Bankrupt Bailed Out Banks Buying U.S. Treasuries to Keep Interest Rates Low

Stock-Markets / Financial Markets 2009 Aug 03, 2009 - 09:32 AM GMT U.S. lenders bailed out by the government are returning the favor by stepping up purchases of Treasuries, helping to temper a rise in borrowing costs.

U.S. lenders bailed out by the government are returning the favor by stepping up purchases of Treasuries, helping to temper a rise in borrowing costs.

Bank holdings of U.S. government securities are up 15.6 percent from a year ago, almost double the average annual growth rate of about 8 percent since the Federal Reserve began tracking the data in 1973, according to the Greenwich, Connecticut-based trading and research firm MKM Partners LP. Purchases may accelerate as lenders look for places to park rising deposits as sales of federal agency debt of companies such as Fannie Mae and corporate bonds slow.

Chase serves itself first in mortgage modifications

JPMorgan Chase, one of the first mega banks to champion the national home loan modification effort, has struck a sour chord with some investors over the risk of moral hazard posed by certain loan modifications.

Chase Mortgage, as servicer of several Washington Mutual option ARM securitizations it inherited last year in acquiring WAMU, has in several cases modified borrower loan payments to a rate that essentially equals its unusually high servicing fee, according to an analysis by Debtwire ABS. Simultaneously, Chase is cutting off the cash flow to the trust that owns the mortgage. In some cases, Chase is collecting more than half of a borrower’s monthly payment as its fee.

The VIX is rising from its lows, but not high enough yet.

--The VIX has risen above a critical support at 25.25, but has not broken out of its wedge formation yet. This indicator is a bit slow, but it will confirm the change in trend. A rally above 27.50 will do the job of alerting us that all is not well in the markets.

The SPX is sitting just above a critical support.

--The SPX gave us a potential sell signal on Wednesday, but climbed back above it on Thursday and Friday. The crossover to a sell signal is not at 982.00. A new weekly low below 968.00 would confirm the sell. I have remained short during the past week due to the fact that the SPX has bumped up against its expanding triangle but not through the trendline, which is a good sign of a valid pattern.

--The SPX gave us a potential sell signal on Wednesday, but climbed back above it on Thursday and Friday. The crossover to a sell signal is not at 982.00. A new weekly low below 968.00 would confirm the sell. I have remained short during the past week due to the fact that the SPX has bumped up against its expanding triangle but not through the trendline, which is a good sign of a valid pattern.

There are two cycle bottoms right around the corner. The first is the Trading Cycle low, due on or near August 7th. The second is a Primary Cycle low due a week later. They may combine their lows or have a double bottom within this window, so I am being patient.

The NDX shows even more weakness.

--The NDX weakened on Friday and closed just below critical support at 1604.00. The small triangle pattern that I mentioned last week may have be successful after all, since it met the minimum rally of 1620.00. However, there may need to be yet another attempt at the top, since the subsequent decline from 1632.97 appears to be corrective. A new weekly low below 1592.00 would turn the NDX trend down. The expanding formation will allow a marginal new high.

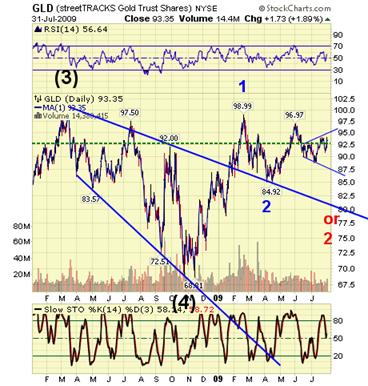

GLD has made a Fibonacci retracement.

-- GLD bounced off support at 90.80, also its 61.8% retracement which seems to give it a new life. There is also a buy signal above 92.30, so this may be the turn back to positive mode that we are looking for. GLD has become short-term positive. The evidence is starting to mount that the buy signal may be a good one.

The Oil Bubble got a reprieve.

--USO did a U-turn into what may be wave (c) of B. Trend resistance is at 37.12 while support lies at 35.44. The next wave of declines may take a little more patience.

--USO did a U-turn into what may be wave (c) of B. Trend resistance is at 37.12 while support lies at 35.44. The next wave of declines may take a little more patience.

TLT making a healthy move as banks buy in.

-- Treasuries advanced for the entire week as banks appear to be buying more of them. Bank holdings of U.S. government securities are up 15.6 percent from a year ago, almost double the average annual growth rate of about 8 percent since the Federal Reserve began tracking the data in 1973, according to the Greenwich, Connecticut-based trading and research firm MKM Partners LP. Purchases may accelerate as lenders look for places to park rising deposits as sales of federal agency debt of companies such as Fannie Mae and corporate bonds slow.

The Dollar retests support.

--UUP slumped back to what may be a long-term support area after what appears to have been a false breakout. The smaller bullish wedge formation seems to have been overridden by a much larger one. It is below support at 23.50, but if the larger wedge is valid, may find itself above support rather soon. .

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.