Stock Market, If You Don't Like 'em, Then Don't Trade 'em

Stock-Markets / Stock Index Trading Sep 10, 2009 - 12:46 PM GMTBy: Guy_Lerner

Last night I read somewhere that the problem with the equity markets was that no one really liked them (except for Cramer), yet that was the precise reason why the markets continued to go up day after day - nobody really liked them. Kind of odd, I guess. However, as someone who likes to bet against the consensus, I can understand that sentiment. As we know, the markets will do their best to frustrate the most.

Last night I read somewhere that the problem with the equity markets was that no one really liked them (except for Cramer), yet that was the precise reason why the markets continued to go up day after day - nobody really liked them. Kind of odd, I guess. However, as someone who likes to bet against the consensus, I can understand that sentiment. As we know, the markets will do their best to frustrate the most.

One of our readers brought up a similar point. The sentiment measures are bullish (i.e., bear signal), yet no one really believes in this rally. Most investors are really bearish. At least, this was his "gut" feel.

Hey, as President Clinton once said, "I feel your pain". It is particularly hard to sit out of a run that goes up day after day. But the reality is this: the market is not attractive at this point. Volume has been diminishing; the market is overbought and oversubscribed. Valuations are high. Economic visibility is uncertain.

Now the markets don't go up because no one loves them; they go higher because the buyers are willing to take shares off of the sellers for higher prices, and these buyers hope to sell higher. It seems obvious, but often times, this notion is lost in the angst of "I am missing out".

But let's get real here. If you don't want to play, then don't. Find another sandbox. And that is o.k. too. As far as the equity markets are concerned, this is not the "fat pitch" that I like.

So where is that "fat pitch"? The Dollar Index remains in a down trend, and those assets denominated in the currency have been and should continue to move higher. Precious metals, commodities, and foreign developed and foreign emerging markets should be relative out performers. I have been on this theme for 3 months now. This is old news in my book.

Another place to consider are TIPs or Treasury Inflation Protected Securities. Yes, a lower Dollar and higher commodity prices will flame the inflation debate, but I don't think TIPs are an inflation play but rather a safe haven play. So let's review some charts and why I believe TIPs may be worth a look.

Figure 1 is a monthly chart of the i-Share Lehman TIPS Bond Fund (symbol: TIP). In the lower panel is the indicator based upon Larry Williams' "Pro Go" indicator. The idea behind the indicator is to identify those times when retail traders are dominating the market action. With the indicator nearing extremes, the retail trader has ridden TIPS lower for the better part of the last year. The indicator is at an extreme and where we would expect a reversal in trend as the "smart money" or strong hands take shares off the weak hands. The last multi -month move higher in TIPs (from August, 2007 to March, 2008) was marked by this indicator moving to extremes as well (gray oval on chart).

Figure 1. TIP/ monthly

Technically, a break out over a trend line formed by two prior pivot high points (red dots) is bullish. These break outs are noted with the blue up arrows in figure 1. In essence, the down trend in TIPs has been broken. The rising simple 10 month moving average is also bullish.

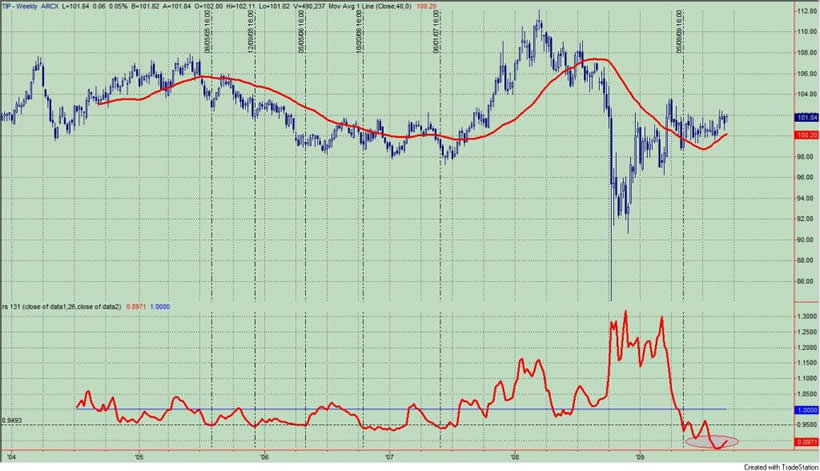

Figure 2 is a weekly chart of TIP. The break out or upside violation of the trend line is noted. A weekly close below the 40 week moving average would be a concern; and a weekly close below support at 98.64 would be reason enough to get out of TIP altogether and move to the sidelines. A price target for TIP would be approximately 110.

Figure 2. TIP/ weekly

Figure 3 is weekly chart comparing TIP to SPY (data hidden). The indicator in the lower panel measures relative strength (with a 26 week look back) between the two assets. What we see and what one would expect after a 50% move in equities is that TIP is at point where a reversal should occur. In fact, the indicator is at its lowest level in 5 years.

Figure 3. TIP v. SPY/ weekly

At some point, the equity markets will correct. The indicators and intermarket relationships will make sense. Until then, we always have the option of choosing where we play and how we want to function in the markets. As far as the equity markets are concerned, I see nothing wrong with sitting this one out.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.