Jobless Data Shock and Stocks Diamond Formation Signals Imminent Market Plunge

Stock-Markets / Financial Markets 2010 Jan 10, 2010 - 05:56 AM GMT The U.S. unexpectedly lost 85,000 jobs in December and revisions showed payrolls increased the prior month for the first time in almost two years, indicating improvement in the labor market will be halting. Payrolls decreased last month after a November gain of 4,000, figures from the Labor Department showed today in Washington. The median estimate of economists surveyed by Bloomberg News projected no change in December employment. The jobless rate held at 10 percent.

The U.S. unexpectedly lost 85,000 jobs in December and revisions showed payrolls increased the prior month for the first time in almost two years, indicating improvement in the labor market will be halting. Payrolls decreased last month after a November gain of 4,000, figures from the Labor Department showed today in Washington. The median estimate of economists surveyed by Bloomberg News projected no change in December employment. The jobless rate held at 10 percent.

Not mentioned in the article is that October payrolls were revised down from -111,000 to -127,000. The CES Birth/Death Model added 64,000 hypothetical jobs to the ranks of the employed. If the “discouraged workers” were kept in the labor force statistics, the unemployment rate would be 12%.

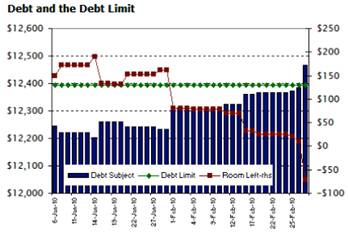

There’s a new debt ceiling, but does it matter?

On December 28, 2009 President Obama signed into existence the bill that allows the debt ceiling to be raised to $12.394 trillion. The bills were passed along party lines in both the House and Senate. But most debt clocks shattered that limit long before, since there is “debt subject to limit” and off-budget debt that doesn’t see the light of day. Our lawmakers, however, will run out of wiggle room by March 1, 2010. This may be the last time they can “kick the can down the road.”

On December 28, 2009 President Obama signed into existence the bill that allows the debt ceiling to be raised to $12.394 trillion. The bills were passed along party lines in both the House and Senate. But most debt clocks shattered that limit long before, since there is “debt subject to limit” and off-budget debt that doesn’t see the light of day. Our lawmakers, however, will run out of wiggle room by March 1, 2010. This may be the last time they can “kick the can down the road.”

Diamonds are not the market’s friend.

-- A unique diamond formation is now apparent in the S&P 500 Index. If this formation is appropriate, stocks are due for a fall in the very near future. The Diamond Formation is a result of a Broadening Top formation combined with a Wedge Formation. While the Wedge is fairly common, the Broadening Top is not. It is usually seen at important market highs.

-- A unique diamond formation is now apparent in the S&P 500 Index. If this formation is appropriate, stocks are due for a fall in the very near future. The Diamond Formation is a result of a Broadening Top formation combined with a Wedge Formation. While the Wedge is fairly common, the Broadening Top is not. It is usually seen at important market highs.

Treasury bonds start the year off badly.

-- Treasuries fell, heading for a weekly loss, before a U.S. report that economists said will show a 23- month run of job losses ended in December.

-- Treasuries fell, heading for a weekly loss, before a U.S. report that economists said will show a 23- month run of job losses ended in December.

I am quoting an article from the previous day since the employment situation was worse than expected. A decline in employment may have the effect of reducing bond yields and driving up the price.

Gold bounces at its trendline.

-- Gold prices fell as the dollar pared a decline, eroding the appeal of the precious metal as an alternative investment.

The greenback was down 0.2 percent against a basket of six major currencies after dropping as much as 0.7 percent following a report that showed the U.S. unexpectedly lost jobs last month. Gold rose 24 percent last year as the dollar fell 4.2 percent.

-- Gold prices fell as the dollar pared a decline, eroding the appeal of the precious metal as an alternative investment.

The greenback was down 0.2 percent against a basket of six major currencies after dropping as much as 0.7 percent following a report that showed the U.S. unexpectedly lost jobs last month. Gold rose 24 percent last year as the dollar fell 4.2 percent.

The Nikkei had a Santa Rally.

-- Japanese stocks rose on speculation overseas earnings will climb, as the yen weakened to its lowest level against the dollar since August following comments by Finance Minister Naoto Kan. The weaker yen has the potential effect of boosting exports, which may boost manufacturing stocks.

-- Japanese stocks rose on speculation overseas earnings will climb, as the yen weakened to its lowest level against the dollar since August following comments by Finance Minister Naoto Kan. The weaker yen has the potential effect of boosting exports, which may boost manufacturing stocks.

.

The Shanghai index slumps.

-- Chinese stocks have lost 2.5 percent in the first week of trading this year on concern government steps to curb lending growth and property speculation will slow expansion in the world’s third-largest economy. The central bank offered three- month bills at a higher rate and said it will seek “moderate” loan growth to support the economy while managing inflation expectations.

-- Chinese stocks have lost 2.5 percent in the first week of trading this year on concern government steps to curb lending growth and property speculation will slow expansion in the world’s third-largest economy. The central bank offered three- month bills at a higher rate and said it will seek “moderate” loan growth to support the economy while managing inflation expectations.

The dollar pulls back from a strong advance.

The dollar fell from a four-month high against the yen as U.S. employers unexpectedly eliminated jobs last month, boosting speculation that the Federal Reserve may extend stimulus measures.

The dollar fell from a four-month high against the yen as U.S. employers unexpectedly eliminated jobs last month, boosting speculation that the Federal Reserve may extend stimulus measures.

The headline doesn’t sit well with the dollar,” said Brian Kim, a currency strategist at UBS AG in Stamford, Connecticut. “People had been bracing for a flat to positive number. It puts expectations for a Fed rate hike on ice.”

The market remains irrational on commercial property.

-- The U.S. apartment vacancy rate rose to an almost 30-year high of 8 percent in the fourth quarter, and rents dropped in the biggest one-year slump in 2009, according to real estate research company Reis Inc.

-- The U.S. apartment vacancy rate rose to an almost 30-year high of 8 percent in the fourth quarter, and rents dropped in the biggest one-year slump in 2009, according to real estate research company Reis Inc.

In the fourth quarter, the U.S. apartment vacancy rate rose 0.10 percentage points from the prior quarter and 1.3 percentage points for the year. At 8 percent, it was the highest national vacancy rate Reis has recorded in its 30 years of tracking the sector.

Gasoline prices almost $1.00 higher than a year ago.

The Energy Information Agency weekly report suggests, “The U.S. average price for regular gasoline increased six cents to $2.67 per gallon, $0.98 higher than the price a year ago. Prices rose in all regions of the country. On the East Coast, the average went up a nickel to $2.65 per gallon. The largest increase occurred in the Midwest where the price jumped eight cents to $2.64 per gallon.”

The Energy Information Agency weekly report suggests, “The U.S. average price for regular gasoline increased six cents to $2.67 per gallon, $0.98 higher than the price a year ago. Prices rose in all regions of the country. On the East Coast, the average went up a nickel to $2.65 per gallon. The largest increase occurred in the Midwest where the price jumped eight cents to $2.64 per gallon.”

Frigid weather affects NatGas prices.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Frigid temperatures throughout most of the lower 48 States and rising crude oil prices appear to have contributed to rising natural gas prices. Price increases since last Wednesday ranged between $0.06 and $7.89 per MMBtu. In general, prices increased by less than $1 per MMBtu at most market locations on the week. However, significant price run-ups in select regions of the lower 48 States characterized the week.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Frigid temperatures throughout most of the lower 48 States and rising crude oil prices appear to have contributed to rising natural gas prices. Price increases since last Wednesday ranged between $0.06 and $7.89 per MMBtu. In general, prices increased by less than $1 per MMBtu at most market locations on the week. However, significant price run-ups in select regions of the lower 48 States characterized the week.”

Is Uncle Ben really that dense?

If there is one man in the nation's capitol who maybe isn't too unhappy about Treasury Secretary Tim Geithner being in the news today, it's probably Fed Chairman Ben Bernanke who delivered a speech titled Monetary Policy and the Housing Bubble over the weekend, a topic that continues to generate a lot of discussion at mid-week, little of it positive.

I will not repeat what others have already written about a speech that, one day, will probably rival (if not exceed) in ignominy the Fed chairman's "helicopter speech" from a decade ago. This link will recap the weakness of his arguments.

Is The Government Misrepresenting Unemployment By 32%?

(The) government spent a record $14.7 billion on Unemployment Insurance Benefits as of December 30, a 24% jump sequentially from the $11.8 billion in November. Yet the DOL has disclosed a mere 1.7% increase in those to whom insurance benefits are paid: from 9.4 million to just under 9.6 million. To put the $14.7 billion number in perspective, in December the Federal Government paid a total of $14 billion ($700 million less) in Federal Salaries!

And some more perspective: in calendar 2009 the government has paid $140 billion in Unemployment Insurance Benefits. This is yet another economic stimulus that nobody in the administration discusses, yet which undoubtedly has the biggest impact on the economy, as all those millions unemployed can moderate their pain courtesy of a passable weekly check from the government which should just about cover the rent and beer.

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.