Central Bankers Blowing Bubbles in Global Stock Markets

Stock-Markets / Quantitative Easing Nov 19, 2009 - 12:00 PM GMTBy: Gary_Dorsch

The Swiss franc is counted among the top-5 reserve currencies in the world, alongside the US-dollar, the Euro, the British pound, and the Japanese yen. The Swiss franc holds this top distinction, even though the Swiss economy does not find its place among the top five economies of the world. Instead, its annual output of $488-billion of goods and services ranks as the world’s 22nd largest.

The Swiss franc is counted among the top-5 reserve currencies in the world, alongside the US-dollar, the Euro, the British pound, and the Japanese yen. The Swiss franc holds this top distinction, even though the Swiss economy does not find its place among the top five economies of the world. Instead, its annual output of $488-billion of goods and services ranks as the world’s 22nd largest.

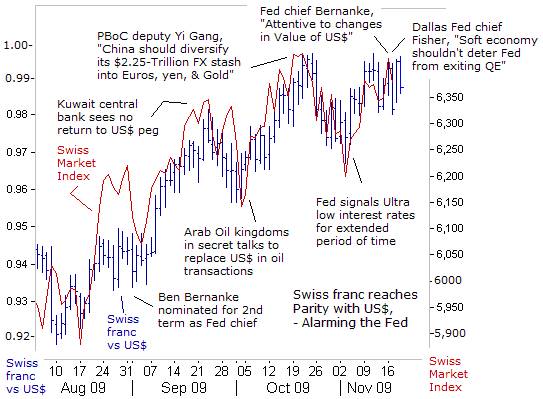

When the Swiss franc nearly reached parity with the US-dollar this week, it raised many eyebrows, since it’s a remarkable achievement, considering the fact that Switzerland’s economy is only 1/25th the size of the US-economy. However, rather than speaking volumes about the intrinsic worth of the Swiss franc, its climb towards $1.00 is signaling that the world can no longer rely, as it has done since the end of the gold standard, on a currency issued by a single country.

At present, roughly 62% of the $7.3-trillion of currency reserves held by central banks and sovereign wealth funds are held in US-dollars and 25% in Euros. But World Bank chief Robert Zoellick warned in late September, “The United States would be mistaken to take for granted the dollar’s place as the world’s predominant reserve currency. Looking forward there will be increasingly other options to the dollar.” To that end, the SDR basket of currencies might be modified to include the Chinese yuan, the Indian rupee, and Brazilian real as well.

The Swissie’s surge from around 94-US-cents in late August, towards parity with the US-dollar in October, began shortly after US President Barack Obama nominated Ben “Bubbles” Bernanke to a second term as head of the Federal Reserve. Soon after, a British newspaper revealed that finance ministers and central bankers from the Arab oil kingdoms, China, Russia, Japan, and France had held a series of secret meetings to plan an end to the use of the US-dollar for oil trading by 2018.

Under the scheme, the US-dollar would be replaced with a basket of currencies, including the Euro, the Japanese yen, the Chinese yuan, and Gold. If correct, such a move would be an economic bombshell. An end to the US-dollar as a medium of exchange for trading in a vital commodity such as crude oil would deal a powerful blow to the greenback’s pivotal role as the world’s reserve currency.

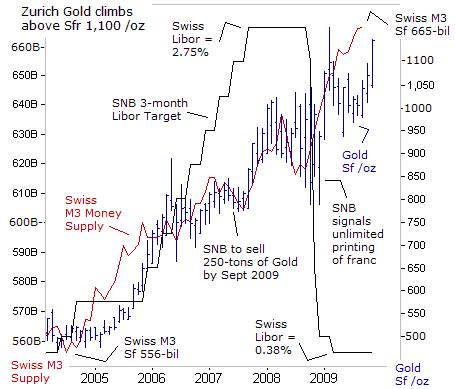

The Swiss National Bank (SNB) usually keeps a tight rein on the Swiss M3 money supply, limiting its growth rate to a 3% annual clip, thus bolstering the franc’s appeal to offshore investors. Because of Switzerland’s lack of natural resources, it’s created an economy that is heavily dependent on a steady tide of foreign capital inflows, for its banking services, wealth management, and global trade.

But the SNB was suddenly forced to loosen its tight-rein on M3, when the Fed began slashing the fed funds rate towards zero-percent and shifted to nuclear “Quantitative Easing” (QE. The SNB responded by slashing the 3-month Libor target rate by 250-basis points to 0.25%, and said it would engage in its own variant offshoot of QE - printing unlimited amounts of Swiss francs, if necessary, to weaken its currency against the Euro, and to widen the profit margins of its exporters.

This year, the SNB has ratcheted-up the growth rate of the M3 money supply to an 8% annualized clip, weakening the franc against the Euro, and slowing the franc’s ascent against the US-dollar. However, these radical moves by the SNB, pale in comparison to the Fed’s onslaught, which is flooding the world with trillions of cheap dollars, and pegging the fed funds rate below the SNB’s 0.25% Libor target.

Whereas interest rate differentials often influence foreign exchange rates, in today’s hallucinogenic world of zero-percent interest rates and nuclear QE, - it’s the degree of risk appetite in global stock markets, that’s become the key factor moving the Aussie, Loonie, the Euro, and the Swiss franc. And every piece of paper that can be electronically printed by central bankers is losing ground to the king of currencies – Gold, now hovering above $1,100 /oz.

In earlier decades, the Swiss franc displayed an 80% correlation with gold, because the Swiss constitution called for the franc to be backed by 40% with gold reserves. This link was broken however, when a panel of government experts delivered a report in October 1997 finding that 1,300-tons of gold “were no longer necessary for monetary purposes and could therefore be withdrawn from the Swiss National Bank’s (SNB) balance sheet and used for other purposes.”

Over a five-year period ending in March 2005, the SNB sold nearly 1,300-tons of its gold at an average selling price of $351.40 /oz, and raked in Sfr 21.1-billion. Thus, these controversial sales turned the Swiss franc into a “relic of the gold standard.” In June 2007, the SNB shocked the markets again, by saying it would sell another tranche of 250-tons of gold thru September 2009, and use the proceeds to increase its foreign exchange reserves.

The SNB’s decision to dump more than half of its gold holdings was in retrospect, one of the greatest blunders in financial market history. It probably ranks alongside the British Treasury’s determination to sell 400-tons of England’s gold in a series of 17-auctions between 1999 and 2002, when the price was at a 20-year low. More than half of England’s gold reserves were sold at an average price of $275 /ounce, - a blunder costing the BoE about 7-billion pounds at today’s prices.

Despite the SNB’s massive sales of gold, the yellow metal continued to climb on an upward trajectory, hitting 1,150-francs /oz, an all-time high. Gold’s value in relation to the Swiss franc has more than doubled since March 2005, when the SNB completed its first round of gold sales. The SNB’s vow to print unlimited amounts of francs in January, and threats to buy other currencies at a fixed rate, helped fuel gold’s rally from 800-francs /oz to as high as 1,150-francs today.

SNB chief Jean Pierre Roth, a 30-year veteran of the bank, announced his intention to retire in December. Sometimes, central bankers will issue a mea-culpa, or a confession about their inner thoughts, before leaving the world stage. It’s a break from tradition for central bankers to speak candidly about key issues, after they’ve operated behind a veil of “smoke and mirrors,” throughout their careers.

When asked on Nov 12th, if he believed the G-20 central banks would be inclined to lift their interest rates to calm stock market exuberance, and pre-empt the emergence of dangerous bubbles, Roth told the Swiss newspaper Le Temps, “If the bourse is euphoric, do we have to raise interest rates? I do not believe that, right now there is, within the G-20 central banking circles, the belief that interest rates should be an instrument to use to limit euphoria,” he said.

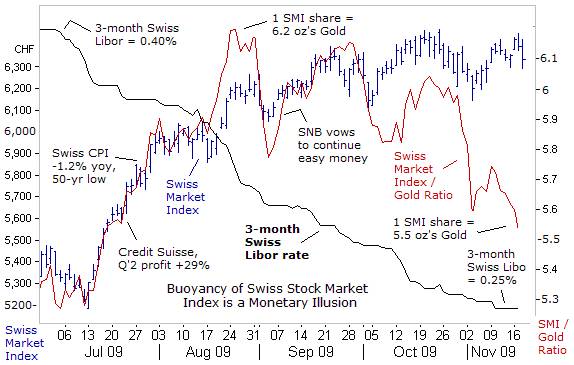

With Swiss consumer prices falling at the fastest rate in 50-years in July, the SNB issued a stark reminder that it’s determined to fight deflation risks by printing Swiss francs. In the process, it pumped-up the Swiss Market Index (SMI) to the 6,400-level, - creating the illusion of an economic recovery. However, when measured versus gold, the SMI has actually tumbled by 11% since its peak on August 20th. In hard money terms, the SMI is trading at 5.5 oz’s of gold, the level which prevailed in mid-July, when the SMI was last seen in the vicinity of the 5,600-area.

“Plunge Protection Team” Engineers Global Recovery

In the United States, the infamous “Plunge Protection Team” (PPT), has been busy at work, engineering the most remarkable recovery in the Dow Jones Industrials, since the 1930’s. The Dow Industrials is up 60% from its 12-year low of 6,500, and is perched near the 10,400-level. The euphoria and greed that dominates stock market psychology today, is completely reversed from the fear and panic meltdowns that prevailed in the aftermath of the default of Lehman Brothers, a year ago.

The central mechanism behind the PPT’s clandestine scheme is a gradual devaluation of the US-dollar through the Fed, which has carried out the electronic equivalent of printing $1.75-trillion through the purchases of Treasury notes and mortgage backed bonds, and flooding the global money markets with ultra-cheap credit. The tidal wave of liquidity has enabled Wall Street’s Oligarchic banks to reap bumper profits in stocks and bonds, and awarding their traders with record bonuses, while making US exports cheaper and foreign imports more expensive.

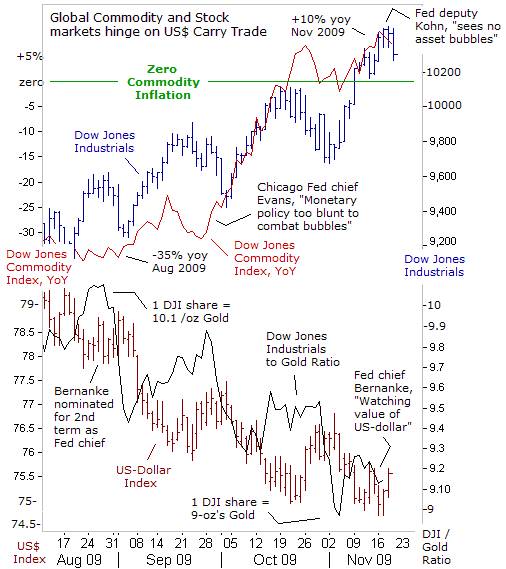

The historic rally in global markets is part of a trend that has emerged since hitting bottom in late March – global stock markets generally move in the opposite direction of the US-dollar. Also in keeping with the dollar’s 16% slide since late March, crude oil, base metals, gold, and grains have also surged sharply higher. The connection between soaring commodity and stock markets and a falling dollar points to the speculative nature of the carry trade. Yet carry traders should be careful about what they wish for, - if the US-dollar’s gradual slide suddenly lurches into a free-fall.

The US dollar has supplanted the Japanese yen as the top funding currency in highly leveraged carry trades. Speculators are borrowing US-dollars at near zero-percent, betting that the greenback will decline further, and investing the funds in volatile stocks and commodities around the world. Over the past six-months, the US-dollar is off 20% against the Canadian dollar, down 16% against the Euro, down 11.4% against the Japanese yen, and is 36% lower against the Brazilian real.

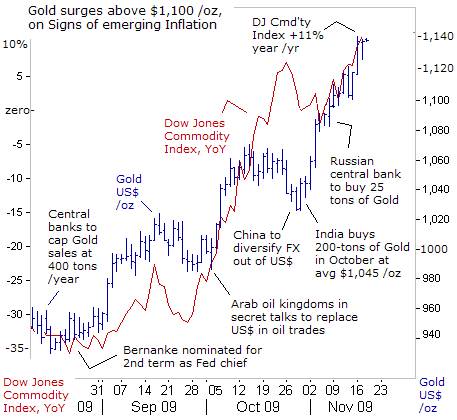

Nuclear QE and the US-dollar’s devaluation have already led to the rapid unwinding of the deflationary forces in the global economy that threatened a second Great Depression. The Dow Jones Commodity Index is now 10% higher than a year ago, portending an outbreak of inflation in 2010. Like its Swiss counterpart, the rally in the Dow Jones Industrials is also a monetary illusion. When measured in gold terms, the Dow is 11% lower below its peak level on August 24th, trading at 9.15 ounces of gold, - reflecting the PPT’s monetization of the stock market.

With the gold market surging above $1,100 /oz, its comforting for gold bugs to know, that Fed chief Ben “Bubbles” Bernanke views the surge in commodity markets as a signal of a revival in global economic activity, “especially in resource-intensive emerging market economies,” rather than the early warning signs of accelerating inflation next year. Instead, the Fed chief argues that inflation will remain “subdued for some time and that gives the Fed leeway to hold rates at record-low levels for an extended period,” he said on Nov 16th.

“Jawboning” is only weapon in the Fed’s arsenal right now that can be used to defend the despised US-dollar, without actually lifting interest rates. It’s a delicate balancing act that’s likely to go down in flames before a sophisticated audience. “We are attentive to the implications of changes in the value of the dollar, and the Fed will help ensure that the dollar is strong and a source of global financial stability,” Bernanke declared. Yet traders are skeptical, given “Helicopter” Ben’s reputation.

By pegging interest rates at zero-percent, the Fed is inflating speculative bubbles worldwide. Right now, Gold has become the most coveted sanctuary from the G-20’s money printing orgy. Even with gold zooming above $1,100 /oz, Bernanke said on Nov 16th, “It’s extraordinarily difficult to tell if a bubble is forming. It’s not obvious to me in any case.” His right-hand man, Fed governor Donald Kohn, went one step further, revealing for the first time, that the Fed’s ultra-easy money policy is in fact, meant to encourage traders to shift money into risky assets, and argued that hiking interest rates isn’t the appropriate tool for deflating asset bubbles.

Beijing fuels Gold, Commodity Rally,

In unusually blunt criticism of the Fed’s “bubble blowing” policy, on Nov 15th, Chinese banking regulator Liu Mingkang said the Fed’s pledge to hold down borrowing costs for an “extended period of time” is creating a new systemic risk for the world economy. “This situation has already encouraged a huge dollar carry trade and has a massive impact on global asset prices. It is boosting speculative investment in stock and property markets and will pose new, insurmountable risks to the global recovery and, particularly, to the recovery in emerging markets,” he warned.

Fan Gang, a top member of the People’s Bank of China’s (PBoC) monetary policy committee, said on Nov 18th, “The US needs to address how to raise interest rates to curb excess global liquidity and rein in volatility in the dollar. Speculative capital inflows or “hot money” into China has become a problem,” he said. In order to maintain the US-dollar’s exchange rate at 6.84-yuan, the PBoC has cranked up its money printing operations, and ordered its state owned banks to extend a record amount of new loans, 20% of which filtered into the Shanghai stock market.

China’s M2 money supply is expanding at a +29.4% annualized clip, and sowing the seeds of faster inflation in China and around the world. The late Milton Friedman, the godfather of monetarism, once remarked that, “Significant changes in the growth rate of money supply impact the financial markets first. Then, they impact changes in the real economy, usually in six-to-nine months,” he observed. Indeed, in China, the rapid expansion of the M2 money supply began in Nov 2008, and the subsequent upturn in the commodity based inflation began to jettison higher in July 2009.

Beijing is wary of printing money at such a fast pace, since an outburst of hyper-inflation would be just as debilitating as a slump in exports. Thus, former Chinese central bank adviser Yu Yongding warned US Treasury chief Timothy Geithner in June, “I wish to tell the US government, - Don’t be complacent and think there isn’t any alternative for China to buy your bills and bonds. The Euro is an alternative. And there are lots of raw materials we can still buy,” he said.

China has already begun to experiment with alternatives. Beijing has signed currency swap agreements with Russia, and Asian and Latin American countries, in order to settle bi-lateral trade in their own currencies, rather than the US-dollar. Moreover, Beijing is increasingly using its $300-billion sovereign wealth fund (SWF) to buy minerals, and stakes in base metal miners, oil companies, and commodity trading firms, rather than to purchase US Treasury bills at near zero-percent.

Hong Kong’s Central Bank Inflates Stock market Bubble

Beijing has kept the yuan’s value frozen against the US-dollar over the past year, and it leading to cries of foul from US-companies, Asian exporting nations, Brazil, and Euro-zone officials, complaining that their currency appreciation against the yuan is giving Chinese exporters an unfair advantage. “Either all countries should have a fixed exchange rate, or all should have a floating exchange rate,” said Brazil’s finance minister Guido Mantega on Nov 9th.

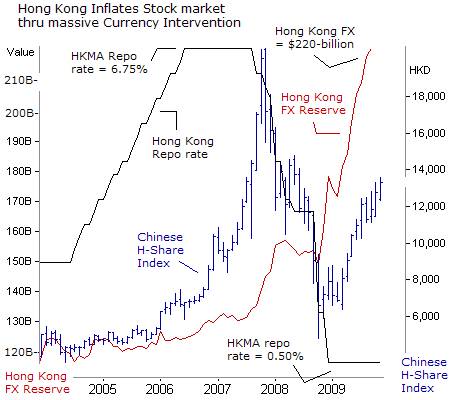

Asian central banks are printing vast quantities of money, and pegging interest rates at ultra-low levels, in order to prevent their currencies from rising further against the dollar, and by default, against the Chinese yuan. The most glaring example of currency manipulation is the actions of Hong Kong’s Monetary Authority, which has injected about HK$546-billion into the foreign exchange market over the past 12-months, in order to offset huge demand for Hong Kong dollars, and to keep the US-dollar fixed at an artificial rate of 7.80 HK-dollars.

The parabolic surge in Hong Kong’s FX reserves, to $220-billion last month, reflects the amount of HK$’s pumped into the local currency market in exchange for US-dollars, which in turn, ends-up inflating the local stock and property markets. The HKMA has slashed its overnight repo rate to a record low of 0.50% from 6.75% two-years ago, encouraging speculation in risky assets. Thus, the HKMA is also pursuing QE, thru its currency intervention tactics.

Hong Kong’s chief central banker remarked last week, “a US-dollar carry trade spawned by ultra-low interest rates threatens to inflate dangerous asset bubbles in emerging markets, the same way low Japanese rates did in the 1990’s.” But St Louis Fed chief, James Bullard said US monetary policy won’t be formulated with regard to prices outside its borders. “It’s very hard to identify bubbles, and I think if there’s problems in real estate markets in Asia, it’s not very practical to say that you should raise interest rates in the US,” he declared.

President Obama bows to Japanese Creditors,

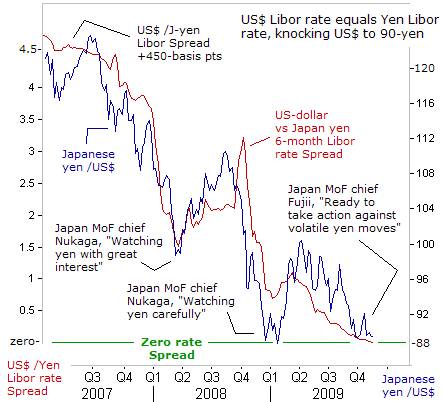

In Tokyo, the six-month US-dollar Libor lending rate fell below the Japanese yen rate for the first time in 16-years, as the Fed signaled it would keep the fed funds rate pegged near zero-percent or an extended period of time. As the US-dollar has lost its interest rate advantage against the Japanese yen, it’s tumbled from around 122-yen in June of 2007, to around 89.25-yen today. The “Yen carry trade,” which dominated the scene from the beginning of 2005 thru the first quarter of 2009, has been virtually unwound, and is no longer causing markets to tremble.

Successive Japanese finance chiefs, have always come to the rescue of the US-dollar after sharp declines, since the yen’s appreciation threatens to undermine Japan’s export-driven recovery and prolong its pain with deflation. The “current level around 90-yen is a bit painful,” said Yukitoshi Funo, vice president of Toyota on Sept 25th. Sure enough, Japan’s new finance chief Hirohisa Fujii heeded the call for help, and issued his clearest warning yet that Tokyo would intervene to prop-up the tumbling dollar. “If currencies show some excessive moves in a biased direction, we will take action,” Fujii warned on October 3rd, stabilizing the dollar at 88-yen.

Japan’s economy has contracted by -7.2% from a year ago, and its annual output of $4.9-billion is roughly eight-percent of the world economy. Japan’s industrialized economy has few natural resources, and foreign trade enables it to earn the currency to purchase raw materials, energy, and food supplies. It’s also the second largest creditor to Washington, holding $751-billion of US Treasury notes, up sharply from $617-billion in September 2008. Thus, it wasn’t surprising to see President Obama bowing last week before Japanese Emperor Akihito at the Imperial Palace.

Increasingly, the US-dollar’s privileged role as the world’s top reserve and trading currency is being called into question. This was highlighted when India’s central bank purchased 200-tons of gold at an average price of $1,045 /oz in the second half of October, in exchange for $7-billion held in its FX stash. The dollar’s demise highlights the transformation of America from the world’s industrial powerhouse, and into the center of global financial speculation and highly leveraged carry trades.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.