S&P500 Stock Market Rally and Forecast 2010

Stock-Markets / Stock Markets 2010 Dec 27, 2009 - 05:26 AM GMT In last October’s reviews we wrote : ” There is a larger support and resistance zone we expect the S&P500 is heading towards. This point in time is also 45 weeks or 225 trading days after the March 2009 bottom. In Gann terms this point in time is typically a hard angle that typically come in as a high. We expect the market to continue it’s uptrend towards this point in time. Our dynamic market timing cycle model following the longterm cycles from the past also supports the larger trend will continue to move upwards until the end of 2009. Earlier in October we mentioned the probable price target of 1121. On the short term we expect the dominant cycle to bottom early to mid November 2009.”

In last October’s reviews we wrote : ” There is a larger support and resistance zone we expect the S&P500 is heading towards. This point in time is also 45 weeks or 225 trading days after the March 2009 bottom. In Gann terms this point in time is typically a hard angle that typically come in as a high. We expect the market to continue it’s uptrend towards this point in time. Our dynamic market timing cycle model following the longterm cycles from the past also supports the larger trend will continue to move upwards until the end of 2009. Earlier in October we mentioned the probable price target of 1121. On the short term we expect the dominant cycle to bottom early to mid November 2009.”

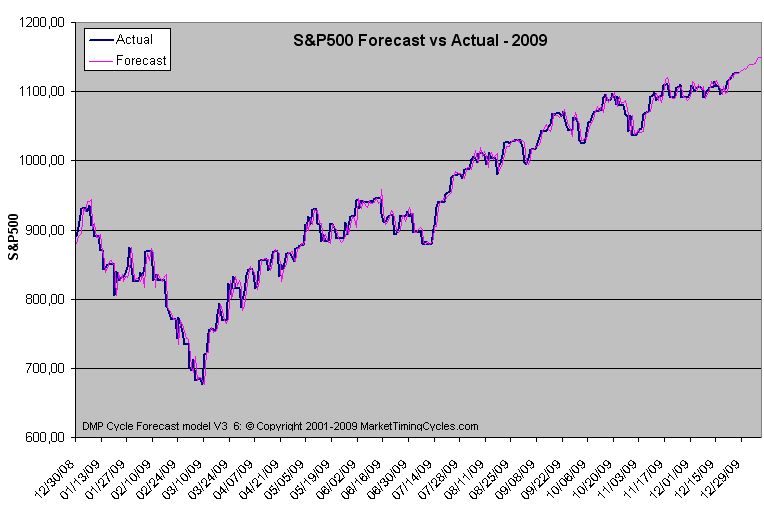

I have received many emails from readers between October and today when we would update our forecasts again. I do apologies to the readers, but actually there was no need to re-iterate what we already stated in the October’s reviews. I would have bored you all. Clearly we bottomed early November as expected, and the trend resumed from there. Our dynamic market timing cycle model forecasted the consolidation period until the middle of December excellent, and the break out of this range was right on the expected time and in the expected direction. Moreover we reached the since mid 2009 forecasted price target of 1120 on the S&P500.

So, what will happen now? Will the market turn at this end as every respectable market commentator is expecting already for months after months.? Will we become a fool by keep on posting a contrarian position?

For now we will update our charts posted in October 2009 for your convenience until early January 2010. We will however reveal our full 2010 forecasts for subscribers only in a week from now! More on this to come in the next few days. Keep watching your email box. If not already done subscribe now at the link on the bottom of this post, so not the miss our full 2010 forecast.

The current S&P 500 market position

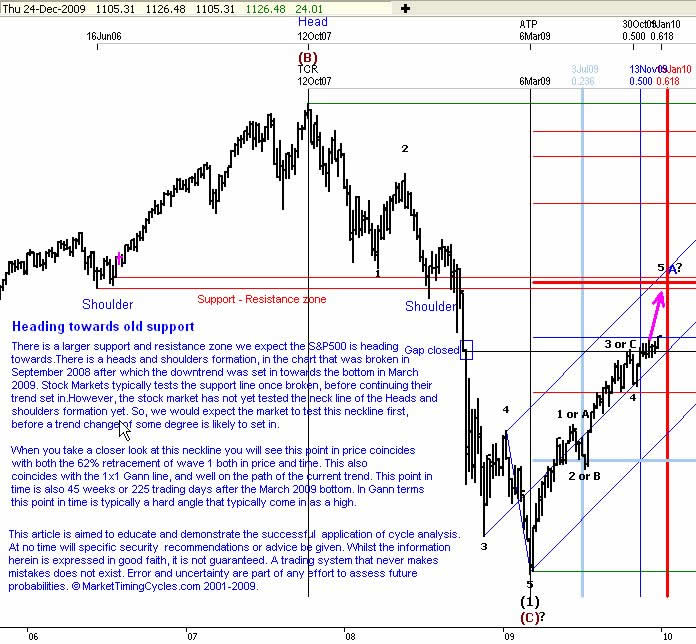

There are many possible scenario’s for the current market position. The S&P500 seems to form an impulsive pattern(5 wave) of some degree, but this still could also be a simple abc counter trend, of which the first part is an impulsive wave. We also still could be in a wave 3 of A of 2. With Elliott Wave you can never be sure until the wave pattern has definitely been formed; the stock patterns form a fractal that can easily subdivide for quite some time and prolong it;s course. Time will tell. For now we stick with our earlier posted abc counter trend pattern, for which we are now in wave 5 of A of 2.

In the above charts we explained where the stock market is heading to, with the S&P500 as an example. Fibonacci and Gann targets suggest the Wave A of 2 to be formed at the 62% Fibonacci retracement in price and time; at which point the S&P500 is in perfect harmony

As all indices are closely related this trend and patterns is found in most other indices around the world as well. They all form similar patters, whether this is the Dow Jones, the German DAX, the FTSE100 etc..

If you care to review the current market position on the FTSE100 yourself, you might notice that the UK major index is very close in price and time to the expected Fibonacci target of early to mid January. It would not be the first time that the FTSE100 leads the way.

Still heading towards old support

It seems hard we will reach the projected time and price target of mid january +- 5 trading days as projected in above chart; it is still a way to go. It is not impossible though. In the past there have been large price swings before in a very short time.

Stock Markets typically tests these old support line( as part of a larger Heads and Shoulders pattern) once broken, before continuing their earlier trend set in. So, we still expect the market to test this neckline first, before a trend change of some degree is likely to set in.

Moreover as mentioned last October’s preview this point in time is also 45 weeks or 225 trading days after the March 2009 bottom. In Gann terms this point in time is typically a hard angle that typically come in as a high. We expect the market to continue its trend towards this point in time.

Longer term cycles support a further up-trend

Our dynamic market timing cycle model following the longterm cycles from the past also still supports the larger trend will continue to move upwards until early 2010.

Note: Please be aware that the projected price is based on a hypothetical Mass Pressure forecast model, that the actual price will differ from the forecast given here, and possibly higher or lower. This mass pressure forecast chart is only to indicate the bullish and bearish trends , and should not be traded upon.

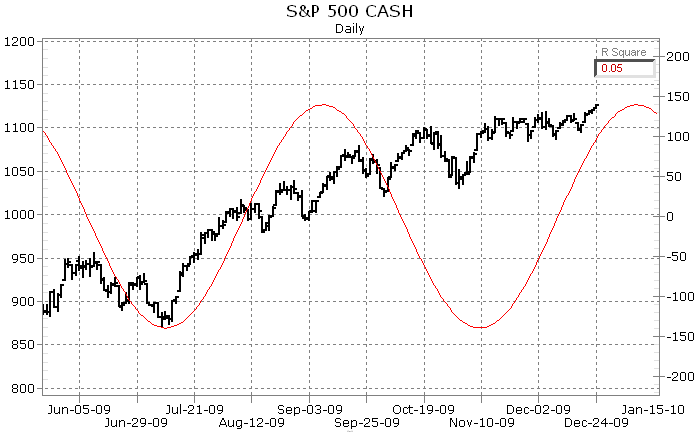

The dominant cycle approaching its crest

On the short-term we expect the dominant cycle to approach its crest early to mid January 2010 on the S&P500. The crest can form as early as January 8th or as late as the end of January +- 4 trading days, as cycles can deviate from their normal course.

Conclusion

Our conclusion remains boring but is still in tact since last October’s preview. The current Elliott wave scenario suggests we are on a wave 5 of A of a wave 2 counter trend on the S&P500 and many other indices around the world. Fibonacci and Gann targets suggest the Wave A of 2 to be formed at the 62% Fibonacci retracement in price and time; at which point the S&P500 is in perfect harmony. Our dynamic market timing cycle model is further suggesting the current trend will likely continue into early 2010, after which a correction of some degree is likely to set in. Be aware this only could be a minor correction.

From the dominant cycle perspective we also expect the market to form a crest early to mid January 2009. This scenario remains valid unless we close below the 1080 on the S&P 500.

The 2010 Forecast

We believe we are still further climbing up the fall of fear, but we still seem to be in a counter trend of some degree. The further we climb upwards the harder we could fall. In chinese astrology 2010 will be the year of the tiger. We expect the stock market too behave in a likewise manner.

In our full 2010 forecasts we will reveal the likely path and pattern the stock market will take in 2010 a full year ahead and even beyond! We will make this forecast available to subscribers only!

Don’t miss this yearly forecast, that will reveal the likely path the stock market will take from various angles that support our vision for 2010.

More on this to come in the next few days. Keep watching your email box. If not already done subscribe now at the link on the bottom of this post, so not the miss our full 2010 forecast.

Join a group of select individuals and subscribe to our newsletter here and we will put you on our mailing-list. We respect your privacy. We don’t sell, rent or share your name or email address.

© 2001-2009 MarketTimingCycles.com. www.markettimingcycles.wordpress.com

This article is not part of a paid subscription service. It is a free service and is aimed to educate and demonstrate the successful application of cycle analysis. At no time will specific security recommendations or advice be given. Whilst the information herein is expressed in good faith, it is not guaranteed. A trading system that never makes mistakes does not exist. Error and uncertainty are part of any effort to assess future probabilities. Trade at your own risk. Read our full disclaimer.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.