The Interest Rate Cosa Nostra

Interest-Rates / Market Manipulation Aug 31, 2009 - 10:36 AM GMTBy: Rob_Kirby

Recently, Bloomberg News reported that a legal brouhaha has developed in Italy surrounding the municipality of Milan entering into a refinancing package, including retiring older existing debt and associated interest rate swaps, with a combination of new bonds and interest rate swap agreements designed to protect Milan against a rise in long-term interest rates, back in 2005. This financing was arranged with a quartet of banks including J.P. Morgan Chase, U.B.S. AG, Deutsche Bank AG and Depfa Bank Plc.

Recently, Bloomberg News reported that a legal brouhaha has developed in Italy surrounding the municipality of Milan entering into a refinancing package, including retiring older existing debt and associated interest rate swaps, with a combination of new bonds and interest rate swap agreements designed to protect Milan against a rise in long-term interest rates, back in 2005. This financing was arranged with a quartet of banks including J.P. Morgan Chase, U.B.S. AG, Deutsche Bank AG and Depfa Bank Plc.

The consternation arose this year when the 1.69 billion swap agreement Milan had signed with the banking counter-parties produced a mark-to-market accounting loss amounting to many millions of Euros. The unanticipated mark-to-market loss, which would only be realized / become payable if Milan were to cancel the existing financing arrangement, is now cited by Italian authorities as grounds by Italian authorities to seek fraud indictments on institutions and individuals involved in the deal alleging the principals never adequately disclosed to Milan that these swap deals held risks and expenses by as much as 599 times more than the stated .01 [one basis point] per cent for advice.

The Bloomberg article delves in to the question of whether there was a crime committed in these actions. I suspect that there is adequate evidence pointing to criminal activity – but not likely the kind of criminal activity that Bloomberg thinks they are reporting and Italian authorities are investigating and trying to prove.

Let me explain:

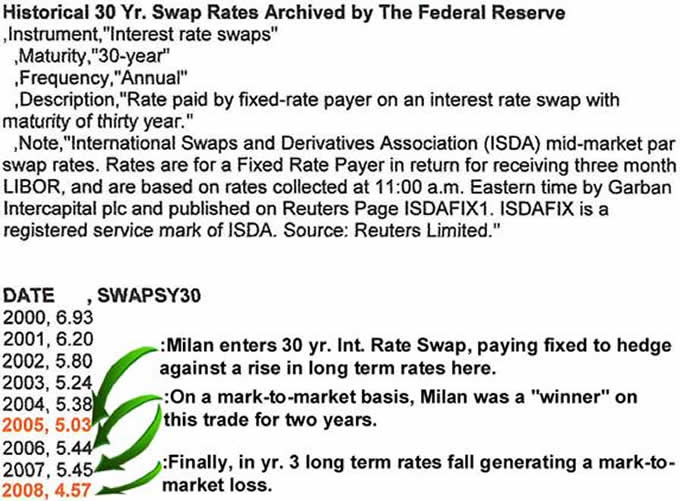

To get a flavor for what long term rates were back in 2005 when this financing was arranged, we can visit archives of the U.S. Federal Reserve which record historical 30-year fixed interest rate swap rates [these rates = 30 year U.S. gov’t bond yield + a spread that fluctuates]:

Take note that we heard nothing negative in the media from Milan during 2006 or 2007 while they were enjoying “mark-to-market gains” on their financing package.

The notion that or the extent to which this quartet of banks adequately disclosed whether interest rate swaps could produce mark-to-market losses; we cannot be sure, but, one might consider that when the refinancing occurred in 2005 [when Milan cancelled then existing swaps] – Milan had to make compensatory cash payments to their former Italian bankers [UniCredit SpA] to exit existing swaps. So the notion that Milan didn’t understand that new swaps would carry the same associated risks is a ridiculous non starter.

So What Makes This Milan Deal [and others like it] Really Stink?

Despite the unfortunate situation that Milan and its finances appear to be in, one must realize that these mark-to-market pratfalls are the double-edged nature of derivatives where end-users of these instruments may find themselves when expected or anticipated outcomes fail to materialize.

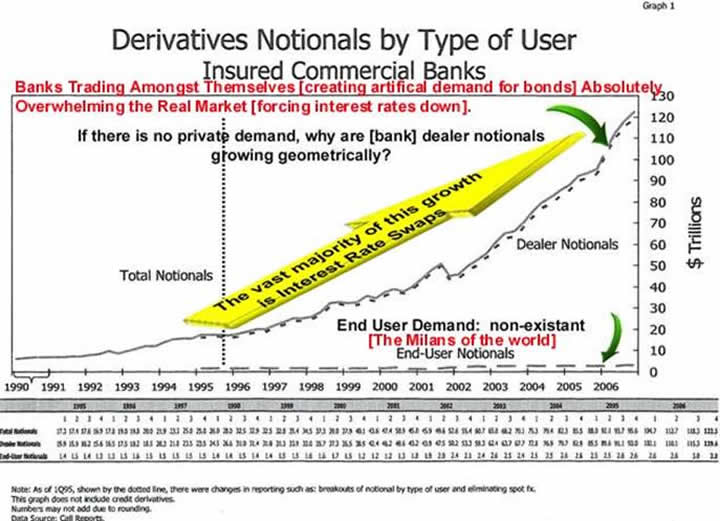

From the chart below, from the U.S. Office of the Comptroller of the Currency, we can see that, in aggregate, the parabolic growth in the trade of derivatives is pyramidal in structure, serves no observable or commercially productive purpose – because, aside from the Milans of the world [isolated exceptions relative to the scale of the market], THERE ARE VIRTUALLY NO END USERS FOR THESE PRODUCTS:

source: Office of the Comptroller of the Currency, Q3/07 Quarterly Derivatives Report

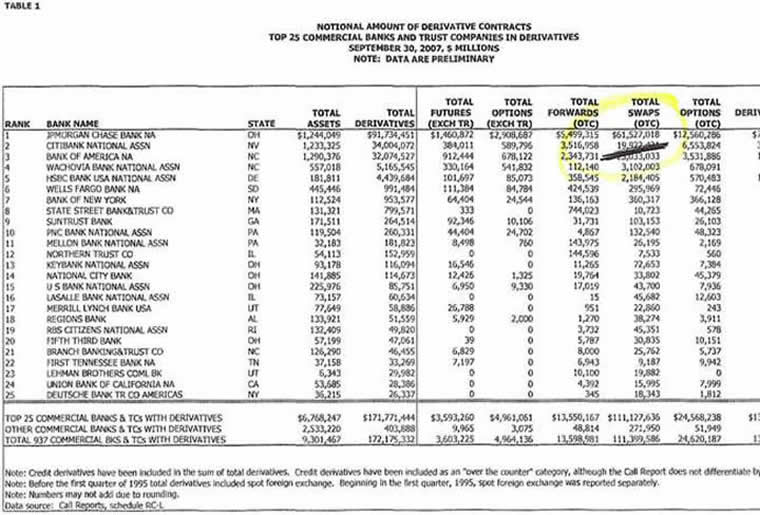

This begs the question - What is the REAL REASON for J.P. Morgan Chase to assemble an interest rate derivatives book – which at Sept. 30, 2007 stood at 61.5 TRILLION in notional?

source: Office of the Comptroller of the Currency, Q3/07 Quarterly Derivatives Report

The answer becomes clear when one stops to realize the effect that this elephant-sized interest rates derivatives edifice [specifically interest rate swaps] exerts pressure on the global interest rate complex.

Here’s how:

Hedging Mechanics of Interest Rate Swaps > 3 yrs. Duration

Interest rate swaps > 3 yrs. in duration customarily trade as a "spread" - expressed in basis points - over the current yield of a corresponding benchmark government bond. That is to say, for example, 5 year interest rate swaps [IRS] might be quoted in the market place as 80 - 85 over. This means that the 5 yr. swap is "bid" at 80 basis points over the 5 yr. government bond yield and it is "offered" at 85 basis points over the 5 year government bond yield. Let's assume that 5 year government bonds are yielding 1.90 % and the two counterparties in question consummate a trade for 25 million notional at a spread of 84 basis points over.

Here are the mechanics of what happens: The payer of fixed rate pays [1.90 % + 84 basis points =] 2.74 % annually on 25 million for 5 years. The other side of the trade - the floating rate payer - pays 3 month Libor on 25 million notional, reset quarterly - typically compounding successive floating rate payments at successive 3 month Libor rates so that actual cash exchanges are settled "net" annually. To ensure that the trade remains a "true spread trade" [and not a naked spec. on rates] and to confirm that 1.90 % is a true measure of where current 5 year government bond yields really are - the payer of the fixed rate actually buys 25 million worth of physical 5 year government bonds - at a price exactly equal to 1.90 % - from the receiver of the fixed rate at the front end of the trade. So, in this regard, we can say that 25 million IRS traded on a spread basis creates a "need" for 25 million worth of 5 year government bonds - because it has a 5 year bond trade of 25 million embedded in it.

- Interest rate swaps of duration < 3 years are typically hedged with strips of 3 month Eurodollar futures instead of government bonds.

In recent years the Chicago Mercantile Exchange [or CME] has developed an interest rate swap - futures based hedging product for the 5 and 10 year terms. I acknowledge the existence of these products but due to their 200k contract size and amounts traded, as reported in archived CME volume data, they do not materially impact the numbers in this presentation.

As demonstrated, Interest Rate Swaps create demand for bonds because bond trades are implicitly embedded in these transactions. Without end user demand for the product – trading for “trading sake” creates ARTIFICIAL demand for bonds. This manipulates rates lower than they otherwise would be. In short, there are not enough U.S. Government bonds IN EXISTENCE to adequately “hedge” J.P. Morgan’s interest rate derivatives book. That’s why we can deduce that these interest rate derivatives are, in fact, the “undeclared” [stealth] central plank of U.S. monetary policy.

The detailed math that explains how many bonds, of maturity between 3 and 10 years, are required to “hedge” an interest rate swap book the size of J.P. Morgan’s is explained in detail here in a paper titled, The Elephant in the Room.

This paper goes on to show how the Federal Reserve and J.P. Morgan act in concert as a single entity and how they’ve NEUTERED USURY, engineering long term interest rates down to preposterously low, uneconomic levels by overwhelming traditional self-corrective free market forces. The EXTREME growth of the interest rate derivatives market has had NOTHING to do with offering interest rate protection to end-users like Milan and EVERYTHING to do with ensuring that ANY AND ALL U.S. Government bonds issued find a home on favorable terms for the issuer that maintain and perpetuate global U.S. Dollar hegemony.

So, the real crime here is more like – Why are J.P. Morgan Chase et al selling “interest rate protection” to the likes of Milan et al when they KNOW that usury has been neutered and that interest rates are not going to be allowed to appreciably rise because they are 100 % complicit in the interest rate suppression racket?

In case anyone is still wondering – this explains the REAL REASON why and how institutions like J.P. Morgan and Goldman Sachs [institutions known for their close ties to the Fed and U.S. Treasury] are constantly “so much smarter” and such “better fishermen” than all their competitors. The reality is that they “trade” – by and large – in KNOWN OUTCOMES. It’s like fishing in a barrel!!!

Folks would do well to realize that Deutsche Bank AG and U.B.S. AG are nothing more than the German and Swiss equivalents in the global derivatives racket that J.P. Morgan Chase is in the United States of America. We only get a peek at the size of American bank’s derivatives positions – the Europeans [Germans, Swiss, French and British] to do not divulge / publish the size of their financial institution’s derivatives books.

The selling of “interest rate protection” in this manner is eerily familiar to mob’s protection rackets that Italian investigators have been so accustomed to dealing with, with varying results, throughout their country’s history.

Let’s see if they decide to combat it.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.