Commodities Sector Timing Trading for Gold, Oil, Silver and Natural Gas

News_Letter / Commodities Trading Jul 02, 2009 - 09:04 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

July 2nd, 2009 Issue #51 Vol. 3

Commodities Sector Timing Trading for Gold, Oil, Silver and Natural GasHello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started. Sector timing commodities - Being able to trade different sectors is crucial for making a living in today’s financial markets. One sector that cannot be over looked is the commodity sector. Timing this sector can be a very profitable venture if executed properly. In the past commodity trading was seen as a high risk investment because of the leverage involved with purchasing futures contracts. A small wrong move in a commodity, and a trader/investor would be holding either a nice gain or a nasty draw down (loss). With the recent creation of ETFs everyone can trade the commodities market and select the level of leverage they are comfortable with. Funds range from 1 to 3 times leverage of the underlying commodity. In this report I cover the basic funds for gold, silver, oil and natural gas which have the least amount of leverage available. It is important to know that my trading signals for these commodities work for any of the leveraged funds as well, for those who like really explosive short term trades. Gold – GLD ETF Trading Chart Gold pulled back to our support trend line as expected and posted in my Sunday night report. The chart looks awesome for a buy signal but I am waiting for a MACD cross over before jumping on the band wagon. I like momentum to be on my side as it helps confirm the reversal putting the odds even more in my favor. Today was a quite day with the Canadian market closed and the US holiday weekend only a day away. Volume was light today and it will be even lighter tomorrow. Generally stocks and commodities rise on low volume days pre-holiday. I would like to see gold pullback to allow for a quicker low risk entry if possible.

Silver – SLV ETF Trading Chart

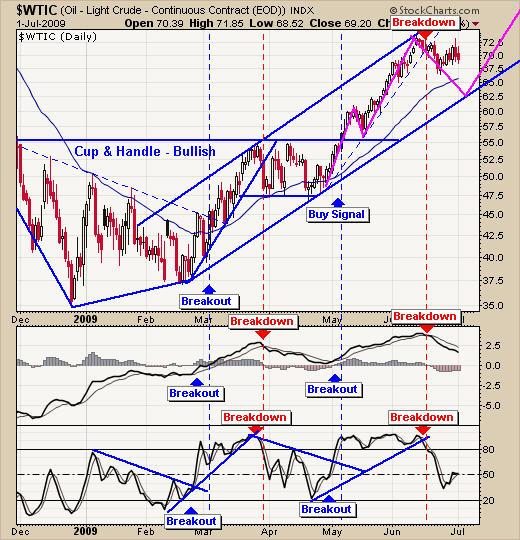

Crude Oil Continuous Contract Chart

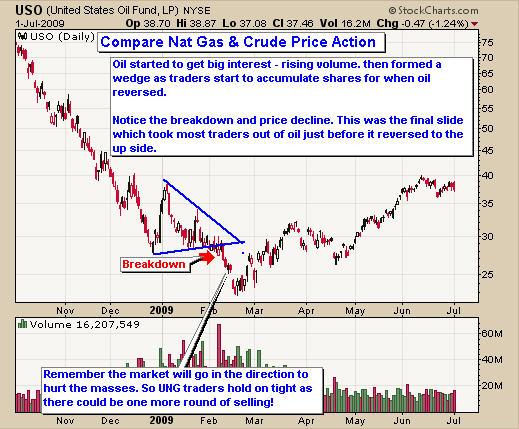

Oil – USO ETF Trading Chart

Oil & Gas Comparison Chart

Natural Gas – UNG ETF Trading Chart

Sector Timing Trading Conclusion:In short all of these commodities are trading at different cycle points.

I do not know when exactly we will have buy signals but I am sure they are not far away. Overall I think gold will hold its value as the equities market and the US dollar are starting to look weak. NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started. I have put together a Recession Special package for yearly subscribers which is if you join for a year ($299) I will send you $300 FREE in gas, merchandise or grocery vouchers FREE which work with all gas stations, all grocery stores and over 100 different retail outlets in USA & Canada. If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk. To Your Financial Success, By Chris Vermeulen Please visit my website for more information. http://www.TheGoldAndOilGuy.com Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return. This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

|||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.