G20 Barons Require A New Magna Carta for Our Times

Politics / Credit Crisis 2009 Sep 26, 2009 - 02:49 AM GMTBy: Submissions

Hugo Salinas Price writes: Magna Carta (1215) was the first document forced onto an English King by a group of his subjects (the barons) in an attempt to limit his powers by law and protect their privileges.” (www.wikipedia.org)

Hugo Salinas Price writes: Magna Carta (1215) was the first document forced onto an English King by a group of his subjects (the barons) in an attempt to limit his powers by law and protect their privileges.” (www.wikipedia.org)

Let us think of President Obama in the place of the English King, and the Group of G-20 meeting in Pittsburgh, Pa. this week as Obama’s Barons.

The present-day Barons – the Presidents of the G-20 countries – are restless.

They are not happy with the conduct of affairs of their King, Obama.

Unfortunately, they do not have the gumption to demand what they really need, which is a return to the gold standard. Perhaps they do not have the necessary gumption, because they do not know that they need the return of the gold standard.

The economics profession has been so screwed up by banking interference in the free discussion of economic problems, that the very advisors of the King’s Barons have forgotten what got them all into this mess in the first place. So there is no one left to give good advice to the Barons.

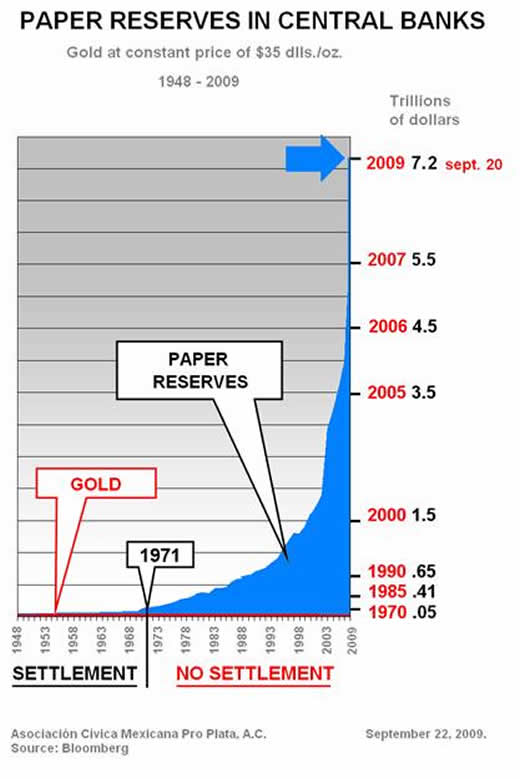

Take a look at the graph below:

You can see that all the trade in the world proceeded in an orderly fashion, under Bretton Woods, established in 1944 as the basis for the post-World War II monetary system, up to 1971.

Under Bretton Woods, gold, and in lieu of gold, dollars, were deemed to be the means of “Settlement” of trade imbalances. The system worked well, although the seed of its final destruction had been sown, in the form of “in lieu of gold, dollars”.

That left open the door for the US to expand credit, import more than it sold abroad, and pay for the trade deficit it incurred in doing so, by means of tendering dollars. We can say that the US “leveraged” its gold holdings – an enormous 20,000 (more than that, but I have not the exact amount) tons of gold – by paying for its trade deficit in dollars and holding on to the gold.

As the US tried to hold on to its gold and honor its commitment to deliver gold to Central Banks, at their request, at the rate of one ounce of gold for every $35 dollars tendered for redemption into gold, the world’s economy evolved pretty smoothly. US credit expansion was relatively modest, in view of the Bretton Woods commitment. Trade deficits and trade surpluses were held down by the need to settles debts and credits in gold, or in dollars which were taken to be “as good as gold”. There were no chronic and exaggerated “imbalances” in world trade, as they are called today – chronic trade deficits on the part of some countries like the US and now, the European Union; and chronic trade surpluses on the part of some exporting countries, like China and other Asian countries. Trade deficits had to be “settled” that is to say, paid for.

So this is why we see a practically flat line representing International Reserves in the Central Banks of the world, up to 1971.

However, some years before 1971, as seen in the graph, the US began to leverage its gold holdings quite excessively. It sent too many IOU’s (dollars) to the world as it expanded credit to pay for the Vietnam war and the Great Society of LBJ.

In 1968, France objected to holding more and more of these IOU’s (dollars) and asked for its gold. Rumblings of devaluation of the US dollar in terms of gold began to circulate. France wanted settlement of US debt; and the only way to settle US debt was by – collecting gold for its dollars. Dollars were not settlement!

The crisis exploded on August 15, 1971, when Nixon, quite unexpectedly, decided to renege on the Bretton Woods Treaty and refused to redeem dollars held by Central Banks for gold. The expected decision was a devaluation of the dollar – down to $70 dollars for an ounce of gold – but that was not what the world got. By refusing to devalue and just shutting down “the gold window”, the whole world was thrown into a world of exclusively fiat money.

Since that fatal day, there has been no settlement at all of international debts.

We are led to believe that payment in dollars constitutes settlement, but that is a total fallacy. There is no settlement except settlement in gold. The proof is that when Central Banks receive dollars, they exchange them for US Treasury Bonds and other American securities deemed credit worthy. (The Euro is now in on this game, also). The debt created by Trade Deficits is not extinguished in today’s world. It remains on the books of Central Banks as Reserves, in the form of Bonds, which are debt instruments.

Please notice the contrast in the graph, between the period before 1971, and the period since then to our time. Reserves have exploded!

Reserves have exploded because there was no need to “settle” trade imbalances. Since the world accepted Nixon’s decision not to settle with gold, but to accept dollars in supposed “payment” of Trade Deficits, a complete disorder set in. So-called “Reserves” are huge - $7.2 Trillion – and yet nothing goes right. All these “Reserves” are debts owed, principally by the US.

Up to 2007, this was a wonderful period for the US: it was able to behave like an adolescent come into a vast fortune: dollars in huge quantities, manufactured at will by the US Fed and Treasury, were spent buying up everything under the Sun for the enjoyment of the US consumer. Unlimited credit expansion!

This week the Barons are gathering in Pittsburgh with the King, and they are restless. The world is out of joint but it appears that scarcely anyone has a clue as to what to do, to put it right again. There is only one way back to an orderly world, a world in which Trade Deficits are actually settled, and settlement requires payment in gold.

This elementary fact seems to be beyond the comprehension, as yet, of most of the Barons. However, the Chinese and Russian Barons are slowly getting there. The truth is dawning: gold must be used to settle debts, as nothing else will do it.

The creation of a “new world currency” will not obtain settlement. It will only mean that debts incurred by Trade Deficits will be papered over with new debt instruments; whoever issues these new debt instruments, they will still be debt instruments, and a Trade Deficit debt cannot be settled with any debt instrument, however pompous its name. Only gold can settle such debt.

Therefore, a new world currency, however ingenious its provisions, will not lead to a harmonious world. All conflicts will simply be directed to the new institution which will administer this new world currency. Conflicts will remain and increase in importance.

One of these days, the Barons will finally wake up and demand a new Magna Carta from the King, or whoever or whatever takes over from the present King, to which he will be forced to accede: international trade must be settled, not papered over with debt instruments; the gold standard must be reinstalled. That will be the new Magna Carta for our times.

e-mail me: hugosalinasprice@yahoo.com.mx

© 2009 Copyright Hugo Salinas Price - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.