UK Unemployment Figures Mean Disaster for the Housing Market

Economics / UK Housing Aug 13, 2009 - 07:25 AM GMTBy: MoneyWeek

David Stevenson writes: Britain's dole queues just got a lot longer. Another 220,000 people were added, according to yesterday's official stats. That takes the total to 2,435,000, or a rate of 7.8%, the highest since 1996.

David Stevenson writes: Britain's dole queues just got a lot longer. Another 220,000 people were added, according to yesterday's official stats. That takes the total to 2,435,000, or a rate of 7.8%, the highest since 1996.

What's more, the number of people without work is set to increase much further. And even if you still have a job, the chances are that your pay packet's hardly growing.

What's more, the number of people without work is set to increase much further. And even if you still have a job, the chances are that your pay packet's hardly growing.

And that spells more trouble for house prices…

The unemployment numbers are horrifying

Yesterday's jobless figures were truly awful. The percentage of the population without work hit its highest for some 13 years, while the nation's dole queues reached their longest for 14 years.

Further, the actual number of employed Britons fell by a record 271,000 in the three months to June, as even more people left the workforce than claimed benefits. Many of these 'non-signers' are now relying on their partner's income, redundancy payments or savings, says Howard Archer of HIS Global Insight. He also points out that although the 'claimant count' only rose by some 25,000, that's probably down to the 'student effect' – i.e. college or school leavers who can't get a job, but aren't eligible for benefits.

Meanwhile, for those still with jobs, the pay picture isn't looking too bright either. Unless you're one of those bankers back on the mega-bonus trail, your income is unlikely to be growing. UK annual average earnings growth, excluding bonuses, rose by just 2.5% in the three months to June, the lowest since the data series began in 2001.

Gloomy enough. But even worse is the likelihood of Britain's dole queues getting a lot longer… for a while longer, too.

Technically, the recession may be ending, though any recovery is set to be sluggish at best. And there's every chance of a double dip, as we talked about in Money Morning the other day (How savers could derail a recovery). But either way job losses won't stop rising.

Even a recovery brings job losses

Back in the 1990s, unemployment rose for 18 months after the economy bottomed out. That's likely to happen again – for two reasons:

Firstly, companies who've had to slash their costs to stay afloat will keep cutting their workforces while the economic outlook stays unclear.

And secondly, many firms simply won't survive.

Ed Stansfield of Capital Economics has forecasted that Britain's jobless total is heading for 3.5m, i.e. over 11%, by 2011.

We're often told that unemployment is a 'lagging' indicator, i.e. it reacts to what's going on in the economy rather than leading it. And we're also told that it doesn't matter if our pay packets aren't expanding very much because consumer prices are now falling.

Enjoying this article? Sign up for our free daily email, Money Morning, to receive intelligent investment advice every weekday. Sign up to Money Morning.

That may help homeowners with tracker home loans to feel flusher while interest rates stay low. But if hundreds of thousands are being laid off, and those with jobs aren't able to wring much more out of their employers, the amount of money sloshing around the economy is going to be severely curbed.

Away from the City-fuelled London and the South East, as Matthew Lynn says in last week's magazine: Britain's about to become two nations once again (if you're not a subscriber, get your first three issues free here), it means less spending in the shops. And we'll all need to pay more tax to pay for the extra welfare benefits the government will have to fork out. The cost to the Exchequer of someone out of work, based on benefits claimed and tax revenues lost, is £9,000 a year, says John Philpot of the Chartered Institute of Personnel and Development.

The threat to house prices

But the real damage of a further job loss surge is likely to be a flood of home loan defaults. Stansfield reckons the number of residential property borrowers who fall behind with their payments could climb even higher than the 350,000 level reached in the 1990s recession.

He's expecting that 375,000 families will run into arrears. That's unless the dole queues lengthen even more than he thinks, in which case up to 400,000 could hit trouble.

This will lead to a spurt in forced selling, and also repossessions. At the same time, the pay squeeze will make life tougher for borrowers if loan rates start rising again – and fixed rates are already up to a ten-month high.

Why housing bulls are wrong

Right now, most commentators appear to have turned bullish on British house prices. And my inbox is full of messages from estate agents citing lack of supply, i.e. not many sellers around.

But that could be about to change. A vicious downward house price value spiral could now start to develop as more borrowers are forced to unload their properties at fire sale prices.

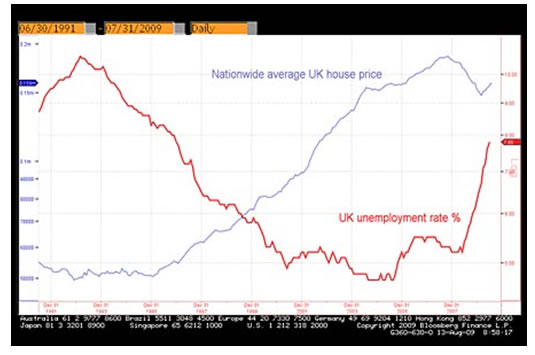

Just look at the chart below:

The red line shows Britain's unemployment rate, the blue line the Nationwide average house price. Note how, despite all the talk that they'd been overvalued for ages, home values only nosedived when job losses really began kicking in during 2008.

As Edmund Conway points out in the Telegraph, in the early 1990s prices climbed quite sharply in some months, but over a three-year period still fell more than they rose.

If Britain's dole queues reach 3.5m this time round, the housing market will bear the brunt. And if some of the gloomier job predictions turn out to be right, outright carnage could be just around the corner.

By David Stevenson for Money Morning , the free daily investment email from MoneyWeek magazine .

© 2009 Copyright Money Week - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Money Week Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.