Financial and Geopolitical Intelligence, Gain From the Banking Cartel Game Plan

Politics / Global Financial System Sep 06, 2009 - 01:18 AM GMTBy: DeepCaster_LLC

Studying The Cartel* Game Plan, to the (considerable) extent that that Plan can be inferred from Cartel actions and their consequences (see below), can be a significant aid in making profitable investment decisions.

Studying The Cartel* Game Plan, to the (considerable) extent that that Plan can be inferred from Cartel actions and their consequences (see below), can be a significant aid in making profitable investment decisions.

Asking key questions which arise from market or economic developments which appear to be rationally inexplicable, often reveals important aspects of that Game Plan.

Why was it that, when the fragility of the Financial System became quite apparent via the collapse of Bear Stearns in March, 2008, did the price of the Traditional Safe Haven Assets, Gold and Silver, not skyrocket, but, rather, declined dramatically?

Why was it that, when the fragility of the Financial System became quite apparent via the collapse of Bear Stearns in March, 2008, did the price of the Traditional Safe Haven Assets, Gold and Silver, not skyrocket, but, rather, declined dramatically?

Why is it that during recent all-time-record debt and monetary creation, especially in the U.S.A., do not the interest rates on U.S. Treasury Securities Skyrocket?

Where are the infamous ‘Bond Vigilantes’?

Why, during record recent (and ongoing), economic and financial crises, did Gold and Silver Not exceed their 1980 inflation-adjusted high? (e.g. approximately $2,300/oz for Gold)

Why, when the Main Stream Media tells us we are in a deflationary period, does our authentic experience tell us that almost everything costs so much more?

Why have the Bailouts and Stimuli overwhelmingly been directed at helping too-big-to-fail financial institutions, while the U.S. Consumer/Taxpayer and, often Mortgage- Holder (who is 70% of the U.S. Economy) has received virtually no help at all, and is in increasingly dire straits?

And how is it that when Investors in the Equities Markets were losing Trillions in the Fall, 2008 Market Crash, certain Mega-Financial Institutions made over $13 Trillion? (See “Opportunities & Threats in Derivatives Shocker” (05/29/2009) at www.deepcaster.com and click on the ‘Articles by Deepcaster’ cache.)

One could continue the list. These questions can all be answered if one first considers Cartel* Market Interventional Realities.

It is becoming increasingly widely known that a Fed-led Cartel* of key Central Bankers and Favored Financial Institutions regularly overtly and covertly intervene in the Precious Metals, Equities and Strategic Commodities Markets, among others.

*We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster’s December, 2008 Letter containing a summary overview of Intervention entitled “A Strategy for Profiting from the Cartel’s Dark Interventions & Evolving Techniques” and Deepcaster’s July, 2009 Letter entitled "A Strategy For Profiting From The Cartel’s Dark Interventions & Evolving Techniques - II" in the “Latest Letter” Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster’s profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these “Interventionals.”

The Motivations for these Interventions are quite predictable: profit and power. [See “A Profit Tool & Strategy for Coping with The Cartel” (08/14/2009) , “Defeating the Cartel... With Profit, Part 2” (06/19/2009), “Coping with Power Moves in the Cartel's 'End Game'” (04/24/2009), “Coping with the Superpower-Cartel Threat!” (01/30/2009) at www.deepcaster.com and click on the ‘Articles by Deepcaster’ cache.]

One major motivation of these Interventions is that The Cartel does not want Gold and Silver to be recognized as for what they are – the Ultimate Stores and Measures of Value. They want their Fiat Currencies and Treasury Securities to be so recognized, because this paper is the source of their Profit and Power.

Understanding these motivations explains periodic Cartel Takedowns of Gold and Silver prices (see below for how these Takedowns are implemented).

But the Interventional Regime operates much more broadly than just in the Precious Metals Markets.

An indication of just how broadly, and to what ends, is provided by understanding key Cartel Interventional Tools.

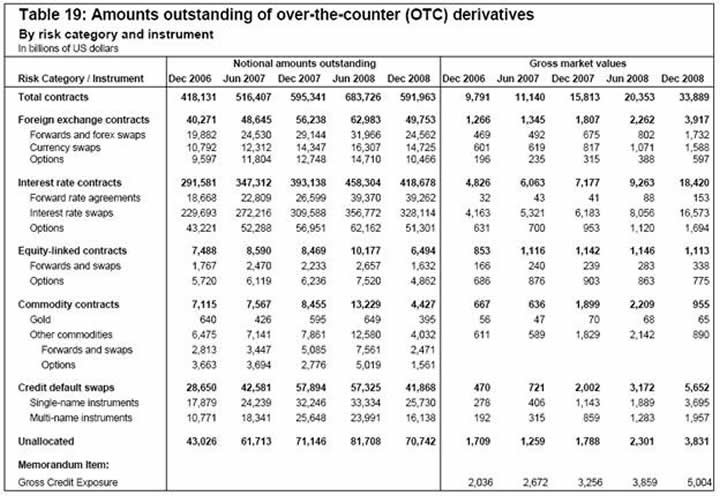

Among these tools are TOMO’s, POMOS, TARP Funds and policies and TALF Funding and Policies, and last but not least the nearly $600 Trillion Notional Value of dark OTC Derivatives reported by The Central Bankers Bank, the Bank for International Settlements (www.bis.org, path: Statistics > Derivatives > Table 19).

(See the following for description of the aforementioned Funds and Tools and their uses: “Profits v. The Threat: Beauty & The Beast Redux” (07/10/2009) and “Defeating the Cartel…With Profit, Part 2” (06/19/09) at www.deepcaster.com and click on the ‘Articles by Deepcaster’ cache.)

Importantly, a Critical Major Consequence of the Ongoing Cartel Interventions is that they create Anomalous and Dysfunctional Dislocations in the Market and Economy.

That is, these Interventions create Market (and Economic) Consequences and Results which are often far different from those which would be generated by Free Market Action.

For example, were the price of Gold (and Silver) not manipulated, Gold should (given recent and ongoing Financial and Economic Crises) many months ago have exceeded its inflation-adjusted 1980 high (i.e. $2,300/oz for Gold), should it not?

And given recent unprecedented massive Monetary and Credit Creation and Fed Monetization of U.S. (and other major Nations) Treasury Securities their prices should be much lower. That is, interest rates should be much higher, should they not?

But they are not. Why?

The answer likely lies in the TOMO, POMO, TARP and TALF funding referred to above and in the derivatives positions reported at the BIS website in Table 19 on www.bis.org, path: Statistics > Derivatives > Table 19 (see above and Table below).

Note the Notional Values of the following in Table 19 below:

-- $395 Billion in OTC Gold Derivatives Contracts available for Gold Market Manipulation.

-- $418 Trillion in OTC Interest Rate Derivatives Contracts available for Bond Market/Interest Rate Manipulation.

-- $4.03 Trillion in OTC Commodities Derivatives Contracts available for Crude Oil and Other Commodities Price Manipulation.

-- $49.7 Trillion in OTC Currency Contracts available for Currency Price Manipulation.

Comparing the Total Market Value of OTC (dark, private, and not Exchange Traded) Derivatives in June, 2008 (pre-Crash) with December, 2008, one finds that certain Major Financial Institutions gained over $13 Trillion in the same period that (i.e. the Fall, 2008 Equities Markets Crash) Equities Markets Investors were losing Trillions (see “Opportunities & Threats in Derivatives Shocker” (05/29/2009) at www.deepcaster.com and click on the ‘Articles by Deepcaster’ cache).

But why are these huge gains Not Obvious and/or, reported by Major Financial Institutions? In answering the questions consider that the private for-profit Fed refuses to reveal key information about their financial assets and transactions to the U.S. Congress. Could it be that the private for-profit Fed’s MegaBank Shareholders are among the beneficiaries of the $13 Trillion in Profit referred to above?

And the Question of The Year is: why for example has the vast Monetary and Credit Creation in recent years not created dramatic Consumer Price Inflation.

Ah, but it has! And that inflation Continues to this very day.

BUT, should not that Inflation and other consequences of Market Manipulation dramatically show up in official Statistics?

Indeed they should, BUT, unfortunately, many Key official Market Statistics are gimmicked.

Indeed, Official Gimmicking of Official Statistics serves the purpose of masking key Economic and Financial Realities, and has for years.

In one key reality they mask is a massive stealth wealth transfer from (mainly middle class) investors/taxpayers to the Mega Financial Institutions. Lost of over 30% of the purchasing power of the U.S. dollar is but one manifestation of this vast wealth transfer.

Consider the Real Numbers for CPI and Unemployment (and other key data) – which are major consequences of the Actions and Policies of The Cartel operating its Interventional Regime, courtesy of Shadowstats.com (Shadowstats calculate these Real Statistic the “old-fashioned way” they were calculated before the gimmicking began the 1980’s and 1990’s.

Official Numbers vs. Real Numbers

Annual Consumer Price Inflation reported August 14, 2009

-3% 5.5% (annualized August Rate)

U.S. Unemployment reported September 4, 2009

9.5% 21.1%

U.S. GDP Annual Growth/Decline reported August 27, 2009

-3.9% -5.9%

A brief look at the Table above shows The Real Consequences of The Cartel Interventional Regimes policies.

Additionally consider the effects of the aforementioned Monetary and Credit Excesses on the U.S. Dollar. It’s purchasing power has declined dramatically in the 21st Century (over 30% in the last six years), and, is likely to decline much more.

In Effect, Cartel-created Dollar Purchasing Power Destruction is a Huge Stealth Tax on Investors, Savers, Retirees, and Income Earners.

So, how can the typical Investor Cope with The Cartel, and Profit as well?

A Strategy for Profit and Protection

Normally, (that is to say, in a Genuine Free Market situation) the go-to “Safe Haven” Assets in times of Financial Crisis would be the Precious Monetary Metals Gold and Silver, as well as other assets such as Strategic Commodities.

We say “normally” because nearly every time yet another Financial Market Crisis has come prominently into the public eye in recent years The Cartel* has successfully taken down the price of what would normally be The Safe Haven Assets - - the Precious Monetary Metals. A prime example occurred during the much-publicized demise of Bear Stearns in March, 2008 to which we referred above, which was accompanied by a vicious Takedown of Gold and Silver. In a non-manipulated Market, given the fact that Bear Stearns reflected great and increasing weaknesses in the Financial System, Gold and Silver should have skyrocketed. But instead they were dramatically taken down.

Yet, the late 2008 - early 2009 Crises appear to be different. Gold launched from the mid $700s/oz. to around $900/oz. during September, 2008, fell back to the low $700s and then launched again toward $900 in December, 2008 and has actually exceeded $900 several times in 2009, and, as we write, is again approaching $1,000/oz.

So the question now, at the beginning of September, 2009, is it different this time around? Have Gold and Silver finally thrust off the shackles of Cartel Intervention? Or will The Cartel be able once again to cap and take down the prices of these Precious Monetary Metals and Strategic Commodities? Deepcaster has very recently addressed this question in a Forecast he issued for the likely fate of Gold, Silver, Crude Oil & the U.S. Dollar in the Alerts Cache at www.deepcaster.com.

One thing is certain: The Cartel will certainly attempt again to take down Gold, Silver and Crude Oil at the earliest opportunity because the Strategic Commodities and Precious Monetary Metals are Competitors as Stores and Measures of Value with the Central Bankers’ Treasury Securities and Fiat Currencies.

Yet there is a Strategy which accommodates Cartel Interventional attempts and at the same time provides excellent Profit Opportunities, whether the Cartel Interventional attempts are successful or not.

A major premise of The Strategy is that one can certainly remain a Hard Assets Partisan (as Deepcaster is) while at the same time insulating oneself somewhat from future Takedowns. The following points provide an outline of The Strategy (particularly as applied to the Gold and Silver Markets) and are designed to help avoid Portfolio unpleasantness, or even possible financial ruin, in the future, as well as to profit along the way:

- Recognize that The Cartel is still Potent, as difficult as that may be psychologically for Deepcaster and other Hard Asset Partisans to acknowledge. The Cartel is still the Biggest Player in many markets and, if the timing and market context are propitious, the Biggest Player makes Market Price. In addition, The Cartel has the advantage of de facto controlling the structure and regulation of various marketplaces and that is a tremendous advantage; just as the Hunt Brothers years ago discovered much to their dismay and misfortune, when they tried to corner the Silver Market.

- Accumulate Hard Assets near the Interim Bottoms of Cartel- engineered Takedowns.

- In order to know when one is likely near the bottom of a Cartel-generated takedown, it is essential to take account of the Interventionals as well as the Technicals and Fundamentals. Paying attention to the Interventionals facilitated Deepcaster recommending five short equities positions as of early September (just before the Fall Crash) all of which we subsequentially recommended be liquidated profitably.

- For example, regarding Gold & Silver, near such Interim Bottoms, accumulate a combination of the Physical Commodity (Deepcaster prefers “low premium to melt” bullion coins) and well-managed Juniors with large reserves. (Deepcaster provides a list of such Junior Candidates in our December 20, 2007 Alert “A Strategy for Profiting from Cartel Intervention” available in the Alerts Cache at www.deepcaster.com.) The “Physical” and “Juniors” are for holding for the long-term as a Core Position.

- Then, to the extent one wishes to speculate on the next “long” move, one should buy the major producers or long-term call options on them. These latter positions are for ultimate liquidation at the next Interim Top and are not for holding for the long-term.

- However, there will be a time when The Cartel price capping is ineffective and Gold & Silver make record moves upward. The benefit of this Strategy is that one will likely be long in one’s speculative positions when this happens.

- Near the next Interim Top, liquidate the long options and majors. Again, in order to know when we are close to the next Interim Top, it is essential to monitor the Interventionals, as well as Fundamentals and Technicals.

- Near that Top, sell short or buy puts on Majors. We re-emphasize the Majors as preferred vehicles for trading positions because such positions are more liquid and tend to be quite responsive to Cartel moves.

- Near the next Interim Bottom, cover your shorts and liquidate your puts and go long again to begin the process all over again. We emphasize that it is essential to consider the Interventionals as well as the Fundamentals and Technicals in order to determine the approximate Interim Tops and Bottoms.

- Finally, Hard Assets Partisans have the opportunity to become involved in Political Action to diminish the power of The Cartel. It is truly outrageous that the average unsuspecting citizen, and prospective retiree, can and does put his hard won assets in Tangible Assets and/or Retirement Accounts only to have those assets effectively de-valued by Cartel Takedowns and other Cartel actions. This is extremely injurious to many average citizens in many countries who are saving for the rainy day or retirement and have their retirement and/or reserves effectively taken from them. In order to help prevent this and similar outrages, we recommend taking three steps:

- Become involved in the movement to Audit and then abolish the private-for-profit U.S. Federal Reserve as Deepcaster, former Presidential candidate Rep. Ron Paul, and legendary investor Jim Rogers, all have advocated. The ‘Audit The Fed’ Bill is H.R. 1207 (and has a large Majority of the U.S. House of Representatives co-sponsors); and The Abolish The Fed Bill is H.R. 2755. www.carryingcapacity.org is a nonprofit organization which actively supports these bills.

- Join the Gold AntiTrust Action Committee, which works to eliminate the manipulation of the Gold and Silver markets (www.gata.org). GATA is a nonprofit organization, which makes a great contribution by gathering evidence regarding the suppression of prices of Gold, Silver and other commodities.

- Work to defeat The Cartel ‘End Game.’ Deepcaster has laid out the evidence regarding the Ominous Cartel “End Game.” Clearly The Cartel is sacrificing the U.S. Dollar to prop up Favored International Financial Institutions and to maintain its power. But this sacrifice cannot continue forever. See Deepcaster’s July 2008 Letter in the ‘Latest Letter’ Archives at www.deepcaster.co

If this aforementioned Strategy is employed effectively, it can result both in an increasing Core Position in Gold and Silver, and in considerable profit along the way.

Additional insights and details regarding this Strategy, which are essential to profiting from The Cartel’s Policies, are laid out in Deepcaster’s article of 3/06/09 entitled “Investor Advantage: Revisiting The Cartel’s ‘End Game’ ” in the ‘Articles by Deepcaster’ cache at www.deepcaster.com.

Protection and profit required Proactivity and attention to the Interventionals, Fundamentals and Technicals, not “Buy and Hold.” We reiterate, “Buy and Hold” rarely succeeds anymore as current market conditions attest.

Indeed, the Key Point of the Strategy for Protection and Profit is careful attention not only to the Fundamentals and Technicals but also to the Interventionals. These Overt and Covert Cartel-generated Interventions have the power to move markets as those who study the matter can attest.

Thus, the Key to Profit and Protection is a Strategy: Successful Investors must become Long-Term Position Traders, with their trading choices informed by the Interventionals, as well as the Fundamentals and Technicals. Moreover engaging in the Actions suggested above can help prevent The Cartel’s obtaining Superpower status, and aid in achieving wealth protection and profits as well.

Source: Bank for International Settlements - www.bis.org, Path: Statistics > Derivatives > Table 19

Best Regards,

By DEEPCASTER LLC

www.deepcaster.com

DEEPCASTER FORTRESS ASSETS LETTER

DEEPCASTER HIGH POTENTIAL SPECULATOR

Wealth Preservation Wealth Enhancement

© 2009 Copyright DeepCaster LLC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DEEPCASTER LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.