Stocks Broke Out, Will Currencies Follow?

Stock-Markets / Forex Trading Jul 26, 2009 - 03:33 PM GMTBy: Dodjit

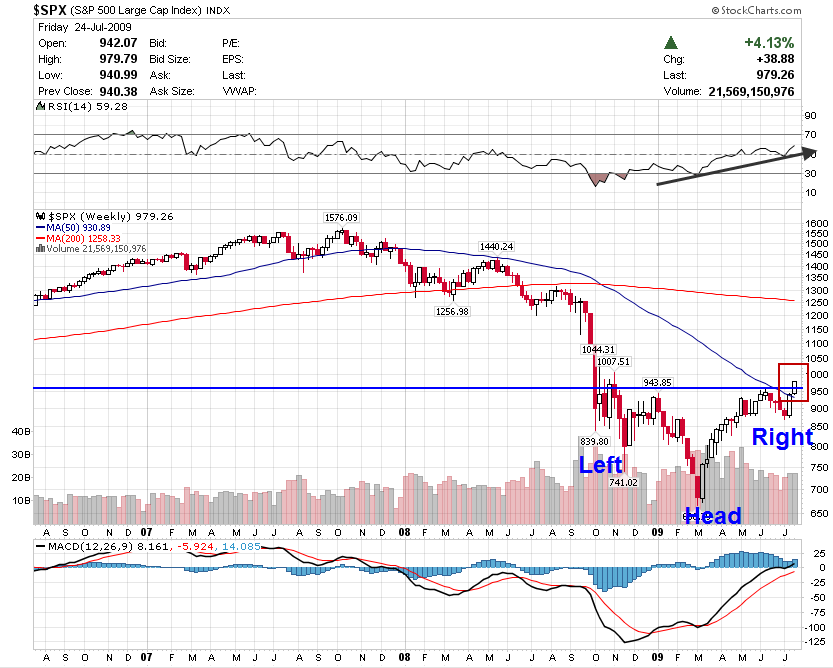

Over the last couple of weeks, we have mentioned numerous times the strong correlation between the U.S stock market and certain currency pairs. Since the beginning of March 2009, stocks have rallied, restoring traders' confidence, while risk appetite has increased dramatically, pushing carry trades higher. Last week the S&P500 soared through recent resistance of 950, after approximately 40% of its components released their earnings.

Over the last couple of weeks, we have mentioned numerous times the strong correlation between the U.S stock market and certain currency pairs. Since the beginning of March 2009, stocks have rallied, restoring traders' confidence, while risk appetite has increased dramatically, pushing carry trades higher. Last week the S&P500 soared through recent resistance of 950, after approximately 40% of its components released their earnings.

While the reports weren’t overly impressive, investors pushed aside the not so good news, out of speculation that the economy could show a brighter future. The S&P500 finished the week with gains of 4.13%, while the Nasdaq soared finishing with a weekly profit of 4.7%. From a technical point of view the S&P500 broke major neckline resistance, completing its inverted Head & Shoulders pattern.

Things are still not all that rosy!

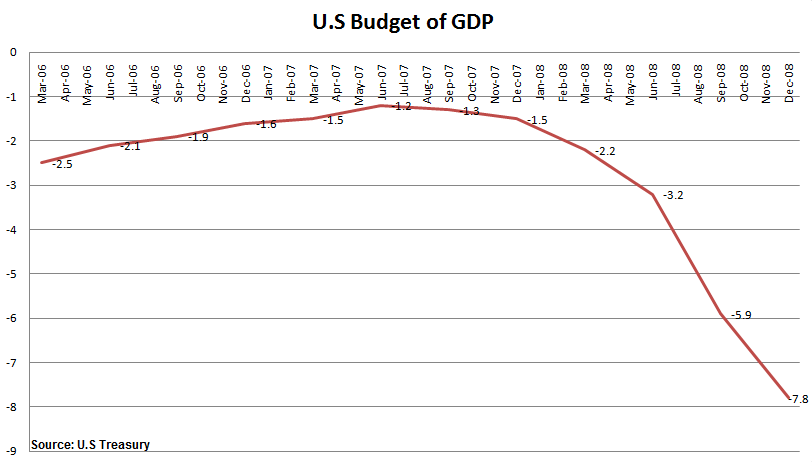

News headlines encouraged buyers back into the market last week stating that the Fed has the required tools to pull the U.S economy out of its slums, while also mentioning that investors could witness sparks of economic growth towards the beginning of next year. In addition, Fed Chairman Ben Bernanke, relieved concerns last week regarding rising interest rates, stating that the FOMC anticipates that economic conditions are likely to warrant maintaining the federal funds rate at exceptionally low levels for an extended period. Even though investors were encouraged by the Chairman’s speech earlier last week, others still expressed their apprehensions that in the long term current methods could lead to uncontrollable inflation.

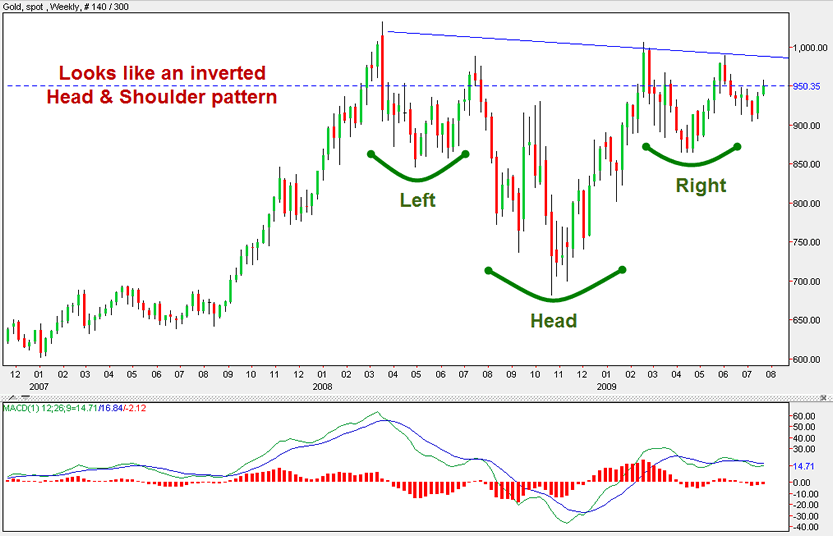

When observing the Gold chart one can see that despite recent optimism, Gold has regained strength and is now heading higher yet again, to test major psychological resistance of $1000. One must note that Gold has always been classed as a safe-haven during tough times, and is often purchased during times of expected high inflation. Due to recent monetary actions by U.S officials, many are now worried that the huge deficit will decrease the value of the U.S Dollar even further, stoking high inflation – something that will lead to a dramatic increase of interest rates.

Currencies haven’t yet followed through

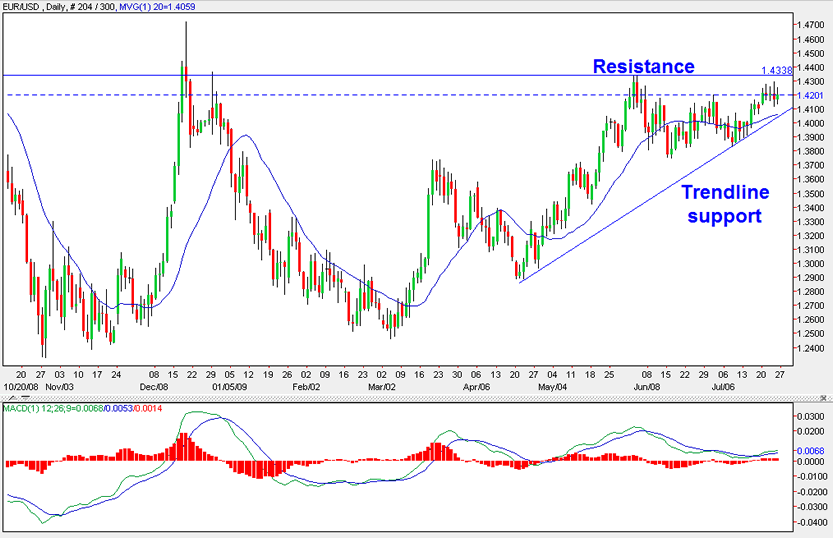

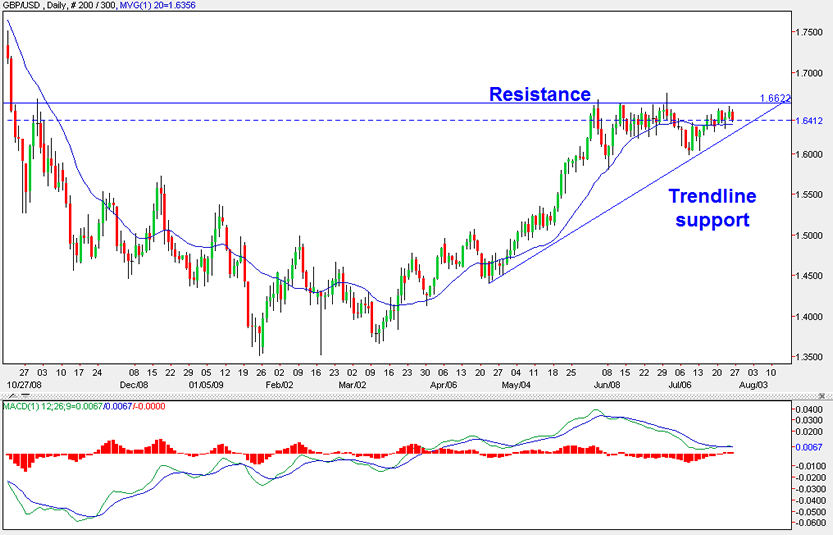

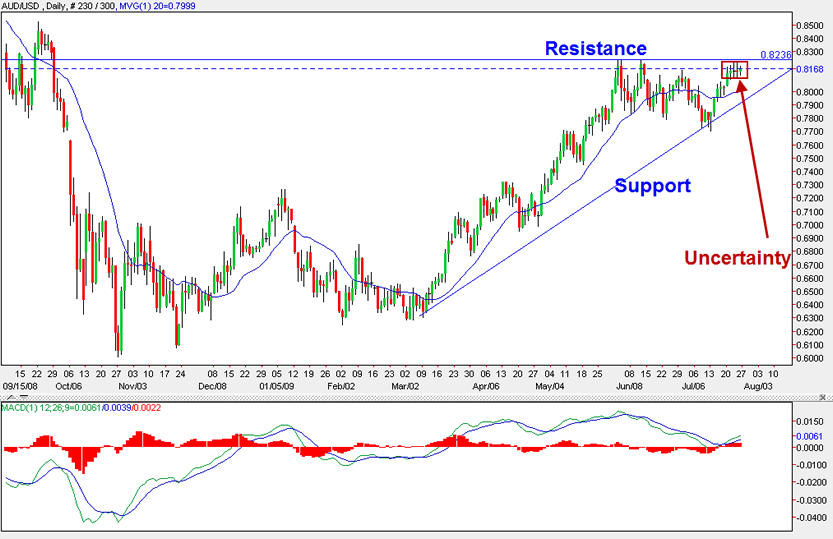

Unlike stocks, currency pairs such as the AUD/USD, GBP/USD and EUR/USD have all failed to follow through and break critical resistance. From a fundamental point of view, traders received mixed signals last week, as economic data showed that only certain sectors are improving. The U.K’s GDP depressed any form of a break-out last week, as the result showed that the country had contracted on an annual rate by -5.6%, compared to the -5.2% drop in the first quarter. The result showed that U.K’s economy is now in its worst recession in over 30 years.

On the upside, the Euro-zone showed impressive figures as German IFO and EZ PMI exceeded expectations. The business sentiment jumped to 87.4, while the PMI composite rose to 46.8, showing that the rate of contraction is now declining. Even though data released from France weighed on sentiment, the 45.5 services PMI result wasn’t low enough to cause any major damage to the Euro crosses, as the Euro maintained relative strength.

From a technical point of view all the three pairs are now presenting low volatile trading sessions, as they prepare for a major move. When observing the charts one can see that all three have now formed a wedge. Even though all the charts are trading within a bullish triangle, short term analysis suggests that they could experience a small correction, prior to any major move.

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

The Week Ahead

With the stock indices now out of range, many will be watching the data closely to make sure that the break-out is not going to turn into a false-break. Currency pairs are now also on the verge of a break-out but recent candlestick action is showing that skepticism is still lingering in the air. If equities continue to push higher, we might witness a break out on certain currency pairs such as the EUR/USD, GBP/USD and AUD/USD. Due to that fact, Investors will be scrutinizing the start of the trading week, hoping for a follow through. Consolidation or a drop in stocks could lead to further uncertainty in the Forex market.

Economic data will also have its say this week as the U.S is expected to release housing data, durable goods and the second quarter GDP figures. As always, the GDP figure should receive the center of attraction, especially as a better than expected result would be beneficiary for the current equity rally.

Furthermore, New-Zealand is scheduled to release its rate decision, while the Euro-zone will release its inflation data, currently expected to show a further decline in the price of goods. With a packed economic calendar and more companies scheduled to release their earnings, many will watch to see whether the markets brush aside the unpleasant data and continue to drive assets higher, or not.

By Dodjit

Dodjit was developed with the idea of simplifying the Forex and stock market, while providing more experienced investors with vast material to catch up on various news events. From market reports to chart analysis, our team of analysts provide vast information, while allowing traders to fully understand and follow the market. For beginners just starting out we urge you to take advantage of our unique center of education that contains over 1000 pages of visual and interactive tutorials.

© 2009 Copyright Dodjit.com - All Rights Reserved

Information reliability and liability: The contents are solely aimed for the use of "Experienced" investors in the financial markets who are fully aware of the inherent risk of trading. Dodjit.com does not accept any liability for any loss or damage whatsoever that may directly or indirectly result from any advice, opinion, information, representation or omission, whether negligent or otherwise, contained in our trading recommendations. Dodjit makes no warranties or representations in relation to the Information (including, without limitation, in relation to its accuracy or otherwise) and do not warrant or represent that the services will be error free or uninterrupted.

Copyright: This article is subject to and protected by the international copyright laws. Use of the information brought in this article is subject to making fair use only in accordance with these laws. It is not permitted to copy, change, distribute, or make commercial use of the information except with permission of the holders of the copyright.

Risk Disclosure: The risk of losses involved in the transaction or speculations in the financial markets can be considerable. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. Speculate only with funds that you can afford to lose.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.