Global Financial Crisis Polarising Market Perspectives- Credit and Credibility Chapter3

Stock-Markets / Credit Crisis 2009 Oct 14, 2009 - 11:17 AM GMTBy: Richard_Karn

Chapter 3: “May you live in interesting times”

Chapter 3: “May you live in interesting times”

The global financial crisis has wrought such extensive damage that it has polarized market perspectives like nothing in our experience. The two prevailing camps may be categorized as those subscribing to variations on either the ‘green shoots’ or the ‘Dawning of the Asian Century’ themes and those believing the lull that has existed since early March is but the calm during the eye of the storm and global markets are in for a fresh, possibly more severe battering.

Those who were sped financial relief by their buddies in the Treasury equivalent of FEMA have progressed in short order from picking through the economic rubble for bargains to seeing rainbows at every turn, while those still traumatized by the storm are surveying the damage and salvaging what they can while attempting to ascertain whether what they are seeing in their secretive neighbors’ behavior is really fresh building or just prudent restocking of their pantry.

We have strived to make it clear that we are now firmly in the latter camp.

As past proponents of the former, that is not to say that we take issue with much of what especially the ‘Asian Century’ advocates are carrying on about—just the timing and extent of it, for we no longer believe it is going to happen on ‘Wall Street time.’ Over the last four years we have been as in thrall to the sheer numerical potential of emerging markets, as gulled by the market technicals, and as enamored with the decoupling thesis as anyone, for it is a truly uplifting story. But as the global financial crisis has demonstrated, without the copious injections of fiat currency and loose credit emerging economies are unable to stand on their own, rendering it just that, a story—one that will only become a sustainable reality when these economies are allowed to develop naturally at their own pace, not force-fed growth via various unhealthy forms of stimuli like chickens having growth hormones and antibiotics crammed down their gullets on an industrial poultry line.

It now appears there has not been enough time for the critical component of emerging market economies, the middle classes, to generate sufficient income and domestic demand to actually replace their reliance on exports. The Developing Asia region, which includes China, has in fact grown more dependent on exports, not less, as is witnessed by the export component of GDP growing from 36% to 47% over the last decade. It is also debatable how long it will be before they get another chance.

We maintain that the global financial crisis is at root a monetary issue that cannot be cured by larger doses of the very medicine that weakened the economic system enough for the disease to take hold in the first place. As has been amply demonstrated especially over the last decade and a half of interventionist policymaking, the best outcome that can be expected from the resolution of one crisis is the subsequent creation of another with invariably more catastrophic results. Because of the increasing frequency of these failures, we believe the financial system today is transitioning from the bubble cycle to an even more destructive crisis cycle. This suggests there will be less time between crises for health to be restored and actual advancement to take place.

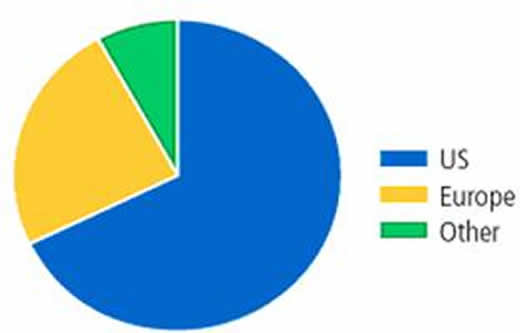

This is why there has been a significant shift in the tenor of the discussion regarding emerging markets ‘decoupling’ from the economies of the US in particular but the OECD generally. The decline in especially American consumer spending gets the most press, but as discussed in Chapter 2 regarding emerging market difficulties accessing capital markets, without western fundraising for emerging market business and economic development the growth story is seriously threatened. In December 2008 Fitch Ratings concluded emerging markets were set to slow sharply and that they had not in fact decoupled from developed markets. The European Central Bank reached a similar conclusion in January of 2009: “on the one hand we find no evidence of decoupling, but on the other hand we calculate that emerging Asia is less ‘coupled’ with the rest of the world than trade data suggests.” Considering how dependent the global economy is on American and European fundraising efforts, tight credit conditions’ impact on the following chart raises the question of just which country is going to step in to fill the void:

Chart 1: Cumulative Fundraising by Region over the Last 5 Years

Source: Reiman/UBS

Wall Street and the City of London would have us believe the answer is China.

In the aftermath of the financial crisis, we are reading a lot today about how for centuries China and India were the world’s economic superpowers and that the shift in power and riches from West to East that gets so much press these days is only a return to the historic norm. Such specious rationalizations reek of another Wall Street and City of London concoction to sell an investment theme. We would like to point out that both were totalitarian powers complete with repressive social systems with little room for upward mobility, little economic opportunity, stifling bureaucracies, and were characterized by a shocking disregard for the value of human life. Let us not forget that in modern times China under Mao Zedong murdered an estimated 70 million of his own people during peacetime under progressive programs known as the Great Leap Forward and the Cultural Revolution — roughly the same number of civilian and military deaths as during all of World War II worldwide. Does Wall Street and the City of London seriously believe the future of the global economy resides in the hands of the same authoritarian regime that today reveres Chairman Mao and controls the country, controls the economy, controls the movement of capital, controls who advances and who does not, and controls the flow of information it wants the world, and especially the West, to see? Did we mention that China crushes democratic movements and suppresses free speech? That Wall Street and the City of London are holding aloft communist China as the future of capitalism as if it were a fait accompli—man, can these guys sell….

The two biggest financial bubbles in living memory have occurred in the space of one decade, and where Wall Street and the financial sector experienced unprecedented prosperity, the average investor that bought their sales pitches has been by comparison impoverished. If history is any guide, in the aftermath of the global financial crisis significant misbehavior will surface, a la the Enron and WorldCom scandals, and Wall Street and the financial sector’s crumbling credibility will be further undermined. It will be interesting to see if after all that has happened whether the American public will let Wall Street and the financial sector off this time with only a fine sans an admission of guilt of any wrongdoing as they did after the Enron fraud, which served to translate the risk of getting caught breaking the law and SEC regulations into a mere business expense, or if there will be a full blown witch hunt. If the latter, it promises to be a grand spectacle and we’d love to have the marshmallow franchise.

Our research suggests the western world is on the verge of an Age of Skepticism in which the general public will no longer accept such malarkey from public or private figures at face value. Admittedly, as history and our performance have borne out, we have also regularly been both early and optimistic in our trend predictions. At some point, however, we think investors will turn a sober, increasingly jaundiced eye on everything Wall Street and the City of London have been promoting, and China looms large because the pair have also spent most of the last decade and a half successfully promoting communist China as an investment destination—and reaping untold riches in services and fees for convincing any company that would listen to redirect money intended for capital investments in the US or Europe to China instead.

We raise this matter because these are the same financial professionals who were so confident they had mitigated risk right out of their industry that they precipitated the largest financial crisis in history, wreaking ongoing economic havoc around the globe—all based on computer models and hype. Now China is being held aloft by this peerless marketing machine as the next pretender to the crown of dominant global economic power, based—in the absence of legitimate data for there is very little transparency in Chinese government statistics—on extrapolations based on computer models and more speculative hype.

This 1-2 combination of mystical computer projections and fervent hype has become a wildly successful marketing tool, so it is little wonder everybody is using it to promote whatever agenda they happen to be pushing. And though one would think it obvious, for some reason people tend to overlook the simple fact that computers produce models and projections that reflect the criteria fed into them by programmers, who likely as not are furthering an agenda, be it profit-, politically-, or socially-oriented. We have commented on this in the past. One example that was discussed in our gold report was how the US government has made 30-odd adjustments to how its computer model calculates the Consumer Price Index (CPI), every single one of which has lowered the CPI, thereby boosting GDP and saving the government tons of money at the expense of our retirees and those on fixed incomes—once those troublesome food and energy prices were excluded from the calculations entirely, that is. Another use of this combination of computer and hype is discussed in Chapter 5 in the context of the UN’s Intergovernmental Panel on Climate Change (IPCC) projections regarding anthropogenic global warming and the effects of climate change policy on the US economy.

Be that as it may, with its massive trade surplus and enormous potential, China has now become something of a litmus test both for the suspect decoupling thesis and emerging market success. The world will likely soon find that the fundraising capabilities of Wall Street and the City of London have been severely curtailed by the financial crisis, and China may find that it is considerably more decoupled than it would like. As would be expected in the current environment, net capital flows have been severely curtailed, and the IMF’s computers project they will remain subdued for some time to come, with Emerging Asia (pictured) and the Middle East expected to see significant outflows related to the investment of current account surpluses in the years ahead :

Chart 2: Net Capital Flows to Emerging Economies

Direct foreign investment in China has fallen for eight straight months through May of 2009, and for the first time since the 1998 Asian financial crisis has also seen a simultaneous fall in all three primary investment indicators: actual foreign direct investment, contractual foreign investment, and new approvals for foreign companies. As recent events have shown, such developments place increasing stress on the cozy vendor-financing scheme driving relations between the US and China, and we expect tensions between the two to ebb and flow with the fortunes of the global economy and the resultant political unrest.

Let us be absolutely clear: it is undoubtedly true that there were, are, and will continue to be considerable cost savings attendant to strategic business decisions such as relocating manufacturing capacity to China—but they come at a long term price Wall Street’s short-term thinking seems incapable of grasping. More than two decades’ experience in the Austral-Asia region has proven to us time and again that the Chinese are an extraordinarily industrious, earnest people, and we admire them greatly, not least for their emphasis on family, education and long term success.

We feel compelled to point out, however, that as a manufacturing nation, they are new to the international arena and noticeably lack sufficient internal quality controls and respect for contractual law that experience has provided nations with a longer history of selling into global markets. Over the last half-century South Korea, Taiwan and Japan all experienced a similar process and discovered the transition to an internationally competitive power involves numerous difficult steps and takes time. A company’s, indeed a nation’s, success ultimately depends upon its products attaining a reputation for a combined level of quality and price that can compete on the global market, with paying customers not government mandate being the final arbiters of success. Certainly, Chinese products are cheap, but you also all too often get what you pay for in terms of the quality of the workmanship, materials used, and longevity of their products. The US is currently rediscovering this altruism, albeit coming from the opposite direction.

An old mining adage states, “There is nothing more expensive than a cheap tool.” Accountants and corporate planners may see initial cost savings in using cheaper labor and materials to produce an inferior product, but the people who have to use those products daily, and whose productivity or enjoyment is adversely affected by the quality of the workmanship, understand the hidden expense, inconvenience and risk in buying Chinese products.

Products that are cheap but so poorly made that they withstand few uses before breaking and being discarded in the long run are more wasteful and provide less value than purchasing more expensive better quality workmanship in the first place. Quite simply, and employing a raft of today’s buzzwords, in the emerging age of value-oriented frugality, the inefficient use of materials, labor and energy in manufacturing cheap disposable products destined to clog landfills is not a sustainable business model. China has arguably benefited more from globalism than any other nation, and in the downturn has managed to hold market share better than its rivals because when people are scared ‘cheap wins,’ but the shift underway now will be away from inexpensive disposability toward a sober emphasis on conservative, durable quality. China will not be able to move up the value-added chain until this perception is overcome because today its products increasingly carry the same stigma the phrase “Made in Japan” carried in the 1960’s, and this will be no small hurdle for the Chinese to overcome in the years ahead.

We believe China will learn these lessons for theirs is a nation made rich by the potential of a billion-strong population culturally biased toward improving their lot in life, but we submit it will take considerably longer than promoted by Wall Street and may well entail a regime change to be fully realized. The basis for our rationale is that the aforementioned reduction in the availability of investment capital for emerging markets, which will be more expensive in any case, will exert incremental pressure on the Chinese economy the longer the global recession lasts, slowing development despite their vaunted infrastructure program. Granted, the Chinese stimulus program would appear to be having the desired effect: retail sales in May were up 15% year-over-year, commercial and residential real estate turnover was up 45% and investment spending was up 33% year-over-year. But as it stands, state banks are burning through China’s accumulated trade surplus by force-feeding loans into the system at below the cost of raising capital, which although spurring growth is rife with corruption and patently unsustainable; China made more loans in the first four months of 2009 than in all of 2008. Another reason has to do with the inefficiency, corruption and waste inherent to the communist economic model that fosters “greed, meeting over-inflated goals, creative accounting and a sense of hubris” and has produced numerous scandals in the last few years, such as those involving milk, seafood, dumplings, pet food, toothpaste, medicine and toys. For the record, and is discussed in the next chapter, we also see exactly these risks in the American economy as the Obama administration leads the besotted country towards a quasi-socialism.

A brief survey of other factors that may serve to slow the Chinese juggernaut include a number of issues that over the long term will require considerable ingenuity to overcome. Foremost, in our opinion, is energy efficiency and an over-reliance on coal for electricity, which increasingly has to be imported. Another is the significant decline in arable land has led China to becoming a net importer of food, and this situation is aggravated by one of the worst water problems on the planet. Taken together, should commodity prices stabilize in a permanently elevated nominal price range, as we submit will be the case long term, China will likely be forced to subsidize all three again, which will both consume foreign exchange reserves and lead to a deteriorating capital-labor ratio driving up manufacturing costs and undermining its economic model.

As it is, China today finds itself in desperate need of economic growth to forestall social and political unrest. Tens of thousands of businesses have failed and countless factories have been shuttered over the last year. Chinese exports dropped 26.4% year-over-year in May, marking the seventh consecutive month of decline, which is consistent with falls of 28.3% in South Korea, 33% in India, and a record plunge of 26% in Japan. The Chinese National Bureau of Statistics in April estimated there were 23 million unemployed, although a university professor in Beijing claims that figure was revised down significantly. The fear is that the relatively recent relocation of tens of millions of rural poor to industrial regions could well devolve into hotbeds of dissent, and China has a history of revolt in response to economic deprivation—including the one that brought Mao to power.

China’s massive stimulus package is helping it to outperform all major economies this year, but despite Wall Street’s cheerleading it is unlikely to be the global economy’s savior. China contributed 7% to global GDP in 2008, which means their advertised 7% growth in 2009 would contribute around 0.5 percentage points to global growth. Although any growth during the global recession would be impressive, it should be noted that numerous commentators have suggested that China’s projected growth rate is wholly implausible in the current environment, its official statistics are more often than not seriously inconsistent, and that perhaps Chinese central planners have been emulating their American counterparts.

Although the stimulus package is laudable and a course we believe the US would be well-advised to follow on an even grander scale as we actually need it, the approach presupposes a relatively quick recovery by the global economy so China will have a market for its products before it runs out of stimulus. Admittedly, domestic consumption is improving as Chinese consumers do their patriotic duty, but should western consumers be slow to regain their appetite for Chinese goods, over-capacity in itself may present a new set of problems for central planners. Although China’s ongoing trade surplus and accumulated reserves provide it with the luxury of being able to initiate further stimulus programs without recourse to the international debt markets, something in their planning appears to be going awry. After getting considerable political mileage from decrying the hypocrisy of any “But American” requirements in the Obama stimulus plan, warning relentlessly about the perils of protectionism, and assuring global markets they would not attach a “Buy China” requirement to their stimulus package, China has in fact done exactly that. Such a reversal has sparked conjecture that the policy reflects mounting anxiety within the communist government regarding job pressures and potential social unrest.

Incidentally, late last year Satyajit Das raised the rather bizarre possibility that China might find itself in the position of a hedge fund with illiquid assets if they were to move too quickly to sell their US Treasury bond holdings to raise money. This aspect of foreign treasury bond sales has fuelled speculation that a portion of the undisclosed use of the $2 trillion of taxpayers’ money referred to in the previous two chapters may have been used by the Fed and US Treasury to purchase foreign central bank bond holdings both to provide liquidity and to insure against broad-based panic selling, which would drive yields higher and be wholly antithetical to American reflation interests. As it is, the Chinese have decided to confine their buying to the short end of the yield curve, sacrificing interest income for the public relations value of the perceived cudgel they can now use to threaten US policymakers.

As Asian economies have declined precipitously, so have the currencies of those countries not tied to the dollar, which has resulted in the rapid appreciation of the trade-weighted yuan. Although China is in a better position financially than virtually any other emerging market economy to ride out the storm, a few commentators have pointed out that should China’s leaders feel threatened enough, they may resort to another massive yuan devaluation such as that in 1992 that ignited its phenomenal economic growth. Authoritarian governments love fiat currencies, and a yuan devaluation, which it would accomplish by unilaterally adjusting its peg to the dollar, would likely prompt further competitive devaluations by other Asian countries and likely spark a significant trade war, the last thing the global economy needs and especially alarming in view of the new ‘Buy China” requirement in the stimulus package. But as mentioned earlier, China has been affecting a stealth devaluation by expanding its M2 to GDP ratio nearly three times faster than the US in any case, and the only reason the yuan is not diving on the world currency markets is because it’s not freely traded. Consequently, we do not believe the Chinese government will announce an official devaluation because it would disqualify the yuan from playing a larger role in international currency markets, assuming it is eventually floated, and would further undermine whatever aspirations the Chinese harbor of the yuan eventually becoming the world’s reserve currency: arbitrary devaluations are frowned upon in fiat currency circles, which prefer the perpetual slow erosion in purchasing power exemplified by the dollar.

The lack of transparency in Chinese figures blurs the distinction between the extent to which China has been a commodity-price driver, which it inarguably is, and how much was and is related to the global fiat currency glut, which China inarguably contributed to with its vendor financing arrangement with the US. By every metric we employ, the global commodity price collapse was as overdone to the downside as the spike was to the upside, which is what we venture the Chinese government concluded also and have been acting on by purchasing record amounts of commodities this year despite the World Bank predicting a 6.1% decline in global trade (please refer to the chart on the next page). Using depreciating surplus fiat dollars to purchase commodities with no use-by date at steep discounts makes absolute sense, but it need not signal a global rebound.

Picking up substantial amounts of aluminum, copper, nickel, tin, zinc and oil at attractive prices is simply money well-spent. China Inc. is not a platform company that needs to be concerned with excessive inventories or just in time delivery: their thinking is strategic, and their time horizon extends far beyond Wall Street’s, who we suspect is using this buying to bring a sense of urgency to their sales pitch. China has bought so much iron ore at discounted prices that currently more than 10% of the global Capesize bulk carrier fleet is anchored off Chinese ports with a two-week wait to be unloaded because port storage facilities are overflowing.

If the global economy were truly rebounding, we doubt Chinese finished steel exports would have been down 70% year over year to the lowest levels since 2005 or that China would be dumping steel on the US market, prompting protectionist legislation. The period between November and late-March, despite the G-20 pledging to avoid protectionism, saw 47 restrictive trade measures implemented—17 by the very members of the G-20 doing the pledging. The following is a chart that provokes protectionist legislation and a curbing of China’s ascendancy, not optimism over the global economy:

Chart 3: World Bank’s Gloomier Outlook

![[gloomier outlook]](/images/2009/Oct/credit-14_image006.gif)

And the longer the global recession lasts, the more protectionism and instability it threatens to visit upon both China and the world.

If emerging markets are indeed unable to decouple, the world will likely be in for a period of heightened social unrest. History suggests the longer a global recession runs the more geopolitical instability it provokes. Further, the longer this financial crisis runs, the more likely intra-government trade agreements will step in to fill the void left by the western funding vacuum with programs tied to ideology, not commerce. This may take the form of increased Sovereign Wealth Fund (SWF) investment, the accelerated strategic expansion of national oil companies (NOCs) and the like, or of widespread mercantilist agreements such as those exemplified by China in its dealings in Africa.

The backlash against the US for the world’s financial woes will almost certainly affect American interests abroad. As discussed in Chapter 6, although less of a threat than originally envisioned, we suspect Hugo Chavez of Venezuela may well be a leading indicator for emerging market sensibilities. In January, as oil prices sank well below the estimated $80 per barrel cost needed to fund the social programs by which Chavez maintains leadership, he was seeking US technical and operational expertise to boost Venezuelan production and signaling a willingness to make concessions unthinkable only a year and a half before when he was publicly vilifying international oil companies (IOCs) and nationalizing American projects worth an estimated $20 billion. The prolonged slump in oil prices saw a corresponding slump in his popularity and prestige as well as support for his socialist policies and agendas throughout the Latin world. But in May, with the bounce in oil prices, rather than pay the more than sixty oil service companies to whom Venezuela owed an estimated $12 billion for work performed since August 2008, Chavez nationalized their assets as well. We believe we will see more of this type of behavior, especially in Africa and in the oil-rich countries that were formerly part of the Soviet Union, the ‘–stans’ if you will, especially if the bounce in global commodity and stock markets do not hold.

It strikes us that too many commentators are looking to China as the global economy’s savior, which we cannot help but view as a dangerous over-estimation in these credit constrained times. The world, and especially the US and Europe, needs time, even temperaments, and careful planning to deal with the new world of finance created by this catastrophe. As the market has been patiently drumming into our leaders’ thick skulls over the last two years, this is absolutely not a problem that will be resolved in the near term with quick fixes, and then it will be a resumption of business as usual.

Those days are gone—get used to it, and plan accordingly.

The combination of the US being the world’s largest economy and the dollar’s position as the world’s reserve currency ensures we will survive the financial crisis and emerge from it better positioned than most of its derivatives. However, as discussed throughout this report, even if the US reflation efforts currently underway are successful, at best it will only amount to a reprieve until the next crisis arrives. The moment it appears interventionist reflation efforts are having a lasting positive effect globally the happy delusion that the crisis has been averted could well seamlessly morph into a new nightmare of exploding interest rates and a collapsing dollar as foreigners repatriate their money, initiating the next crisis. This is what we meant with our earlier submission that we are transitioning from the bubble cycle to the even more destructive crisis cycle, and it will be what we accomplish in the calm between storms that determines the level of our future prosperity.

The one long term benefit we see resulting from the global financial crisis is the discrediting of the entire financial sector both at home and abroad. In the simplest of terms, for the time being the world wants nothing to do with American ‘financial innovation’ and has essentially stopped buying it; this in turn will re-focus the financial sector on the domestic markets. Whether the US will revert to manufacturing, developing, growing and extracting more of the things it needs and the world wants to buy remains to be seen, but we certainly have the ability to do so. Though the gaping hole rent in the economy from the collapse of the financial sector means we are in for hard choices and hard times, should the US decide that it wants to produce its way out of the financial crisis, it is far better positioned and much more competitive than is widely perceived , the misperception that it is not being due in no small part to the propaganda emanating from Wall Street in its endless lobbying on behalf of China.

The simple truth is that the US is the largest manufacturing country on the planet, bar none. At more than $1.5 trillion dollars in 2007, our manufacturing sector alone was larger than the entire GDP of every country on the planet except for six: Japan, Germany, China, the United Kingdom, France and Italy. And though it is doubtful US manufacturing can fully replace the damage wrought by the financial sector any time soon, putting people to work expanding and developing our industrial base will go a long way toward improving as well as balancing the overall economy. This may well thwart China’s ambition to move up the manufacturing chain toward more value-added products, increasing friction between the two countries.

As explored in the rest of this report, there will be an upside to the financial crisis, albeit one with a rocky ride. The collapse of the financial services industry is forcing long overdue adjustments in the lopsided US economy and will mean for example that there is a good chance the electrical grid will be returned to the capable hands of engineers; that infrastructure projects will stop being sloughed off on the next municipal, county, state or federal administration; that capital will again be allocated to projects that promise long term growth for the real economy instead of short term nominal profits qualifying corporate officers for fabulous bonuses.

We believe this will be welcomed not only by Americans looking for meaningful change but also by the rest of the world that expects us to provide it.

* * * *

Credit and Credibility presents the Emerging Trends Report’s comprehensive assessment of today’s financial turmoil and what we consider to be five of the most pressing issues that stand to impact the global economy in the years ahead. These issues are explored in the first five chapters:

- fiat currency, the financial abuse it engenders, interventionist policy response to perpetuate it, and the role of the US dollar going forward;

- our contention that all fiat currencies today have become derivatives of the US dollar has stunning implications globally;

- the extent to which emerging markets can decouple from ‘consumer’ economies, and the role of China as the litmus test for both the regional and the emerging market thesis;

- our contention that the world has had its fill of ‘financial innovation,’ and the only way the US economy can recover will be through its traditional strengths in agriculture, manufacturing, invention, and hard work; and,

- our assessment of the issues attendant to the anthropogenic global warming debate and pending legislation.

Credit and Credibility then delineates the investment approach demanded in this ‘brave new world,’ identifying potential pitfalls to recovery, asset classes likely to become candidates for bubble-dom, a set of leading indicators likely to mark the true bottom, and how these five issues will affect each of our investment themes.

In order to facilitate the comparison and update of our nine themes within this context, we are including complete copies of our original coal, gold, water & food, nuclear energy, silver, electric grid, transportation fuels, material science, and natural gas reports and have appended substantial commentary regarding the performance of each going forward, including a ranking by viability in the current environment. The heavily annotated eBook runs to more than 430 pages of text, not including 200+ pages of source material and suggestions for further reading.

To purchase Credit and Credibility as an individual report, or on an annual subscription basis, we invite you to visit our website at: http://www.emergingtrendsreport.com

By Richard Karn/ETR

310 Arctic Boulevard #102

Anchorage, AK 99503

Phone: 510-962-5021

www.emergingtrendsreport.com

© 2009 Copyright Richard Karn / ETR - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.