Investing in the Next Google, P2P More than Just Sharing Songs

Companies / Tech Stocks Oct 09, 2009 - 05:06 PM GMTBy: Alex_Daley

You know that house down the street that’s for sale? The gigantic castle of a house, with an uncut lawn, a few weeks away from foreclosure? That’s your fault. After all, it was you who loaned the former owners the money for the house they could never afford.

You know that house down the street that’s for sale? The gigantic castle of a house, with an uncut lawn, a few weeks away from foreclosure? That’s your fault. After all, it was you who loaned the former owners the money for the house they could never afford.

No way, you say? You’d never have loaned any money to that irresponsible hack. But of course you did lend it to him… just not directly. That’s what banks are for -- lending your money to other people, often people just like the owner of that house.

Forgetting for the moment how modern finance found a way to twist and pervert the banking system to its breaking point, for hundreds of years the foundation has been one of shared benefit and distributed risk. You keep some portion of your savings in a bank, and in exchange they share back a percentage of the proceeds from lending your money to others (including Mr. Irresponsible), keeping a cut for themselves.

That’s been the only option. Until now…

If the Internet is good at one thing, it is connecting large numbers of people to each other. Thus it seems only logical that the Web would be a more efficient way of matching lenders to buyers than any one local or even national bank. Electronic systems can connect people at scale, automating an otherwise manual process and eliminating scores of middlemen from the process. And that is exactly what a handful of new lending institutions on the Web -- such as www.prosper.com and www.lendingclub.com -- are starting to do.

They call it “peer-to-peer (or P2P) lending,” and the premise is simple: I have money I am willing to lend; you would like to borrow some; these companies bring us together and facilitate the loan. Because their systems are automated and connect lenders and borrowers more directly, the companies can afford to take much smaller commissions on the loan than a traditional bank.

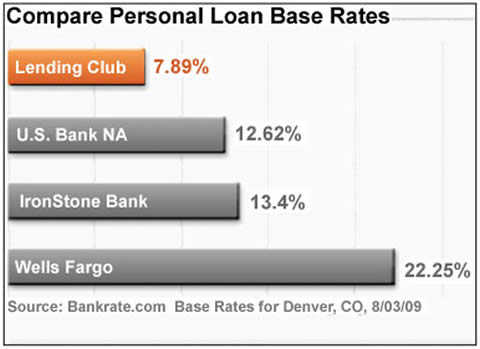

As a result, you enjoy a much higher yield than on your savings account, and they attract borrowers by undercutting bank rates. Prosper’s returns for lenders average 7.02% for the highest three credit grades (the only data they make available). Lending Club averages 9.62% across all loans for investors. And credit is available to borrowers as low as 7.89%, much cheaper than most banks.

As a result, you enjoy a much higher yield than on your savings account, and they attract borrowers by undercutting bank rates. Prosper’s returns for lenders average 7.02% for the highest three credit grades (the only data they make available). Lending Club averages 9.62% across all loans for investors. And credit is available to borrowers as low as 7.89%, much cheaper than most banks.

An investor can diversify by bidding to fund portions of many loans, in increments as low as $25 each. A $5,000 loan might be spread across as many as 200 individual lenders, each choosing to purchase a $25 note. The process is largely invisible to the borrowers, as they receive just one payment and pay just one bill. The companies collect and distribute the payments to each lender, proportionally to the amount each funded.

One of the more interesting, and unconventional, aspects of the sites is the way they use social networking tools to provide lenders and borrowers with a way to connect more directly. On each site, borrowers are required to provide not only credit history and similar information, but a brief personal statement on why they want the loan, and anything else they think is relevant. Lenders can browse the loans and pick specific people and specific requests they want to fund. Prosper.com takes this farther than LendingClub.com, allowing borrowers to add photos and encouraging more dialogue -- on Lending Club, the descriptions are often just simple half-liners like “Buying a used Acura RSX.”

Browsing the loan requests provides a fascinating peek into what people borrow money for (weddings, used cars, debt consolidation, and home repairs look to be the most common, in no specific order), not to mention their credit histories, borrowing habits, and even spelling and grammar…

This technique of hand picking loans only scales so far, especially when lending $25 at a time. So both lenders also offer automated matching of loans to your criteria (loan amount, credit score, etc.). Prosper.com’s system is more automated and much simpler to use, but both are adequate for the job.

Of course, you also lose the liquidity that comes with indirect vehicles like bank accounts. But both lenders try to address this issue by packaging your loans as notes and allowing you to trade the notes in a market provided by FOLIOfn. Prosper.com has only recently restarted lending after a government-mandated quiet period while their note model was reviewed by the SEC, so activity on their trading platform is limited as they build the network. However, the Lending Club version is working smoothly, providing decent near-term liquidity options (and some good opportunities for arbitrage, we imagine).

If you’re looking for a way to diversify some of your investment activity beyond traditional stocks, bonds, futures, and the like, P2P loans could make for an interesting choice. Or if you just want to try the next new thing, they make for an entertaining way to play banker for a day (or 36 months, the length of the loan terms on both sites).

Technology is the number one growth industry in the U.S. – and many of those investors who have kept their eyes open for new, promising tech developments have been making fortunes in the process. Just think of the lucky people who invested in Google when it was still a small startup.

Finding the next Google is not impossible, but you have to know what to look for. Read this new report to get some ideas… click here.

© 2009 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.