U.S. Dollar Key to Financial Market Trends

News_Letter / US Dollar Aug 18, 2009 - 06:40 AM GMTBy: NewsLetter

The Market Oracle Newsletter

August 16th, 2009 Issue #64 Vol. 3

The Market Oracle Newsletter

August 16th, 2009 Issue #64 Vol. 3

U.S. Dollar Key to Financial Market TrendsFeatured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By:Andrew G. Marshall While there is much talk of a recovery on the horizon, commentators are forgetting some crucial aspects of the financial crisis. The crisis is not simply composed of one bubble, the housing real estate bubble, which has already burst. The crisis has many bubbles, all of which dwarf the housing bubble burst of 2008. Indicators show that the next possible burst is the commercial real estate bubble. However, the main event on the horizon is the “bailout bubble” and the general world debt bubble, which will plunge the world into a Great Depression the likes of which have never before been seen.

By: Mike_Whitney The Fed has only one tool at its disposal; to create more money. Typically, the way the Fed adds to the money supply is by lowering interest rates. When the Fed lowers rates below the rate of inflation; they're basically selling dollars for under a buck. That's a good deal, so, naturally, speculators jump on it and trigger a credit expansion. What follows is a frenzy of market activity that ends in a housing, credit, tech or equity bubble. Eventually, the bubble bursts and the economy goes into a tailspin. Then, after a period of digging-out, the process resumes again. Wash, rinse, repeat. It's always the same. The moral is: Cheap money creates bubbles; and bubbles move wealth from workers to rich motherporkers. It's as simple as that. That's why the wealth gap is wider now than anytime since the Gilded Age. The rich own everything.

By: Mike_Whitney Credit is not flowing. In fact, credit is contracting. That means things aren't getting better; they're getting worse. When credit contracts in a consumer-driven economy, bad things happen. Business investment drops, unemployment soars, earnings plunge, and GDP shrinks. The Fed has spent more than a trillion dollars trying to get consumers to start borrowing again, but without success. The country's credit engines are grinding to a halt.

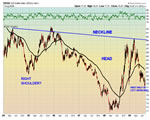

By: The_BullBear In the last BBMR we focused on the US Dollar and concluded that a major break of very long term support was imminent and that a substantial devaluation of the greenback vis-à-vis its major currency pairs and commodities was likely. It’s always healthy to revisit one’s conclusions in light of developments in the market. Recent action has caused me to reevaluate and question the bearish view on the USD and commodities as well. I think that there is a valid bullish case to be made for the Dollar as well as a bearish case for gold, silver, oil and other commodities. I will explore these views in this report.

By: Mike_Whitney Booyah. It's morning in America. The jobless numbers are stabilizing, the stock market is sizzling, quarterly earnings came in better than expected, traders have turned bullish, housing is showing signs of life, and clunker-swaps have given Detroit a well-needed boost of adrenalin. Even Cassandra economists --like Paul Krugman and Nouriel Roubini--have been uncharacteristically optimistic. Is is true; did we avoid a Second Great Depression? Is the worst really behind us?

By: Sean Brodrock The U.S. dollar is in a world of hurt, and that means the golden juggernaut — the long-term rise of gold — is gathering steam. What do I mean by a world of hurt? I mean the U.S. dollar tumbled below crucial support. Oh sure, it could bounce higher for a bit — nothing travels in a straight line — but the easiest path for the greenback is lower.

By: Alistair_Gilbert Silver was decimated in last year’s market rout falling by over 80% in just seven months. Part of the reason is that it is not just bought for investment or jewellery purposes but is an industrial metal as well. Most people think of its industrial use in photography, but in fact it has myriad uses in the medical field because of its antibacterial qualities and more recently in creating superfibres for the clothing industry.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.