Bear Stearns Caught in Subprime Mortgages Slime

Stock-Markets / Financial Markets Jun 22, 2007 - 07:05 PM GMT

Bear Stearns is attempting a $3.2 billion dollar rescue of one of its hedge funds specializing in subprime mortgages. It has offered a deal to several of its creditors of the less leveraged of its two collapsing hedge funds whereby it will assume $3.2 billion of their debt in exchange for an agreement not to seize any of the funds' collateral for 90 days. Merrill Lynch has already seized $850 million of the funds most marketable assets and put them on the market, causing mutual funds and hedge funds holding mortgage backed securities to re-price their assets.

Bear Stearns is attempting a $3.2 billion dollar rescue of one of its hedge funds specializing in subprime mortgages. It has offered a deal to several of its creditors of the less leveraged of its two collapsing hedge funds whereby it will assume $3.2 billion of their debt in exchange for an agreement not to seize any of the funds' collateral for 90 days. Merrill Lynch has already seized $850 million of the funds most marketable assets and put them on the market, causing mutual funds and hedge funds holding mortgage backed securities to re-price their assets.

Over half of the collateralized debt obligations (mortgage-backed securities) issued in 2006 were backed by subprime mortgages. Losses in these securities are estimated to be over $25 billion this year because of subprime defaults. Bear Stearns' hedge funds had borrowed approximately $9 billion of the hedge funds $11 billion value to invest in these securities.

The bailout of the fund would be the largest since Long-Term Capital Management LP, which received $3.5 billion from 14 lenders in 1998. The Greenwich, Connecticut-based fund, run by John Meriwether, lost $4.6 billion.

``The problem is not what we see happening, but what we don't see,'' said Joseph Mason, associate professor of finance at Drexel University in Philadelphia and co-author of an 84-page study this year on the CDO market. ``We don't know the price of these assets. We don't know which banks are exposed to this sector. These conditions are the classic conditions for financial crises across history.''

Blackstone IPO…a sign of a top in the Market?

Meanwhile, another action associated with a market top is the Blackstone Group's initial public offering of its stock (IPO). This is the largest public offering since 2002 , bringing in $4.13 billion. Is the smart money cashing out?

A second Hindenburg sighting...and a third!

Yesterday's market gave us a second Hindenburg Omen sighting…and today's activity in the market may give us yet a third zeppelin sighting. This now confirms the probability of a major decline in the next 120 days. The probability of a move greater than 5% to the downside after a confirmed Hindenburg Omen within the next 41 days after its occurrence is 77%, the probability of a panic sellout is 41% and the probability of a real big stock market crash is 25%. (Source: Wikepedia.com)

The occurrence of a confirmed Hindenburg Omen does not necessarily mean that the stock market will go down. On the other hand there has never been a significant stock market decline in history, that was not preceded by a confirmed Hindenburg Omen.

The Nikkei has met its target.

The Nikkei was off its 7-year closing high this morning . The weakness in the market (not shown in the chart) was associated with a decline in real estate stocks, which are sensitive to rising interest rates. The labored pattern you see in the chart is called an ending diagonal. Once finished, it should completely retrace all the gains as its first order of business. I am currently neutral in the Nikkei.

The Nikkei was off its 7-year closing high this morning . The weakness in the market (not shown in the chart) was associated with a decline in real estate stocks, which are sensitive to rising interest rates. The labored pattern you see in the chart is called an ending diagonal. Once finished, it should completely retrace all the gains as its first order of business. I am currently neutral in the Nikkei.

Getting Shanghaied again?

Stocks fell in Asia, paced by the Shanghai index . (Today's market data not shown.) The inability of this index to achieve its May highs is notable. The index fell last night by 3.3% last night and may have set another decline in motion. Just as the Japanese markets were affected by rising interest rates, so too were the Chinese.

Stocks fell in Asia, paced by the Shanghai index . (Today's market data not shown.) The inability of this index to achieve its May highs is notable. The index fell last night by 3.3% last night and may have set another decline in motion. Just as the Japanese markets were affected by rising interest rates, so too were the Chinese.

This time it's the Dow leading the world markets down!

In the last major decline, the weakness in Shanghai sparked a world-wide decline. Today it appears that the trouble with Bear Stearns has re-awakened the concept of risk here in the United States . Wall Street is having rates jitters. " There's lots of volatility in the market right now," said Mike Malone, trading analyst at Cowen & Co. "More than anything, it's concerns with what's taking place in the credit markets with all the issues about hedge funds and subprime mortgages."

In the last major decline, the weakness in Shanghai sparked a world-wide decline. Today it appears that the trouble with Bear Stearns has re-awakened the concept of risk here in the United States . Wall Street is having rates jitters. " There's lots of volatility in the market right now," said Mike Malone, trading analyst at Cowen & Co. "More than anything, it's concerns with what's taking place in the credit markets with all the issues about hedge funds and subprime mortgages."

Are bonds on the mend yet?

The chart pattern says, “No.” There may be even more volatility ahead next week since there will be a lot of market-moving news, including a U.S. treasury auction. It will be hard to separate the “noise” from the real news as some investors move into treasury bonds for a safe haven while the subprime market blows up.

The housing market is searching for new lows again.

They could be much lower than people expect. Economist Marc Faber weighs in with his comments , “ My view would therefore be that the coming housing slowdown or slump could actually significantly exceed expectations and lead to across the board economic weakness. Don't forget that if home prices no longer appreciate, home equity extraction will come to a halt.

They could be much lower than people expect. Economist Marc Faber weighs in with his comments , “ My view would therefore be that the coming housing slowdown or slump could actually significantly exceed expectations and lead to across the board economic weakness. Don't forget that if home prices no longer appreciate, home equity extraction will come to a halt.

The consumer will then likely have to begin saving again from current income. Both these factors would obviously depress consumption and retail sales. One more point! The weak sales growth at Wal-Mart seems to confirm that the typical US household is already struggling.”

The dollar retests its support today.

I have commented several times in the past that once the dollar moves solidly above its 50-day moving average, it will re-test the 50-day for support. This is pat of the stair-step process that all indexes use to maintain their advances. Today, the dollar is at its 50-day average (not shown). Once it finds support (hopefully, today) it may re-start its advance toward the next hurdle, the 200-day moving average.

I have commented several times in the past that once the dollar moves solidly above its 50-day moving average, it will re-test the 50-day for support. This is pat of the stair-step process that all indexes use to maintain their advances. Today, the dollar is at its 50-day average (not shown). Once it finds support (hopefully, today) it may re-start its advance toward the next hurdle, the 200-day moving average.

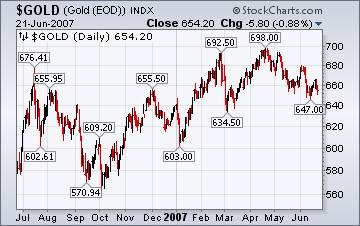

Precious metals not well with higher dollar and higher bond yields.

Gold prices declined for the second straight session Thursday as the dollar strengthened and bond yields extended their rise. The competition for investors' money heightened as interest rates have begun to appear more favorable than they have for almost a year. The common complaint about precious metals is that they pay no dividends, as bonds do.

Gold prices declined for the second straight session Thursday as the dollar strengthened and bond yields extended their rise. The competition for investors' money heightened as interest rates have begun to appear more favorable than they have for almost a year. The common complaint about precious metals is that they pay no dividends, as bonds do.

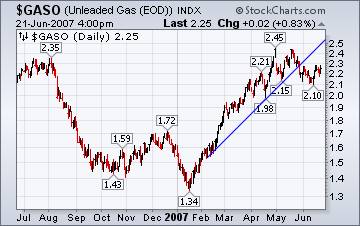

Oil & gasoline prices are no longer fixated on domestic supplies…

… but international news is still driving the markets . The EIA's report on Wednesday that showed crude inventories jumped by 6.9 million barrels in the week ended June 15 lent some support to prices. Analysts had expected crude stocks to drop by 150,000 barrels. Gasoline inventories rose by 1.8 million barrels, more than the 1 million-barrel increase expected by analysts surveyed by Dow Jones Newswires.

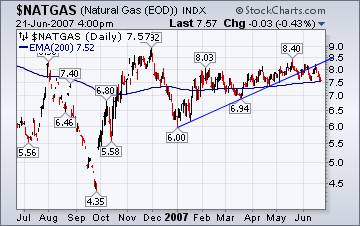

Natural gas prices due for a solid decline.

June 22 (Bloomberg) -- Natural gas in New York fell to a three-month low as adequate storage eased concern over potential supply shortfalls later this year and as analysts forecast lower prices.

June 22 (Bloomberg) -- Natural gas in New York fell to a three-month low as adequate storage eased concern over potential supply shortfalls later this year and as analysts forecast lower prices.

Prices have broken through ``hard'' on the 200-day moving average (not shown) of about $7.18, suggesting $7 and then $6.80 are the next lows to be tried out by traders, Fitzpatrick said.

The trader's view is correct. Once the 200-day moving average is broken, a commodity such as natural gas is in the bear's lair.

Back on the air again.

Tom Wood of www.cyclesman.com and I have had a running commentary on the markets since I had done my radio shows last fall. I haven't restarted the radio programs, but Tim and I have decided to post our thoughts on his website. You can listen to our comments by clicking here .

The Practical Investor will be moving its business location at the end of July. Further updates on the move will follow.

Please make an appointment to discuss these strategies by calling me or Claire at (517) 324-8741, ext 19 or 20. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski

Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.