expansion.

We focus on the following from now:

1) the degree of the fall-off of policy stimulus on consumer durables,

2) the degree of acceleration in the pace of recovery in private capital investment, and

3) traction of export expansion to non-manufacturing industries. In general, a subsidy to the purchase of consumer durables influences the timing of consumption, which accompanies front-loaded demand prior to the deadline and an ensuing fall of the same size after the deadline.

The “eco-car subsidies” are scheduled to end in the end of September and the “eco points” in the end of December. It seems difficult for consumption to sustain QoQ growth until these deadlines arrive and thus reasonable to assume that the falloff of demand would take place toward the end of 2010. This could constitute the soft patch of the business cycle around the end of 2010. Private capital investment has been recovering, mainly led by machinery and equipment for export-related industries. Investment in structures and buildings for domestic demand looks flat at best, and tends to lag behind investment in machinery and equipment. Capital investment is influenced by the capacity utilization in the short-run and by the potential growth of the economy over the long-run. For the attitude of the business sector toward capital investment to turn positive, it will require longer time.

The overall pace of capital investment recovery in 2010 will be moderate in our view. In the previous recovery phase, the traction of recovery into non-manufacturing sectors began in the third year. Since year 2010 is the second year of recovery, it might be premature for the similar traction to take place in the non-manufacturing industries during this year.

Source: Central committee, GS, MS, DB Research

Source : http://investingcontrarian.com/global/japan-gdp-too-early-to-celebrate/

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.