Will Dubai Debt Crisis Crack Uber Bullish Stock Market Sentiment?

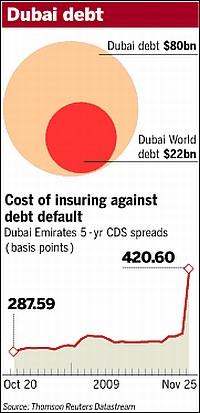

Stock-Markets / Financial Markets 2009 Nov 29, 2009 - 07:25 AM GMT As shoppers were emptying their purses on Black Friday bargains, Dubai’s attempt to reschedule its debt roiled financial markets, plunging risky assets into the red. The government of Dubai requested a six-month payment freeze on the $59 billion debt issued by Dubai World - a state-owned conglomerate that has become known for its extravagant real estate projects.

As shoppers were emptying their purses on Black Friday bargains, Dubai’s attempt to reschedule its debt roiled financial markets, plunging risky assets into the red. The government of Dubai requested a six-month payment freeze on the $59 billion debt issued by Dubai World - a state-owned conglomerate that has become known for its extravagant real estate projects.

Worries about Dubai’s debt woes rattled investors’ confidence, precipitating a sell-off in equities, high-yielding corporate bonds, commodities and the Baltic Dry Index, while mature-market government debt, the US dollar and the Japanese yen attracted safe-haven buyers. On Thursday and Friday, many emerging-market and high-yielding currencies declined sharply.

A fact not widely known is that Dubai has the worst debt per capita in the world. Ah well …

Source: Peter Brookes, Times Online

The credit-rating agencies promptly downgraded Dubai’s government-related debt and the cost of insuring against default jumped across the United Arab Emirates (UAE) region. As shown in the Bloomberg screenshot below, courtesy of Bespoke, the price of Dubai’s sovereign debt credit default swap (CDS) last week spiked up to 541 basis points. “Now that global markets have stabilized and exited crisis mode, an isolated event in Dubai where default risk doesn’t even spike to its 2009 highs [of almost 1,000 basis points] has caused a global market selloff,” remarked Bespoke.

Source: Bespoke, November 27, 2009.

Geoffrey Yu, strategist at UBS, said (via the Financial Times): “Although the majority of market observers believe the problems in Dubai are not insurmountable, the wider fallout has simply revealed how fragile markets are - and risk appetite may not be as strong as previously assumed, regardless of how profligate central banks globally have been in providing liquidity.”

Also as reported by the Financial Times, Julian Jessop of Capital Economics argued that Dubai’s move was unlikely to affect the positive outlook for emerging markets in the longer term: “We do not believe the events in Dubai mark a new phase in the global crisis. But if they are the catalyst for a more selective approach to investment, that might be no bad thing.”

In terms of banks’ exposure to Dubai, JPMorgan Chase comments (via The Big Picture) that the Royal Bank of Scotland underwrote more Dubai World loans than any other institution. In terms of capital at risk, HSBC has the largest exposure to the UAE.

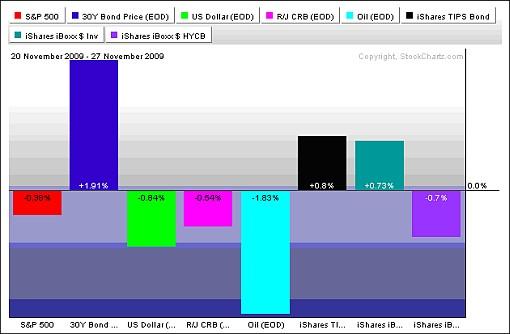

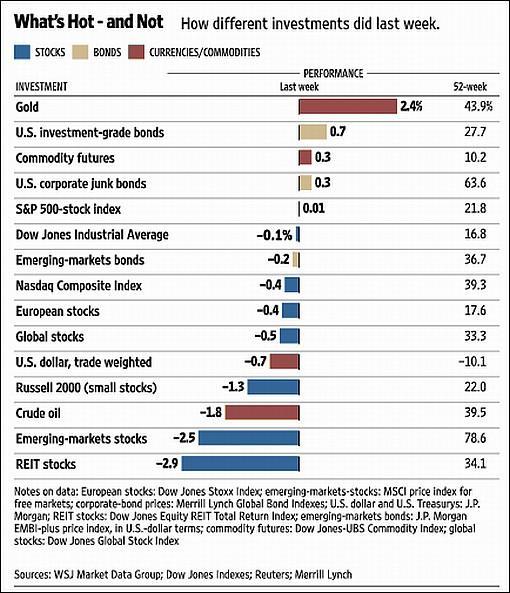

The past week’s performance of the major asset classes is summarized by the chart below. Gold bullion (not shown on the graph) touched a record high of $1,194.90 on Thursday before tumbling to $1,136.80, but subsequently recovered to close 2.4% up for the week at $1,177.63. Similar volatility was seen in the oil price, with West Texas Intermediate Crude declining by more than $5 at one point on Friday, but later regaining some ground to end the week 1.8% down at $76.05.

Source: StockCharts.com

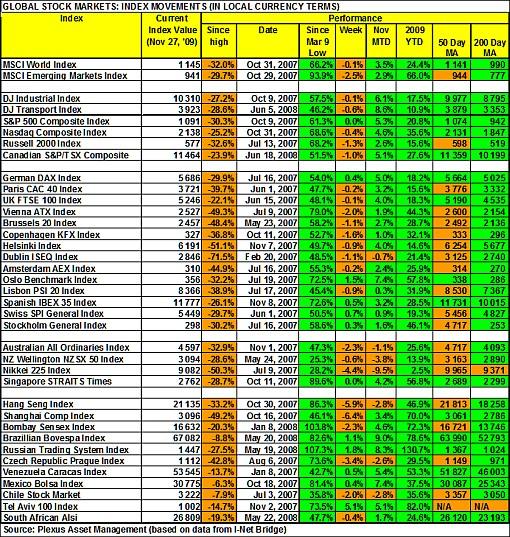

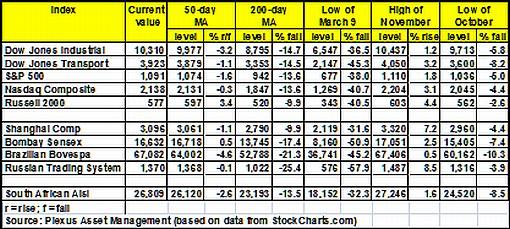

A summary of the movements of major global stock markets for the past week and various other measurement periods is given in the table below.

The MSCI World Index (-0.1%) last week marked time, whereas the MSCI Emerging Markets Index (-2.5%) experienced more selling from risk-averse investors. However, the aggregate indices mask greatly varying performances. For example, among mature markets the Japanese Nikkei 225 Index (-4.4%) recorded a fifth consecutive down-week, suffering from the strong Japanese yen that recorded a 14-year low versus the US greenback. On the other hand, the Brazillian Bovespa Index (+1.1%) and the Russian Trading System Index (+1.8%) bucked the broader downtrend among emerging markets.

As far as the US indices are concerned, Friday’s losses wiped out the gains from earlier in the week, reversing a new recovery high of 10,464 made by the Dow Jones Industrial Index on Wednesday. By the close of the Thanksgiving-shortened week on Friday, the S&P 500 Index remained unchanged on the week, whereas the other major indices experienced a second down-week. Five of the ten economic sectors (as measured by the SPDR exchange-traded funds) closed higher for the week, with Telecoms (+1.8%), Health Care (+1.3%) and Utilities (+0.9%) outperforming, and Financials (-2.2%) in the red.

The year-to-date gains in the US remain firmly in positive territory and are as follows: Dow Jones Industrial Index 17.5%, S&P 500 Index 20.8%, Nasdaq Composite Index 35.6% and Russell 2000 Index 15.6%.

Click here or on the table below for a larger image.

Top performers among stock markets this week were Bangladesh (+5.7%), Ecuador (+4.3%), Kuwait (+3.4%), Kenya (+2.1%) and Estonia (+1.9%). At the bottom end of the performance rankings, countries included Cyprus (‑15.6%), Vietnam (-11.7%), Serbia (-8.8%), China (-6.4%) and Greece (‑6.2%). The declines in the Shanghai Composite Index came in the wake of a warning by China’s banking regulator that it would refuse approvals for expansion and limit banking operations if lenders did not meet new capital adequacy requirements.

Of the 98 stock markets I keep on my radar screen, 30% recorded gains (last week 39%), 65% (58%) showed losses and 5% (3%) remained unchanged. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that, as far as exchange-traded funds (ETFs) are concerned, the winners for the week included United States Natural Gas Fund (UNG) (+10.0%), Rydex S&P Equal Weight Utilities (RYU) (+3.0%), Currency Shares Japanese Yen (FXY) (+2.6%), PowerShares DB Gold (DGL) (+2.5%) and Vanguard Extended Duration Treasury (EDV) (+2.5%).

At the bottom end of the performance rankings, ETFs included iShares MSCI Turkey Investible Market (TUR) (-5.6%), SPDR S&P Emerging Europe (GUR) (-5.4%) and Market Vectors Russia (RSX) (-4.9%).

Referring to the bull market in gold, the quote du jour this week comes from Richard Russell, 85-year-old author of the Dow Theory Letters. He said: “There’s still loads of scepticism about the rising price of gold and the bull market in gold. It’s been so long since the US public (since 1971) realized gold was real Constitutional money that they don’t know what to make of the gold action. They think gold near $1,200 an ounce is expensive and they’d rather have dollar bills.

“I’ve coined the phrase, ‘dollar-bugs’ for these ignorant Americans. I guess they’ll have to get educated the hard way, which means holding on to their fading Federal Reserve Notes, no matter what. As far as I’m concerned, it’s an amazing example of mass brainwashing. ‘Hey, I’d rather have junk paper turned out by the Fed than the real thing - gold.’ Pathetic. And the happy thought is that you can (legally) still swap your junk fiat paper for gold.”

Still on the topic of gold, Ian McAvity (Ian McAvity’s Deliberations) said: “Gold bubble? I regard such talk as nonsense … Gold is about 52% higher than the peak weekly average price of January 1980. The US CPI is 177% higher, US M-2 Money Supply is 464% higher, and the S&P is 892% higher. I don’t think it untoward to suggest gold is badly lagging a number of important yardsticks and at these levels has some catching up to do.”

In other news, MarketWatch reported that the number of distressed banks in the US rose to the highest level in 16 years in the third quarter. The Federal Deposit Insurance Corporation’s (FDIC) Deposit Insurance Fund, which is used to protect depositors, swung to an $8.2 billion loss in the third quarter, the largest drop since the savings-and-loan crisis of the 1990s.

Separately, according to MarketWatch, rates on 30-year fixed-rate mortgages averaged 4.78% last week, matching April’s all-time low of in Freddie Mac’s weekly survey of conforming mortgage rates. The mortgage rate averaged 5.97% a year ago.

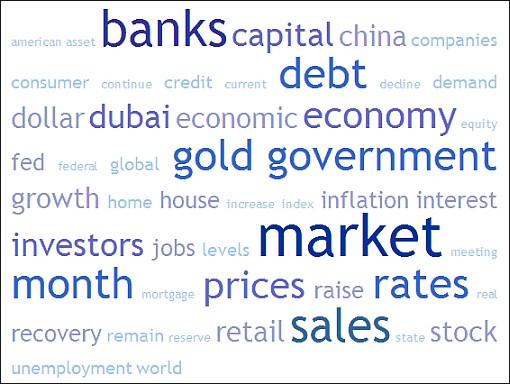

Next, a quick textual analysis of my week’s reading. This is a way of visualizing word frequencies at a glance. There is nothing specific to report here, other than that “gold” and “banks” are still prominent and “Dubai” is making an appearance.

Back to the stock markets: The major moving-average levels for the benchmark US indices, the BRIC countries and South Africa (where I am based in Cape Town) are given in the table below. With the exception of the Russell 2000 Index and the Bombay Sensex Index, the indices in the table are all trading above their 50-day moving averages, with all the indices also above their respective 200-day moving averages.

However, many stock markets have already fallen to below their 50-day lines (not shown on this table, but indicated on the performance table higher up), pointing to possible further weakness. Also, the Japanese Nikkei 225 Index last week became the first major market to breach its key 200-day moving average, pointing to a very weak technical picture.

The October lows are also given in the table. A break below these levels would indicate a reversal of the uptrend since March, i.e. reversing the progression of higher-reaction lows.

Click here or on the table below for a larger image.

In addition to having retraced 50% of their bear market declines, the Dow Industrial and S&P 500 are up against significant medium-term downward trend lines. Also, negative divergences have been showing up in a number of breadth indicators, financial stocks and small caps, suggesting a more cautious tone.

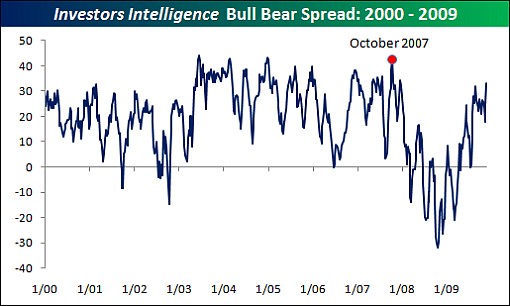

According to Bespoke, last week’s sentiment survey from Investors Intelligence showed bullish sentiment among newsletter writers was near its highest levels since the March lows (50.6%), while bearish sentiment is at a five-year low (17.6%). This puts the spread between bulls and bears at 33, which is the highest level since December 2007. “High levels of bullish sentiment are typically considered contrarian, but we would note that sentiment can remain bullish for extended periods of time with little impact on the market. While it is true that markets typically peak when bullish sentiment is high, however, high levels of bullish sentiment don’t necessarily mean an imminent decline,” said Bespoke.

Source: Bespoke, November 25, 2009.

Casting his eye on 2010, Eoin Treacy (Fullermoney) said: “Most markets rallied from deeply oversold levels this year and have posted impressive advances since March. It is unreasonable to expect the same type of performance to be repeated next year. Nevertheless, monetary conditions are unlikely to pose a headwind and the environment is likely to remain largely bullish despite the potential for swift mean reversion in markets somewhat overextended relative to their 200-day moving averages.”

In my opinion, stock markets have run too far too fast - driven by an avalanche of liquidity - and they have moved out of alignment with economic and earnings growth that may not live up to the expectations being priced into equity valuations. I will bide my time while the fundamentals play catch-up.

For more discussion on the economy and financial markets, see my recent posts “Dubai’s latest mega-project - a massive default?“, “Japanese Nikkei 225 nosedives“, “Gold ETF makes it 9 up-days in a row“, “Gold bullion - overdue for a pullback?“, “Ritholtz: “Buy and hold” is a disaster“, “Charlie Rose in conversation with Barton Biggs“, “Picture du Jour: Will emerging-market outperformance last?” and “WealthTrack: Robert Kleinschmidt - reveling in contrarian investment philosophy“.

Twitter and Facebook

I regularly post short comments (maximum 140 characters) on topical economic and market issues, web links and graphs on Twitter. For those readers not doing so already, you can follow my “tweets” by clicking here. You may also consider joining me as a friend on Facebook.

Economy

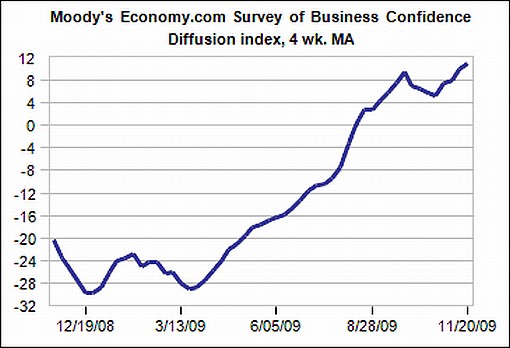

“There has been no meaningful change in global business sentiment during the past three months. Since mid-August, business confidence has been consistent with a tentative global economic recovery,” according to the results of the latest Survey of Business Confidence of the World by Moody’s Economy.com. “Businesses have remained consistently more upbeat about the outlook than their assessment of current conditions. Sales and hiring are soft, as are pricing and inventories. South American businesses and professional service firms are the most positive and North Americans and those working in government generally the most negative.”

Source: Moody’s Economy.com

Purchasing managers indices for the 16-country Eurozone region showed private sector activity expanding this month at the fastest pace in two years, led by France and Germany, reported the Financial Times. The composite index, covering Eurozone services and manufacturing, reached 53.7 in November, up from 53.0 in October, making it the fourth consecutive month of expansion.

As far as hard data are concerned, Germany’s economy expanded again in the third quarter of 2009. GDP rose by 0.7% on a seasonally adjusted basis from the previous quarter, when it expanded by a revised 0.4%. Economic activity was boosted by inventory restocking and spending on machinery and equipment.

Concerns remain about the pace of the global economic recovery, and therefore how quickly governments and central banks should withdraw emergency support measures. According to the Financial Times, Mr Strauss-Kahn, managing director of the International Monetary Fund, said the global economy stood at the cusp of recovery but remained vulnerable to shocks and policy missteps. Fiscal and monetary stimulus programs should not be stopped too soon, he said.

A snapshot of the week’s US economic reports is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

Tuesday, November 24

• Minutes of November 3-4 FOMC Meeting - spots of optimism are visible, concerns about dollar, commercial real estate loans, and low interest rates are noticeable

• Widespread revisions of Q3 GDP

• Home prices - signs of stability remain in place

• Consumer Confidence Index moves up slightly

Monday, November 23

• Low mortgage rates and tax credit lift sales of existing homes

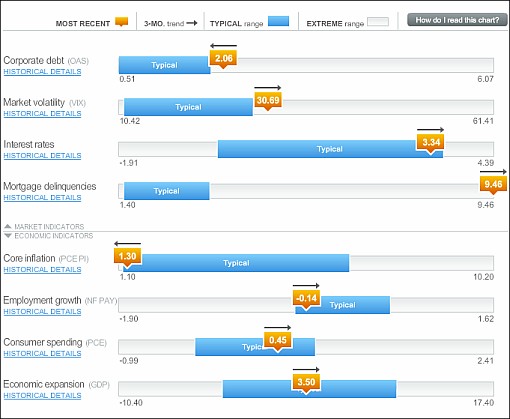

A very handy graph to assess the current state of the US economy comes courtesy of Russell Investments. Click here to link to the interactive version.

Source: Russell Investments, November 22, 2009.

The minutes of the Federal Open Market Committee’s (FOMC) November 3-4 meeting point to continued aggressive monetary policy in the near term. Although participants agreed that the recession was over, they expected the unemployment rate to remain elevated and the inflation rate to remain below the central bank’s optimal level. Participants expected economic growth to slow a bit in 2010 and then pick up again after that.

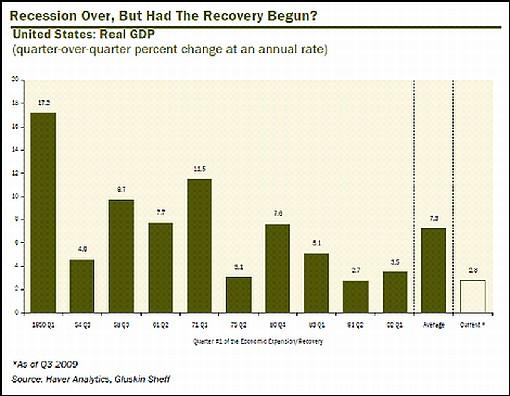

On the topic of the magnitude of the US economic recovery, David Rosenberg, chief economist and strategist of Gluskin Sheff & Associates, provided the following interesting snippet:

“The recession in the US may be over, but what sort of recovery lies ahead remains in question. All we can say is that when looking at what is normal in the context of a post-recession rebound during the post-WWII era, the first quarter of growth is closer to 7.3% at an annual rate, not 2.8% as we just saw in the latest real GDP estimate - the median was 6.3%. The fact that with the massive amount of stimulus - without it, growth would have flirted with 0% - this first quarter of positive growth was basically one-third of what is typical, really says something.”

Food for thought indeed.

Source: Gluskin, Sheff & Associates - Breakfast with Dave, November 26, 2009.

Week’s economic reports

The European Central Bank (ECB) will make an interest rate announcement on Thursday (December 3). US economic data reports for the week include the following:

Monday, November 30

• Chicago PMI

Tuesday, December 1

• Construction spending

• ISM Index

• Pending home sales

• Auto and truck sales

Wednesday, December 2

• ADP employment report

• Fed Beige Book

Thursday, December 3

• Jobless claims

• Productivity

• ISM Services

Friday, December 4

• Nonfarm payrolls

• Factory orders

Markets

The performance chart from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, November 27, 2009.

“Regardless of the dollar price involved, one ounce of gold would purchase a good-quality men’s suit at the conclusion of the Revolutionary War, the Civil War, the presidency of Franklin Roosevelt, and today,” said Peter Burshre (hat tip: Chart of the Day). Let’s hope the news items and quotes from market commentators included in the “Words from the Wise” review will assist the readers of Investment Postcards to not only don decent suits, but also build considerable wealth with their investment portfolios.

That’s the way it looks from Cape Town (where I will be spending my time over the next few weeks, because my visit to New York had to be cancelled to attend to local business responsibilities).

Source: Wayne Stayskal, November 11, 2009.

Financial Times: Bets rise on rich country bond defaults

“The mounting level of debt in the industrialised world is prompting a growing number of investors to use the derivatives market to bet on the chance of rich governments defaulting on bonds.

“The volume of activity in sovereign credit default swaps - which measure the cost to insure against bond defaults - linked to the US, UK and Japan have doubled in the past year because of concerns about their public finances.

“CDS volumes for Italy, which has one of the highest debt burdens of the developed economies, are now the highest for an individual country, according to the Depository Trust & Clearing Corporation.

“In contrast, the outstanding volume of CDS linked to emerging nations such as Russia, Brazil, Ukraine and Indonesia have been flat or fallen in the past 12 months as investors have become less interested in trading the risks of those countries.

“In the past, the CDS market for developed countries was sluggish, because few investors saw the need to buy or sell protection against a risk of default that seemed exceedingly remote.

“However, rising debt levels and growing political and economic uncertainty have created a more active market, with more investors now seeking insurance. Meanwhile, many banks are prepared to offer protection in exchange for a fee.

“This fee has recently jumped, since the cost to insure the debt of developed countries has increased since the summer of last year, while the cost of insuring emerging market debt has fallen.

“Gary Jenkins, head of fixed income research at Evolution, said: ‘The biggest single risk hanging over the bond markets is the rapid rise in public debt in the industrialised world.

“‘If we get to a point where the market thinks the levels of debt are unsustainable, then we will see an almighty sell-off in the government bond markets, with yields soaring. Governments need to take action to cut deficits and debt.’

“Nigel Rendell, senior emerging markets strategist at RBC Capital Markets, said: ‘It is not surprising that investors are increasingly worried about debt in the industrialised world. Debt to GDP of more than 100 per cent is difficult to sustain.’”

Source: David Oakley, Financial Times, November 22, 2009.

Financial Times: Dubai World

“Dubai has shocked investors by asking for a debt standstill at Dubai World, the government’s flagship holding company that has developed some of the world’s most extravagant real estate projects. The move raised the spectre of default in the Middle East’s trading hub just as early signs of economic recovery have emerged. John Paul Rathbone analyses recent developments in Dubai.”

Source: John Paul Rathbone, Financial Times, November 24, 2009.

Financial Times: Dubai shock after debt standstill call

“Dubai has shocked investors by asking for a debt standstill at Dubai World, the government’s flagship holding company that has developed some of the world’s most extravagant real estate projects.

“The move raised the spectre of default in the Middle East’s trading hub just as early signs of economic recovery have emerged. During the boom, Dubai rode the wave of easy credit generating phenomenal economic growth but was badly hit by the global credit crisis.

“Dubai’s surprise move angered some investors who had been reassured by local officials for months that the city would meet all obligations on its $80bn of gross debt in spite of recession and a real estate crash.

“‘Investors view this as shockingly bad news,’ said Rob Whichello of BNP Paribas. Two hours after announcing it had raised $5bn from two Abu Dhabi banks, the department of finance asked for a standstill until May 30 on all financing to the heavily indebted Dubai World and its troubled property unit Nakheel, which is due to pay back $4bn on an Islamic bond on December 14.

“‘Investors view this as shockingly bad news,’ said Rob Whichello of BNP Paribas. Two hours after announcing it had raised $5bn from two Abu Dhabi banks, the department of finance asked for a standstill until May 30 on all financing to the heavily indebted Dubai World and its troubled property unit Nakheel, which is due to pay back $4bn on an Islamic bond on December 14.

“Dubai also launched a restructuring of the government holding company, which oversees ports operator DP World, the UK-based P&O Ferries and troubled investment company Istithmar. Nakheel, the developer behind the city’s Palm Islands that boast celebrity owners such as David Beckham, has had to shed thousands of staff and left contractors out of pocket as local property prices halved and credit dried up.

“A symbol of Dubai’s pre-crunch excess, the government company has had to cancel plans for the world’s tallest tower and a constellation of reclaimed islands, as collapsing cash flow left the developer on the brink.

“‘This will destroy confidence in Dubai, the whole process has been so opaque and unfair to investors,’ said Eckart Woertz, economist with Dubai’s Gulf Research Centre.

“The gaping size of Dubai World’s $22bn debt problem has been apparent for a year. But the government’s level of support has been clouded by politics and a lack of clarity on how much it could raise from international markets and the oil-rich capital of the United Arab Emirates, Abu Dhabi.

“Bond markets reacted sharply to the news with investors demanding higher premiums to hold debt from the region. In London trade it cost about $460,000 annually over five years to insure $10m worth of Dubai government debt against default, compared with $360,000 on Tuesday. Prices rose for its neighbours with Abu Dhabi protection $100,000 more than on Tuesday.

“Standard & Poor’s and Moody’s Investors Service immediately downgraded the ratings of all six government-related issuers in Dubai following news of the repayment delay and left them on review for possible further downgrade.

“Moody’s cut ratings on some government-related entities to junk status, while S&P cut ratings on some entities to one level above junk.

“S&P said the restructuring ‘may be considered a default under our default criteria, and represents the failure of the Dubai government (not rated) to provide timely financial support to a core government-related entity’.”

Source: Simeon Kerr and Jennifer Hughes, Financial Times, November 25, 2009.

Eoin Treacy (Fullermoney): Dubai could trigger corrective phase

“Middle Eastern stock markets have been laggards over the last year despite the advance in oil prices. Laggards usually lag for a reason and these are now becoming apparent with yesterday’s announcement. This news has had little effect on the region’s stock markets which suggests either some expectations of credit problems are already in the price or the focus of these problems lies with the Dubai government and foreign creditors.

“Dubai took full advantage of loose credit conditions earlier this decade to build on a massive scale. A huge percentage of the world’s cranes were domiciled in the country and the ‘before and after’ pictures of the city were commonly used to illustrate the extent of the development. The aim of building a financial and tourist hub and becoming a gateway between Europe and Asia as a solution to the Emirate’s lack of oil and gas reserves is laudable, but as with any mania, the good idea was taken to excess. The contraction of global liquidity has put pressure on Dubai’s ability to attract investment and has contributed to the current problems.

“Countries that experienced the biggest building booms on credit alone are experiencing some of the deepest recessions. The US, UK, Ireland, Spain and a number of Eastern European and Middle Eastern countries share this characteristic. However, the stock market action of the last year demonstrates that not all countries have been affected the same way and those which avoided building to excess have largely avoided recessions and posted the best stock market performances.

“The extent to which British banks are exposed to Dubai World has begun to rekindle worries about contagion but I wonder how justified this is? Dubai’s big brother, Abu Dhabi, is on a sounder financial footing and remains likely to provide assistance. Creditors may have to endure a delay in getting their capital returned but massive writedowns akin to those experienced following Lehman Brothers’ bankruptcy are probably unlikely. However, the perception of these problems is more important in the short-term. Stock and commodity markets have had an exceptional run since March. The Dubai default could be a catalyst for a deeper corrective phase unfolding generally.”

Source: Eoin Treacy, Fullermoney, November 26, 2009.

Nouriel Roubini (Forbes): Will the world go shopping?

“Roughly one year ago, around the Thanksgiving festivities, the National Bureau of Economic Research announced that the US recession started in December 2007. One year later, though the US economy is in recovery mode, retailers are approaching the holiday season - which accounts for slightly less than one-fifth of yearly US retail sales - with some concern.

“A sharp collapse in US consumer spending since mid-2008 led to a particularly dismal 2008 holiday retail season. As per US Census Bureau estimates, core retail sales (which exclude autos, gasoline and building supplies) fell by 1.1% year on year during November and December 2008, compared to an average 4.6% year-on-year increase in holiday season sales over the past decade. Total retail sales suffered a larger collapse, falling 9.5% year on year.

“After collapsing in 2008, retail sales showed signs of stabilizing over the summer of 2009. While auto sales have fluctuated sharply during recent months due to the government’s ‘cash for clunkers’ initiative, core retail sales have risen for three consecutive months as of October 2009, creeping up at a pace of about 0.5% month on month. Entering the 2009 holiday season, the recent uptick in core sales offers hope for better than anticipated holiday retail sales.

“Economic indicators, however, suggest a note of caution. The renewal in US consumer confidence over the first half of 2009 faded. Successive grim reports on the employment situation revealed no quick end to labor market woes, lowering consumers’ income expectations. According to the October Reuters/University of Michigan Survey of Consumer Sentiment, in October 2009, consumers reported worsening personal finances for the 13th consecutive month, the ‘longest and deepest decline in the 60-year history of the surveys’.

“The poor state of personal finances has driven consumers to reduce debt at an accelerated pace. In September, consumer credit fell for the eighth consecutive month at an annualized pace of 7.2%. The poor health of personal finances, labor market uncertainty and the ongoing household balance- sheet repair will continue to promote frugal behavior by US consumers. The Conference Board consumer confidence surveys tell a revealing story: Consumers’ plans to purchase big-ticket appliances have declined in the run-up to the 2009 holiday season. This is a bit unusual as plans to buy big-ticket appliances usually display a sinusoidal pattern, with a trough in the month of October and a peak sometime the following spring.

“A measure of weekly retail sales released by the International Council of Shopping Centers and Goldman Sachs indicates that same-store sales flattened over the first three weeks of November, though compared to 2008, sales are up by a promising average pace of 2.9%. The National Retail Federation projects retail sales will fall 1% during this holiday season, compared to an average 3.4% annual gain in holiday sales over the past decade. After the sharp slide in 2008, a decline of ‘only’ 1% or even a small positive gain in 2009 holiday sales may seem like a welcome number; however, accounting for the base effects of a dismal 2008 season, the underlying reality for retailers remains grim for this holiday season.”

Click here for the full article.

Source: Nouriel Roubini, Forbes, November 26, 2009.

The article continues here

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.