Tactical Trading in the Commodity Markets

Commodities / Commodities Trading Aug 06, 2009 - 02:24 AM GMTBy: Andrew_Abraham

In some of my earlier posts I spoke about Tactical trading in Commodity futures. I want to provide you an example that is occurring right now in commodity futures trading. This is not from one of those web sites with commodity tips. This is real trading in a commodity market with a real commodity trade.

The premise of tactical trading is to identify the strongest markets as well as the weakest. When I look at over 80 markets all over the world it can become evident on a relative basis which markets are the strongest and weakest. Once these markets are identified my liquidity can be focused on these commodity markets or forex markets. However with this said, this does not guarantee to the slightest if the commodity trade will work ( as well as forex trade).

The goal of tactical trading is to find new trends…or more better said put us in a position to be able to Trend follow in the commodities market. Also bear in mind even with the filter of identifying the strongest and weakest markets I have many small loses in commodities trading. There is no way to prevent these losses and do not faze me.

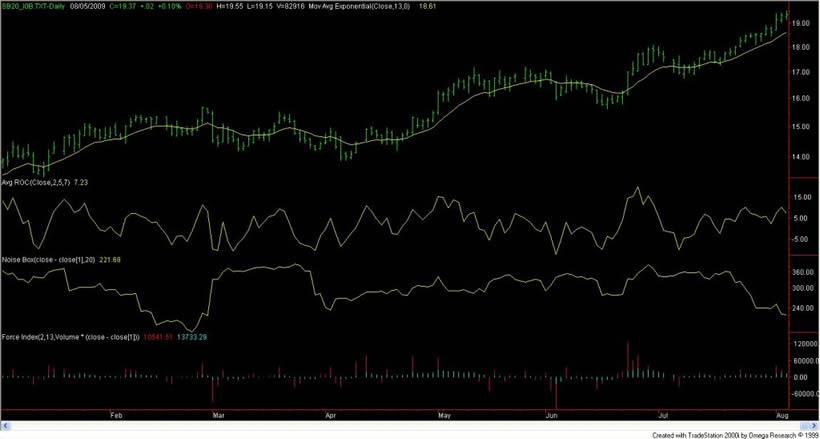

Sugar has been a standpoint recently. When this trade was put on I had no opinion about sugar nor do I know anything about sugar other than it is sweet. Currently sugar has been moving in the commodities market (think about what this might mean for inflation??). Money is made by trend following trends that exist for long periods of time in commodities trading. The idea is make one available for any and all opportunities yet manage the risks.

Currently there are substantial profits in sugar not just in our trading but as well as with other commodity trading advisors that we have allocated money to as well. What is interesting is when the sugar trade occurred we entered the trade two days after one of our colleagues who is also a commodity trading advisor did. We think alike yet we do have different trades at times. The main point however is how we both approach risk .We know that anything can happen. We are always trying to guard ourselves against something that no one would ever think of.. This is the idea of the Black Swan with Nissim Taleb.

No one knows when a trend starts or more importantly stops in the commodities market. The idea of tactical trading is more a filter to guide your capital and focus it and benefit when there is a rare substantial move starts in the commodity markets.

Andrew Abraham

www.myinvestorsplace.com

Andrew Abraham has been in the financial arena since 1990. He is a commodity trading ddvisor and co manager of a Commodity Pool. Since 1993 Andrew has been a proponent of quantitative mechanical trading programs. Andrew's major concern is not only total return on investment but rather the amount of risk that one would have to tolerate in order to achieve returns He focuses on developing quant models that encompass strict risk adherence and correlation. He has been a speaker at conferences as well as an author of numerous articles. Andrew has spent years researching ideas that have the potential to outperform indices as well as maintain fewer draw downs.

Visit Angus Jackson Partners (http://www.angusjacksonpartners.com) Contact: A.Abraham@AngusJackson.com (mailto:A.Abraham@AngusJackson.com)

© 2009 Copyright Andrew Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.