Japanese Yen Fractal Path for the U.S. Dollar?

Currencies / US Dollar Aug 24, 2009 - 09:20 AM GMTBy: Adam_Brochert

Though I keep hearing how we're different than Japan and their lost two decades of deflation (or as close to it as we seem to get in a fiat world), we are making the same foolish mistakes: protecting the financial/banking keiretsu that caused the current mess, burying the bad debt under a cloak of secrecy, and engaging in a massive quantitative easing campaign to "stimulate" the economy.

Though I keep hearing how we're different than Japan and their lost two decades of deflation (or as close to it as we seem to get in a fiat world), we are making the same foolish mistakes: protecting the financial/banking keiretsu that caused the current mess, burying the bad debt under a cloak of secrecy, and engaging in a massive quantitative easing campaign to "stimulate" the economy.

Yes, there are important differences, and unfortunately, they make the U.S. picture more grim! We have no savings to fall back on and our access to the reserve currency printing press ensures that we will abuse this privilege until the dam breaks and our currency spirals out of control.

However, one step at a time. The deflationary forces engendered by the collapse of the private credit/debt markets continue to pull Americans and their favorite bankers deeper into an asset price decline/debt morass. If you are a bank or overleveraged financial institution or individual, this is a problem that has not yet gone away (for large banks, this is true even after pillaging the world's taxpayers). While it is true that our government and its [privately held, non-federal, corporate] federal reserve central bank have caused a great deal of damage to the structure of the U.S. economy and the longer-term viability of our currency by their actions, it is also true that other countries with their fiat money machines are engaging in similar plans of taxpayer-sponsored spendthrift madness.

It is a race to the bottom for all fiat currencies and this is why I hold debt-free money (i.e. physical Gold). However, secular credit market implosions are not minor events and bureaucrats only have so much control over the economy, even in places like China and Russia. So, yes, the U.S. Dollar (just like all fiat currencies) will eventually get even closer to its intrinsic value of zero before it is replaced.

But the game is not so simple for those looking to trade the markets (as an example, please don't ask how I've done in my trading account over the past 3 months!). Despite bailing out the banks and "printing money," the Japanese saw their currency strengthen during their mighty cyclical deflationary bear market in the 1990-1993 time frame. I know, I know, we are printing more in the U.S. and we are different, blah, blah, blah. Yes, the greater government debt creation will eventually come home to roost and cause more problems down the road.

But I again believe that a rise in the U.S. Dollar on an intermediate-term basis is upon us. I found an interesting fractal in the Japanese Yen price from the 1990-1991 time frame I wanted to share to show what could happen with the US Dollar despite all of its problems. And again, keep in mind that I store my savings in physical Gold, not fiat dollars from any country. I am a [transient] deflationist who is bullish on Gold because the value of Gold relative to other assets rises during deflationary wipe outs. I also more importantly believe that we are getting dangerously close to the end game for the current global fiat currency system. This is an event one MUST be early for, as being a day late could leave you close to wiped out as a holder of U.S. Dollars.

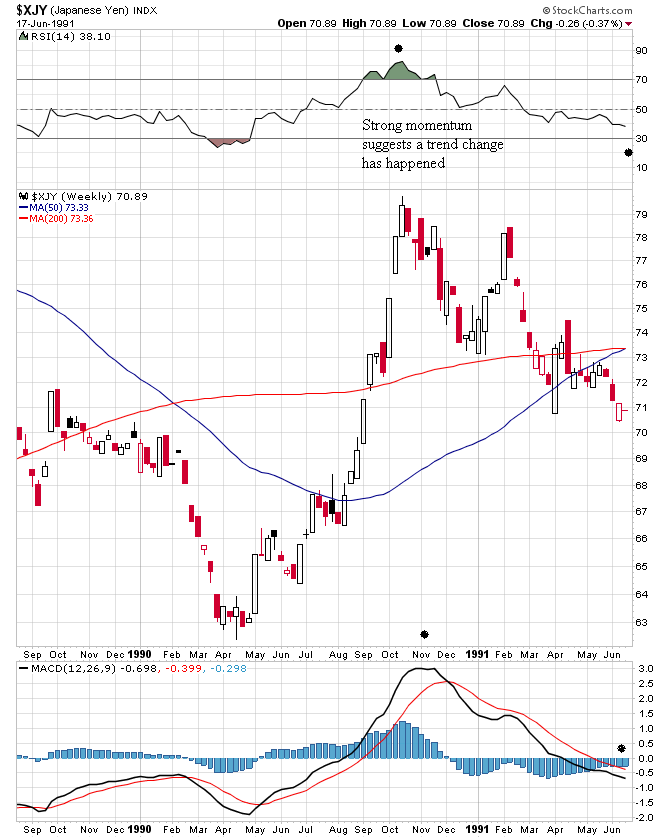

Anyway, following is a weekly chart of the Japanese Yen during the 1990-1991 time frame. Keep in mind that this weekly candlestick chart includes the time frame following two brutal legs down in the cyclical bear market that began their lost 2 decades (which by the way haven't ended!):

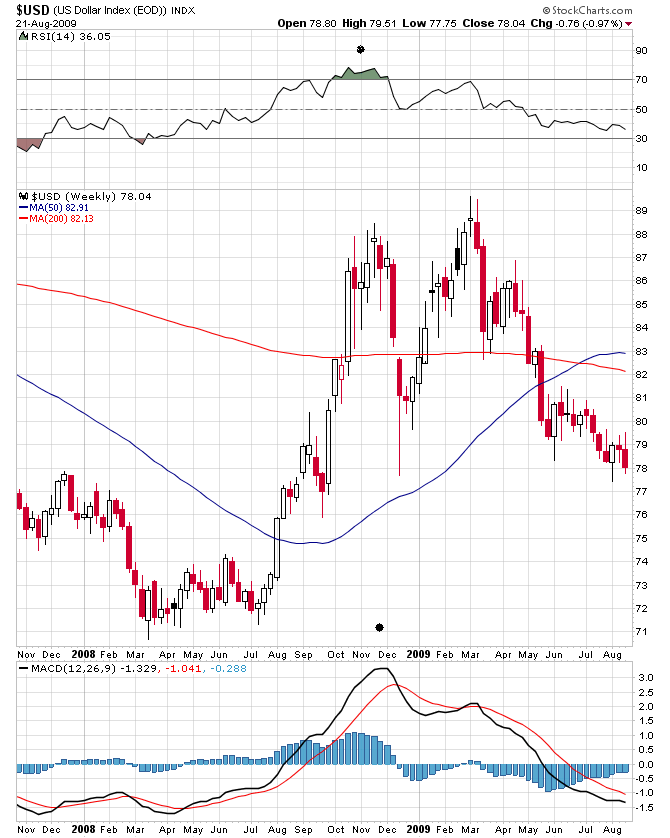

And in case you haven't seen it lately, here's a 22 month weekly chart of the U.S. Dollar:

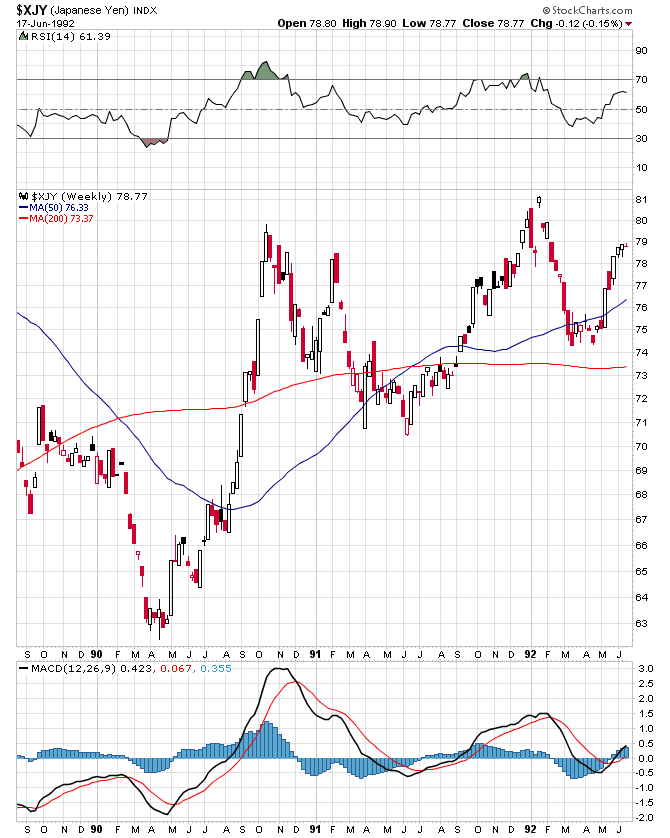

Now, for the obligatory "what happened next" chart in the Japanese Yen:

If you don't think this can happen to the U.S. Dollar, ask yourself why. Think of it this way: what caused the U.S. Dollar to rise so spectacularly last fall? Whatever your answer is, do you think that those forces cannot occur again?

The reason I keep harping on this is because I am passionate about Gold as an asset class in this environment. It seems that 90% of Gold bulls ignore the "reserve currency of last resort" function of Gold / its role as money. This means that Gold can do well during deflation by holding its value. It also means that commodities can tank while Gold can remain strong (which is wildly bullish for Gold miner profitability). Many Gold bulls are also commodity bulls, but I think the commodity bubble, if its poster child oil is any indication, has already burst. We are closer to the 1930s disaster than the 1970s disaster, though both decades are inexact comparisons.

The governments and central banks of the world hold physical Gold as a monetary asset and reserve "just in case." Well, we are now at one of those "just in case" decades where Gold's insurance function is just as important as its appreciation function. I believe Gold will rise significantly in price and possibly in a wild and exponential fashion. But if Gold just sputters along and holds its value in the $1,000/ounce range while every other asset class that a typical individual desires collapses in value, the holder of Gold has become significantly richer in real world terms.

No, I am not talking about the world coming to an end, eating Gold, or using Gold to buy groceries. Last I checked, stocks and bonds were not used to buy food or guns! I am talking about value as well as stabilization and enhancement of one's net worth in a scary investment environment. Those who plan to hold U.S. Dollars will profit from the Dollar's rise during the pending wave(s) of further deflationary panic. "Cash is king" during deflation. However, eventually the world will pull the plug on the U.S. Dollar as the reserve currency of the world. Though this could come about as an orderly process, history suggests otherwise. I don't know when this will happen and, at this point, Obama and Bernanke probably don't know either.

I think another buying opportunity in Gold is pending (still...). Once the U.S. Dollar starts rising, Gold will take an initial hit precisely because so many are holding Gold for the wrong reasons right now. When the Dollar spikes higher, you can bet the Gold bulls and momentum traders will panic, shorts will press their advantage, and a brief price spike down will allow longer-term oriented investors to pick up more Gold on weakness.

As an aside, although change often happens at the fringe, expect to see more stories like this one about the role of Gold as money throughout the world.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.