Social Unrest and Global States of Combustibility 2010

Politics / Social Issues Jan 01, 2010 - 03:51 PM GMTBy: Mac_Slavo

The Economist says that 2010 could be a year the sparks unrest in the Global Tinderbox: “IF THE world appears to have escaped relatively unscathed by social unrest in 2009, despite suffering the worst recession since the 1930s, it might just prove the lull before the storm. Despite a tentative global recovery, for many people around the world economic and social conditions will continue to deteriorate in 2010. An estimated 60m people worldwide will lose their jobs. Poverty rates will continue to rise, with 200m people at risk of joining the ranks of those living on less than $2 a day. But poverty alone does not spark unrest—exaggerated income inequalities, poor governance, lack of social provision and ethnic tensions are all elements of the brew that foments unrest.“

The Economist says that 2010 could be a year the sparks unrest in the Global Tinderbox: “IF THE world appears to have escaped relatively unscathed by social unrest in 2009, despite suffering the worst recession since the 1930s, it might just prove the lull before the storm. Despite a tentative global recovery, for many people around the world economic and social conditions will continue to deteriorate in 2010. An estimated 60m people worldwide will lose their jobs. Poverty rates will continue to rise, with 200m people at risk of joining the ranks of those living on less than $2 a day. But poverty alone does not spark unrest—exaggerated income inequalities, poor governance, lack of social provision and ethnic tensions are all elements of the brew that foments unrest.“

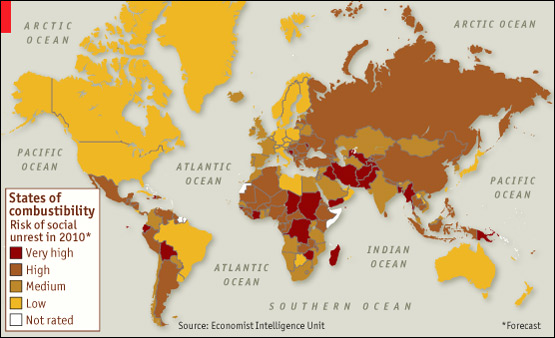

States of Combustibility Map:

We are surprised to see Argentina in the high category, as there has been quite a bit of positive news on the stability of this country with lots of alternative investors, like Doug Casey, promoting real estate and agricultural investments.

Mexico, however, is a given, and should probably ranked in the very high category. This country is a disaster, as evidenced by the thousands of deaths on the northern border related to narcotics trafficking, gangs, and mafia. Couple that with a population that has no jobs, and is now losing revenue from family members in the US, and you can have a serious breakdown in social order. It would be no surprise if these local wars make their way across the border into Texas, New Mexico and Arizona.

We think the Very High rating for the Middle East is dead on. If World War III is going to break out, this is where it is going to start. With religious wars spanning millennia , and resources underground being drastically reduced through increased consumption around the world, it’s no wonder that this part of the globe is what one could deem a current SHTF scenario, and it’s only going to get worse.

It is also interesting that The Economist rated China as “High” risk, what with all the positive news about the new capitalist leanings and increased freedoms for their people. Here at SHTF Plan, we don’t doubt this rating one bit, considering the fact that all the hooplah about China being “decoupled” from the US economy and being the engine that’s driving the world, is just that, hooplah. Any economic problems in the USA are going to have a direct and immediate impact on China. End of story. That being said, if the mainstream is so incompetent as to see this relationship, I don’t think their competency can be trusted about understanding capitalism and how it functions in a politically communist system.

We do wonder about the USA. For the most part, things seem stable now, and save a few days of tea parties in 2009, nothing seems to be brewing. Though many have lost their jobs, the poverty levels have not increased significantly, at least not significantly enough to drive millions of people into the streets across major cities in the entire country. However, poverty, as opined by The Econmist, is only part of the combustibility equation, so we must consider the other aspects noted in the article:

- Exaggerated Income Inequalities - This is a potential time bomb, as private sector, hard working Americans are seeing their 401k’s deteriorate, the values of their homes collapse, and their wages decline. All the while bankers and financiers on Wall Street pay themselves hundreds of thousands and multiple millions of dollars in bonuses. On top of that, the average salary of a government employee in America is almost double that of the private sector. Eventually, the plebs are going to realize that they are doing twice the work for half the pay, in some cases, fractions of pay. Will this happen in 2010? Maybe not, but it seems that income inequality could easily become an issue that sparks unrest.

- Poor governance — Do we even need to go here? Really? The people have already had enough. When 90% of America calls Congress to reject the TARP bailout program prior to the vote, and then Congress pushes it through overwhelmingly, what is that? Good governance? How about raising property taxes, adding new health care taxes, eliminating Bush’s tax cuts and even taxing plastic bags from grocery stores? Is that considered good governance when your constituents are losing their jobs, defaulting on their credit cards and having problems putting food on the table?

- Ethnic tension - Racism is not dead in America just because Barrack Obama was elected President. We can play these games all we want, but white people, black people, hispanic people, asian people — we have a hard time getting along. I mean sure, we get along for the most part and we’re cordial and all that, especially while everything is going smoothly in the system, and their isn’t a hiccup. But any number of events can set off this powder keg — with anti-immigration protests being just one. There’s a reason that Rodney King’s famous line, “Why can’t we all just get along?” still gets chuckles nearly 20 years later no matter what color the person is that makes the joke. Because the point being made is apparent to everyone that hears it.

- Lack of Social Provisions - Maybe everything seems to be ok right now insofar as the recipients of social distributions are concerned, but at the rate we are going, social provisions MUST be cut. Look at California, just one of many examples. California is so broke that it is going to have to pull the plug on some social programs. What happens when welfare, medicare, medicaid, unemployment assistance, or a host of other programs need to be cut? Sure, the Federal government may bail out the states — at first — but then they themselves go broke, and they have to make cuts. Those living on the very edge will lose what little support they had, and then the SHTF.

The Economist focuses on the risks of social unrest in 2010. While the above points may be on the back burner for now, they are slowly simmering. Serious civil unrest, the kind that might warrant a Medium or High risk rating, does not seem to be likely this year. Though, this may be argued by a number of other forecasters who see this as a distinct possibility for 2010.

Rather than making a forecast that predicts that we will either have civil unrest or we won’t, we’ll try to make our views as vague as possible, so that a year from now we can say we were right no matter what happens: Maybe social unrest in America on massive scales is not probable, but it is certainly within the realm of possibility. We hope that makes everyone feel better about it all.

By Mac Slavo

Mac Slavo is a small business owner and independent investor focusing on global strategies to protect, preserve and increase wealth during times of economic distress and uncertainty. To read our commentary, news reports and strategies, please visit www.SHTFplan.com

© 2009 Copyright Mac Slavo - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.