Stock Market Manipulation and Gold Trading

Stock-Markets / Market Manipulation Feb 05, 2010 - 12:56 AM GMTBy: Clif_Droke

Our recent commentary on the subject of market manipulation elicited a wide range of feedback, pro and con. Some respondents agreed with my assertion that, assuming the existence of market manipulation, it doesn’t preclude one’s ability to successfully navigate financial markets with a reliable technical discipline. Others expressed the view that manipulation and government/central bank interference in the market make it untenable for small traders to be participants.

Our recent commentary on the subject of market manipulation elicited a wide range of feedback, pro and con. Some respondents agreed with my assertion that, assuming the existence of market manipulation, it doesn’t preclude one’s ability to successfully navigate financial markets with a reliable technical discipline. Others expressed the view that manipulation and government/central bank interference in the market make it untenable for small traders to be participants.

Many readers had some interesting comments to make and their views are worth sharing here. What follows is a sampling of readers’ viewpoints along with my response to them. Without further introduction, let’s examine some of these comments.

Concerning the existence of the so-called “Plunge Protection Team” (otherwise known as the PPT), one reader had this to say:

“I have been following the irrational behavior of the markets and have concluded that something like the PPT must be at work. Exhibit A is the overt bailout of several ‘too big to fail’ companies, which amounted to nationalization of large segments of several US markets (banking, mortgage lending and auto manufacturing for three). Obviously, the government has no qualms about donating vast quantities of tax dollars to favored companies, be it over the table, or under it.

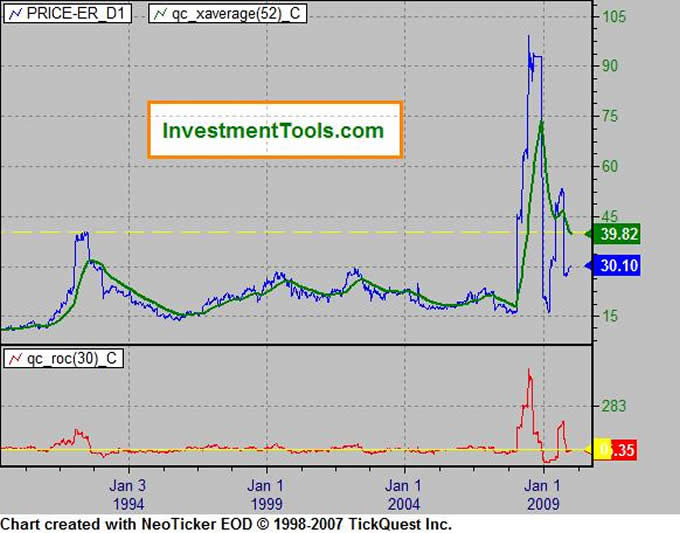

“ Secondly, the P/E of the US stock market is completely irrational. As the chart below shows.

“I can think of no investor, and only a few speculators, who would aggressively buy the market at a P/E over 50, especially given the business climate our current administration is promulgating, but that’s exactly what was happening through most of the 2009 ‘recovery.’ Even more suspicious is the fact that often the greatest part of daily volume was in just a few financials, a market segment that is largely government owned. (What better way to recoup the government’s bailout ‘investment’ than by pumping up the stock price?)

“As for the idea of letting the failed companies fail, I’m all for it. What we are doing is very much like a fellow with a toothache that won’t go to the dentist. He’d rather suffer long, dull agony than the sharp, but brief, pain of fixing the problem. Also like the toothache sufferer, eventually the dull agony will become unbearable and have to be addressed anyway. In the best form of politicians everywhere, our government is giving the can a mighty kick down the road in the hopes that nothing will happen until after the next election….

“In the markets, my suspicion is that the PPT is propping things up at an acceptable level in the hopes that increasing economic activity will eventually raise the floor and allow for withdrawal of the government safety net. Given all the other government initiatives that are positively punitive to business, I see this more as a trap than a viable long term policy.”

This respondent makes some sensible observations that we can’t help agreeing with. I’ll pass over the P-E ratio remarks for now but will have more to say on this after the interim weekly equities cycle bottoms.

His concluding remarks concerning the PPT are poignant in that he admits the possibility that manipulation can indeed “increase economic activity,” regardless of the rationale behind it. This agrees essentially with my original proposition that manipulative activity can serve to both prop up the financial markets and stimulate the economy, even if the effects are only temporary. It’s hard to disagree with his final conjecture, however, that eventually the government safety net will be withdrawn to the detriment of those caught up in the game at the time of the withdrawal.

In the previous commentary on market manipulation we addressed the issue of why the PPT would allow the markets to crash in 2008, assuming they have the power to prevent plunges (as their name implies). One reader had this to say in response:

“Why did they let the markets crash in 2008? Simple, [it was] the last chance to get good buddy Paulson to pass out billions to his friends before he was out. Do you think Wall Street was left holding the bag or small investors and funds?

“Notice how the markets surge in the last few minutes of trading almost everyday so the markets show a gain. Would real traders really pass on buying stocks all day at a cheaper price and suddenly race to buy them at a higher price at day's end without some ulterior motive and absolute knowledge they would go higher?

“Goldman Sachs, which is about the 40% of US markets, had only one losing trading day in the third quarter. Do you believe that is luck? The only thing the government has going for it is a propped up stock market to try and fool people that something is actually good in this country.”

A reader from Canada had another take on the existence of the PPT and the possibility of market manipulation. He writes:

“The intervention of the PPT would be hard to disguise and would involve huge sums of money. It would be far easier to just jam the overnight futures on heavy down days. I followed this action closely back when we had those 200+ down days and you could see it in the S&P E-mini. At critical junctures you'd see huge buying which would trigger trading programs and other such automated nonsense. Once the turn was made the funds would pile in and you'd get a rally. All short term, but if you do it often enough that players notice, it discourages heavy shorting, which I believe is the goal. Just another version of don't fight the Fed, at least that's my take on it.”

In the previous commentary I also asked the rhetorical question, “Does the anti-PPT faction actually desire a market collapse and the Great Depression that would inevitably follow? And for what reasons? A love of anarchy and revolution?” Here is how one reader responded to this question:

“No! We desire a deeper market correction and, if necessary, another Great Depression that would reestablish normal, healthy and sustainable valuations of the markets, precisely to PREVENT the anarchy and revolution which is now virtually guaranteed by the constant interference by government in the once free markets.

“For example, after LTCM failed in 1998, the ramifications should have so severe as to have caused a cascade effect throughout the credit markets and triggered a long overdue recession. Instead we got the dot.com and NASDAQ bubble. When that bubble burst, we should again have had a much larger correction in the markets leading to an even bigger recession, or possibly a multi-year depression to clear out all the dead wood and bad investments. Instead we got artificially low interest rates and an even larger real estate and commodities bubble. Inevitably that bigger bubble burst, so now we have 0% interest rates as far as the eye can see and they are sowing the seeds of a hyperinflationary depression, which might cause a breakdown in society, food riots, marshal law, civil war, etc.

“So, no; I am NOT thankful that the PPT has stepped in to ‘save the day’ because while they may have saved “today” they are just delaying the inevitable utter destruction of ‘tomorrow’.”

Another respondent continues on the theme of the existence of the PPT as he articulates his take on the subject:

“Without being argumentative or taking sides too strongly, I'd like to make a few comments on your article...

“1. The existence of the PPT is basically proven - I'm a reasonably skeptical person and even several years back I've found much I read to be convincing. Extremely large trades in the futures markets by unidentifiable huge traders with unbelievably deep pockets working through brokers known to be government fronts have been documented, usually at critical junctures. It's been some time since I followed this, but it was all quite convincing.

“2. The view that the PPT should be thanked for saving us from a Great Depression has one serious flaw - you are assuming that the distortions required to save the market today will not cause an even greater collapse in the future. Many people have this reasonable view. If true, then the PPT isn't saving us from a depression, they are merely delaying one while also making it worse. And those who vilify the PPT are not in favor of anarchy etc....they just want to take the medicine now, rather than taking even more medicine later.

“3. The most interesting articles I've seen on this are the ones that compare volatility over time, in the sense of ‘how many days does the Dow correct 5% or more,’ something like that. Comparing the frequency of small declines in various past times to today shows that the market, for some reason, just doesn't correct with anything like the frequency it used to. If there's no PPT to explain this, it suggests a basic change in human nature, something quite startling.”

The topic of suppression and the manipulation of precious metals was also mentioned by many respondents. One reader commented:

“Your discussion of a ‘rigged market’ appears to be not only a reasonable conclusion, but one perhaps deemed necessary by the Fed for sustaining life in the U.S. economy.

“If you carry these speculations a bit further, you may also conclude that in order to keep people in the market, precious metals had to be suppressed. This is supported by the huge short positions held by four firms (Tarp recipients who in turn probably sell their positions to the Fed). A similar scheme is used in Treasury bond sales.

He concludes, “An audit of the Fed is in the works and if these allegations are proved true, do [small investors] that had losses while opposing these actions have a claim?”

It was perhaps inevitable that a reference to the famous tome, “Reminiscences of a Stock Operator” would be made when discussing the subject of market manipulation. The famous autobiography of stock trader Jesse Livermore contains some intriguing insights into the subject of manipulation from one of the most famous plungers of the early twentieth century. As one reader put it:

“Jesse Livermore spoke about manipulation….His basic premise was that while manipulation does occur in markets at various levels at various times, ultimately, manipulation cannot stop a bear market - or bull market - from running its course. Though there are many different mechanisms not available in his day, I believe his basic premise remains true and always will.”

Gold Trading

Gold has garnered its fair share of the investment spotlight in recent times and for good reason – the yellow metal has outperformed virtually every major asset category and remains a favorite long-term investment the world over due to its intrinsic worth.

Gold’s value as a hedge against runaway inflation is well known. Less well known is its benefits as a store of value in runaway deflation. This is an important consideratino for investors given that the final “hard down” phase of the Kress 120-year cycle begins in 2012. Along these lines, the current interest rate policy of the Federal Reserve is beneficial to the long-term gold outlook. When the Fed funds rate falls under the consumer inflation rate, gold comes into its own as an investment. This happens because investors have a hard time getting an honest return on their money and so turn to the yellow metal as a safe haven. Paul Kasriel, chief economist at the Northern Trust Company of Chicago, pointed this out at the commencement of the gold bull market several years ago. He observed that when the Fed funds rate falls to 1%, gold always shines.

Gold and gold mining shares offer excellent trading opportunities for retail traders due to their liquidity and tendency to trade in repitive patterns. By using a series of reliable technical indicators and moving averages, a trader can realize immense gains over time sticking to a trading discipline proven to work. It was to that end that I wrote, “How to Trade Gold and Gold Stocks” at the commencement of the gold bull market in 2001. The book discussed a number of simple yet effective techniques for profiting in the gold and PM shares markets. Also included are considerations for sound fundamental analysis of the mining stocks.

Now in its third printing, “How to Trade Gold and Gold Stocks” has been updated to reflect changes in the PM markets. Click here to order:

http://www.clifdroke.com/books/book01.mgi

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.