S&P 500 Temporarily Falls to 20 Day Moving Average, Russell 2000 Back to "Broken"

Stock-Markets / Stock Index Trading Nov 27, 2009 - 09:39 AM GMTBy: Trader_Mark

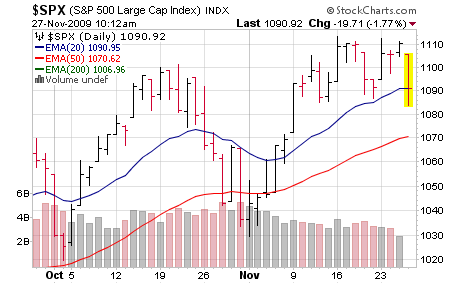

Overnight, S&P futures had fallen all the way down to 1070, but as has been the case so many times the past year furious buying in premarket pushed the market higher in the 2 hours before the US markets opened. Hence domestic markets launched far above the worse levels overnight. The S&P has jumped as I write all the way back up to test its 20 day moving average from below (1090)...

Overnight, S&P futures had fallen all the way down to 1070, but as has been the case so many times the past year furious buying in premarket pushed the market higher in the 2 hours before the US markets opened. Hence domestic markets launched far above the worse levels overnight. The S&P has jumped as I write all the way back up to test its 20 day moving average from below (1090)...

I had thought potentially last night that the "gap" at S&P 1070 would be filled (the hard way) this morning but I forgot about the "anxious buyer" - he who buys futures without regard to price in urgent manner whenever is needed. Ironically a move to 1070 would not only of filled a gap from Nov 8/Nov 9 but this would of pushed us down exactly to the 50 day moving average, setting up for an excellent low risk bounce play opportunity... but that 'easy trade' never came.

Clearly S&P 1111(ish) has been the ceiling of late, and for now until some more folks "thankful" for any opportunity to get back into the market get us back over the 20 day, we're in the 20 to 50 day moving average band. As I type this, buyers are already pushing the market out of this band and up, up, and away...

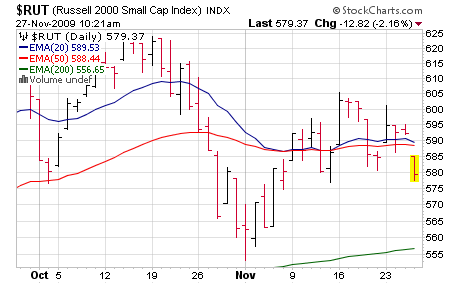

As for the Russell 2000 it is back in "not good" mode... once more the larger averages (NYSE, SP500) are masking a lack of follow through in the median stock. This divergence continues week after week but has yet to "matter".

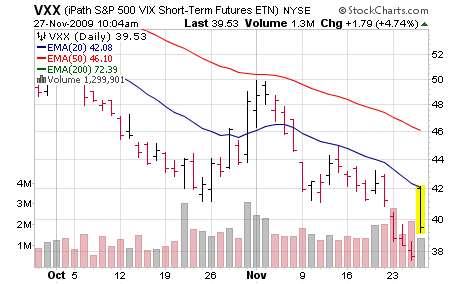

On a side note, the hedge we put on mid week betting on an increase in volatility is helping us out today... or WAS helping us out, but already giddy buyers are rushing into the market and the "what me, worry?" attitude is back. VXX opened at its high and has sold off for 50 minutes straight... boo yah.

Long VXX in fund; no personal position

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.