Stock Market Bounces as it Closes

Stock-Markets / Financial Markets 2009 Jul 07, 2009 - 04:40 AM GMTBy: PaddyPowerTrader

After a rocky start following on from equity weakness in Asia and Europe, US stocks ground higher following a better than expected read on the ISM’s June non-manufacturing (services) index of activity. What strikes me as curious is that commodities and equities are telling two different stories with notable weakness in crude, oil, gold and copper prices yesterday pressuring producers, refining and mining stocks as the re-flation trade gets pricked and traders realise how much the prices of these stocks got ahead of themselves. After the bell last night Discover Financial Services (a credit card company) announced a $500m rights issue. This may pressure the market at the off today.

After a rocky start following on from equity weakness in Asia and Europe, US stocks ground higher following a better than expected read on the ISM’s June non-manufacturing (services) index of activity. What strikes me as curious is that commodities and equities are telling two different stories with notable weakness in crude, oil, gold and copper prices yesterday pressuring producers, refining and mining stocks as the re-flation trade gets pricked and traders realise how much the prices of these stocks got ahead of themselves. After the bell last night Discover Financial Services (a credit card company) announced a $500m rights issue. This may pressure the market at the off today.

Today’s Market Moving Stories

- It was deathly quiet on the news wires overnight.

- Regarding any discussion on reserve currencies at the G8 summit, an unnamed senior Canadian official says “there may well be some discussion around this. For the time being though, the issue right now is not so much on the currency question going forward but rather again, how do we deal with the crisis we have with us right now. I can tell you I don’t foresee anything in the declaration on that, on reserve currencies.”

- The British Chambers of Commerce’s quarterly economic survey of more than 5,600 businesses shows that sales and orders continued to fall in the three months to June, though at a much slower pace than in April’s first-quarter survey. BCC chief economic adviser David Kern said the figures were consistent with the economy having shrunk by 0.1-0.4% in the second quarter.

- Laura D’Andrea Tyson, a member of the panel advising President Barack Obama on tackling the economic crisis, says: “we should be planning on a contingency basis for a second round of stimulus.” She adds that she personally felt the first round of stimulus had been slightly smaller than she would have liked.

- Rating agency Fitch cut its rating on California’s long-term bonds to BBB, citing the state’s budget and revenue crisis. The rating agency also kept the debt on watch for additional downgrades.

- The FT says that Société Générale is set to report €1.3bn in losses from credit default swaps when it reports second-quarter results next month. It says that the bank said it expected to register only “slightly” positive net income in the quarter, in spite of strong results from its corporate and investment banking arm.

- Germany has decided to change an accounting rule to give Commerzbank, which is now effectively state-dependent, some further breathing space. The idea is to relax the rules regarding “revaluation surpluses”, an accounting item that registers potential losses on securities banks have earmarked as for sale. Commerzbank would benefit the most, but Deutsche Bank would also enjoy some more leeway. In the UK and France the rules have already changed, so the issue does not conflict with European rules, however analysts have said that the rule change reduces transparency, which is about the last thing you want to do now. As German politicians are getting scared about a credit crunch two months before election date, they are exploring all possibilities of rule change to force banks to lend.

- US unemployment to reach 14%? Maybe Joe Biden was right.

- It seems that Deutsche Bank liked to keep a very close eye on its board members and shareholders as its revealed that they spied on them.

The US Dollar Heading For A Long Decline

Brad Setser offers very good discussion on the dollar’s exchange rate. He says that both economists and traders seem to get this one wrong persistently. His own perspective is that the dollar is headed for a secular decline because of an overhang.

“Mexicans no longer have to keep as many dollars under the mattress. Brazilian companies no longer need to keep a war chest of dollars hidden in the Cayman Islands in order to ensure access to imported inputs. Sovereign wealth funds have realized that it is neither wise nor prudent to keep so much of its stock of wealth in one currency. Investment management firms are starting to offer more non-dollar share classes for their products. And Italians, Poles, and Turks — peoples closely linked in one way or another to the euro — are thinking less and less in dollars (it is amazing that they still do at all). The transactional demand for dollars is also declining. This too puts downward pressure on the dollar.”

“Mexicans no longer have to keep as many dollars under the mattress. Brazilian companies no longer need to keep a war chest of dollars hidden in the Cayman Islands in order to ensure access to imported inputs. Sovereign wealth funds have realized that it is neither wise nor prudent to keep so much of its stock of wealth in one currency. Investment management firms are starting to offer more non-dollar share classes for their products. And Italians, Poles, and Turks — peoples closely linked in one way or another to the euro — are thinking less and less in dollars (it is amazing that they still do at all). The transactional demand for dollars is also declining. This too puts downward pressure on the dollar.”

Trading The Range

The market appears to be getting increasingly comfortable with its ranges as powerful opposing forces fight to a draw. One side encompasses deleveraging, large negative output gaps and fears over fiscal deficits generating a weak medium-term global economic outlook. On the other is the most expansive monetary and fiscal policy in history supporting asset valuations. As far as equities are concerned, materials have been the weakest sector since  the stocks peaked around the middle of June. The decline in resources equities suggests that confidence about the outlook for global growth is a little shakier.

the stocks peaked around the middle of June. The decline in resources equities suggests that confidence about the outlook for global growth is a little shakier.

Industrial metals prices have generally remained steady since reaching their peak around the same time as equities, but oil prices have fallen. In general, the market is more circumspect about the global recovery, and is no longer looking for more gains in resource equities or an inflation hedge in commodities. This places downward pressure on yields in major economies and helps stabilise global asset markets. This stability is increasing demand for higher yielding currencies. With no clear reason to see a major break-out in asset or currency markets the strategy may be to adopt range trading strategies, including selling volatility, even though it has retreated sharply in currency and bond markets in the last two weeks. Unless of course China blows up (see below).

Perils In Western China

Before the western Chinese province of Xinjiang (where there are vast oil and gas reserves) could be properly developed the area would was always going to need to have a majority of Han Chinese from the eastern provinces. Changing the population mix of an enormous area like Xinjiang which borders Tibet, India, Russia, Mongolia and other states is no easy task. But according to China Today, the Han Chinese now account for at least 41% of the population. Many of the Uyghur groups who traditionally dominated the area had moved out seeking jobs in eastern China to take advantage of the boom. Some of those people have come home because of the slump in manufacturing in eastern China which has cost 20 million jobs. The return of these Uyghur people may have increased the unrest pressures in Xinjiang.

The great weakness in the China growth story is that to date most of the benefits of the boom have been in the east. The recent solution from the government has been to substantially increase infrastructure spending in its western provinces. One of the biggest recipients of this infrastructure spending plan has been Xinjiang. The Chinese realise that Xinjiang is one of their most dangerous areas, but it is also one of the most valuable because of its vast oil, gas and coal reserves. There is a gas pipeline to Shanghai and large new coal mines are planned. The green shoots theory of China saving the world has a lot at stake in western China. If western China starts to break up then the China growth story will also start to break down and with it will come a much lower demand for global resources. Also the Chinese stock market has been one of the prime leaders in the Emerging Markets / BRICs rally. A major pullback would be a serious down draft for world markets looking for a catalyst to break out of their summer torpor and tight trading ranges.

Equity News

- CRH issued a predictably downbeat trading update indicating that operating profits in the first half are likely to be one-third of the H1 2008 outcome. Following from the statement, the market now expects to have to cut earnings from €1.35 to the low €1.20s. For 2010 numbers, the increase in cost savings of €500 million announced in the trading statement is big positive, offsetting much of the damage inflicted by the deteriorating trading environment. The stock has been under extreme pressure over the past month, and while the trading figures are very poor, the expansion of the cost saving plan limits the earnings, and therefore the valuation, downside. The stock is off about 3.5% so far today.

- On the heels of yesterdays upgrades by RBS of builders Bovis and Bellway, sector bellwether Persimmon’s has issued an encouraging end-H1 trading update. Two points in particular stand out: (1) its order book is now up yoy, and (2) there is an indication from management that unless there is a substantial change in market conditions there should not be any further land write-downs.

- Supermarket chain William Morrison has been upgraded to a buy at Bank of America, as has Samsung by BNP.

Data Ahead Today

At 09:30 UK industrial production for May is released. Output should rise by 0.2% given survey data continues to improve and anecdotal evidence of production resuming after extended winter shutdowns.

At 11:00 German factory orders for May should show that orders rose by an above-consensus 1% given a broad improvement in survey data.

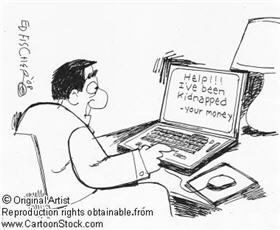

And Finally… Repossession Is A Fairly Embarrassing Situation

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.