Wyndham Worldwide (WYN) Beats, Raises Guidance

Companies / Corporate Earnings Oct 29, 2009 - 11:47 AM GMTBy: Trader_Mark

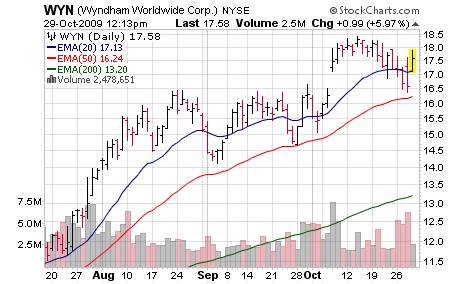

Wyndham Worldwide (WYN) reported Tuesday evening, we did not have time to discuss it yesterday due many other activities happening. This hotel chain continues to be one of our best performers of the year and as I say in almost every update on the name ... it is STILL cheap. As I'm looking at the chart now the action the past 48 hours allowed the stock to fill a gap, and I'm smacking myself in the head because I completely missed an opportunity to add. Unlike many other names, the stock was able to fill a gap but stay over key moving averages...

A closer look at earnings:

- Wyndham Worldwide Corp (WYN), which franchises more than 7,000 hotels, raised its 2009 earnings forecast on a brightening economy and said it was looking for opportunities to add more brands to its stable of hotels.

- The company boosted its full-year EBITDA outlook by about 2 percent and forecast 2009 revenue and fourth-quarter results above analysts' estimates.

- Wyndham also reported better-than-expected third-quarter profit. (the company) reported third-quarter net income of $104 million, or 57 cents per share, down from $142 million, or 80 cents per share, a year earlier. Excluding one-time items, it earned 58 cents per share. Analysts, on average, had expected 56 cents, according to Thomson Reuters I/B/E/S.

- Revenue fell 17 percent to $1.02 billion, while expenses fell 18 percent.

- Wyndham, which operates the Days Inn and Ramada hotels, said revenue per available room slumped 17 percent in the third quarter. (definitely a negative, but more than represented in the cheap stock price)

- For the fourth quarter, it now expects earnings of 35 cents to 38 cents a share, above analysts' average estimate of 32 cents.

- It expects full-year earnings before interest, taxation, depreciation and amortization (EBITDA) of $775 million to $825 million, up from a previous forecast of $760 million to $810 million. Analysts, on average, expect $782.12 million.

- The company forecast 2009 revenue of $3.5 billion to $3.9 billion, compared with analysts' average estimate of $3.6 billion.

- The company said 2010 earnings should be roughly in line with 2009 results.

- Mid-scale and economy hotel chains, like the ones Wyndham operates, have held up better than their luxury counterparts amid the downturn. But Holmes was cautious about calling a bottom. "We can't call it a real uptick yet," he said in an interview with Reuters. "Obviously we're still seeing RevPAR (revenue per available room) declines."

- Chief Executive Stephen Holmes said the company is looking to invest in its hotel group and said Wyndham could acquire more brands and add rooms, given current plentiful opportunities to buy distressed properties. "We do believe there will be a significant restructuring of the lodging industry over the next 12 to 18 months," he said during a conference call with analysts.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.