Educational ETF’s, Futures & CFD’s Low Risk Trading Setups Explained

InvestorEducation / Learn to Trade Jan 30, 2010 - 03:29 AM GMTBy: Chris_Vermeulen

I thought I would put this more detailed report on finding and trading low risk setups for gold, silver, oil indexes etc…. In short it does not matter what time frame you trade with or if you trade exchange traded funds, futures contracts or CFD’s (contract of difference).

I thought I would put this more detailed report on finding and trading low risk setups for gold, silver, oil indexes etc…. In short it does not matter what time frame you trade with or if you trade exchange traded funds, futures contracts or CFD’s (contract of difference).

This type of trading setup works for virtually every investment but I mainly focus on trading: Gold Futures, Gold ETFs, Gold CFD’s, and the SP500 & Dow 30 futures, ETF’s and CFD’s as I find they are very accurate and profitable.

Obviously swing traders who watch the daily chart will have few trades because it takes weeks and months for these low risk patterns to form. This is the reason I am using short term intraday charts and using a setup from yesterday (Thursday) for demonstrating my trading setups.

My Short Trading Setup – Rough Guideline

1. Trend on 2hour and 1hour charts are down

2. Increased volume during sell offs, and light volume on rallies/rising prices

3. Entry is best at Fibonacci retracement level which is also at a previous resistance level.

4. Set Stop just above the resistance level you are expecting the current price to stop at. Exit if this top is penetrated and wait for a new opportunity.

5. Cover half of your position just before the investment reaches the first level of support to lock in gains and reduce overall risk.

6. Once the price of the investment starts to make a new short term high exit the balance of the position. Shown in the charts below.

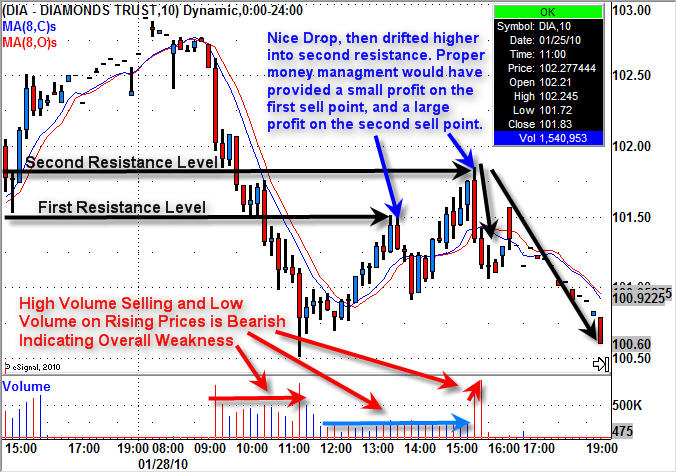

DIA – Dow 30 Index Fund

This is a chart I sent to members on Thursday pointing out the market weakness. We had a nice sell off in the morning and the price drifted up on light volume later in the afternoon. This low volume drift is crucial to recognize as it tells you the general public is buying. This is what Big Money likes to see. After they crush the market with their large sell orders in the morning they take a break allowing regular retail traders/investors move the market back up before the big sellers start dumping shares again.

So, I am looking to short at a resistance level in hope the big sellers step back in.

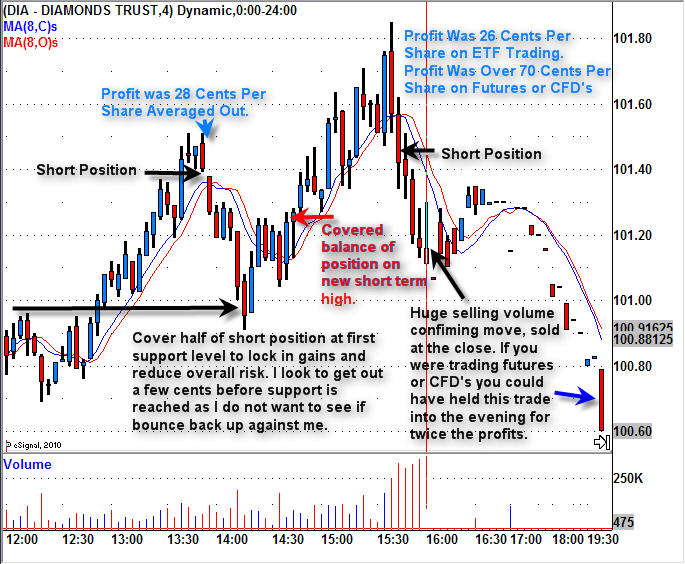

DIA – Dow 30 Index Fund – End of Day

This chart quickly shows the two intraday setups for shorting at resistance levels. Both trades worked out well but wait until you see the results of trading with futures or CFD’s shown later.

Anyways, the first short was a great play but we did not see the big sellers step in, which led to a reversal and the price continued to move higher taking us out for a small profit.

The second short had huge selling volume indicating sellers were back in control. This play we held into the close. The next chart shows how this is done.

DIA – Dow 30 Index Fund – Step By Step Play

The chart is a little small to see but it explains and shows how these low risk setups should have been traded according to my trading strategy to maximize gains while minimizing risk.

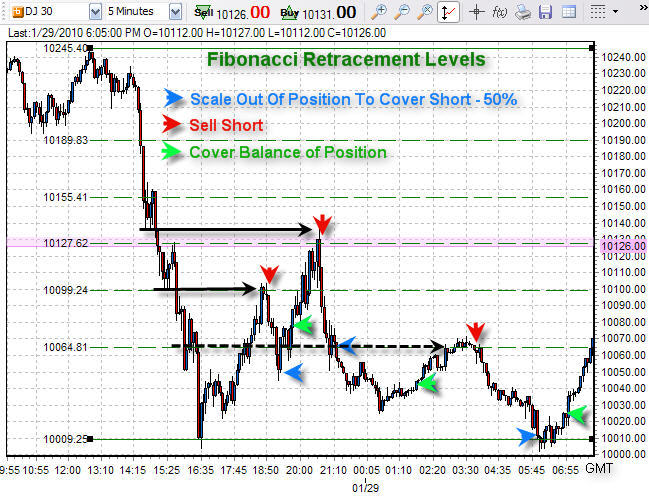

Dow 30 Futures & CFD Day Trading Signals/Setups

This is the same Dow 30 index but is zoomed out so we can take advantage of the 24 hour price action which the futures market trades.

Here I show the Fibonacci retracement levels which happen to be at resistance levels from earlier that day.

During regular trading hours the trades were the same as the DIA etf above, but with futures trading you can traded 24 hours a day. So with the last ETF trade I talked about earlier we only made 28 cents profit per share, but with futures we could have held this position until it fully matured netting a total gain of 40 cents per share. This is 42% more profit simply by trading with futures or CFD’s.

To make things more exciting there happened to be another fantastic trade after dinner making us another 45 cent move. These gains may not sound like much but it equals $1000 – $3000 in profits depending on what you are trading ETF’s, Futures contracts, or CFD’s.

End of the Week Trading Education and Wrap Up:

Overall this week was nothing short of awesome!

The overall market is trying to hold up but sellers continue to pull it lower. Unless there is a strong rally into the close on Friday I figure Monday will gap down because the daily charts are very scary looking. This is what makes the general public panic out as it flushes out the remaining sellers, just before the market makes a sizable bounce and possible rally to new highs.

Get my Free Weekly ETF Trading Reports at www.GoldAndOilGuy.com

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.