U.S. Housing Market Deteriorates as Foreclosures Soar

Housing-Market / US Housing Jul 01, 2009 - 12:45 AM GMTBy: Mike_Shedlock

The Office of the Comptroller of the Currency says Delinquencies Double on Least-Risky Loans.

The Office of the Comptroller of the Currency says Delinquencies Double on Least-Risky Loans.

Delinquency rates on the least-risky mortgages more than doubled in the first quarter from a year earlier as U.S. efforts to help homeowners failed to keep pace with job losses that pushed more borrowers toward foreclosure.

Prime mortgages 60 days or more past due climbed to 2.9 percent of such loans through March 31 from 1.1 percent at the same point in 2008, the Office of the Comptroller of the Currency and the Office of Thrift Supervision said today in a report. First-time foreclosure filings on the loans rose 22 percent from the fourth quarter, the report said.

“I’m very concerned about the rise in delinquent mortgages and foreclosure actions,” Comptroller of the Currency John Dugan said in a statement with the report. President Barack Obama’s plan to create “sustainable, payment-reducing modifications is a positive step that should show significant benefits in the coming months,” Dugan said.

Obama’s program, unveiled Feb. 18, aims to help as many as 4 million homeowners by modifying loans and calls for Fannie Mae and Freddie Mac to refinance mortgages for as many as 5 million borrowers who owe more than their houses are worth. Foreclosure filings surpassed 300,000 for a third straight month in May, according to RealtyTrac Inc., and the U.S. economy has shed about 6 million jobs since the recession began in 2007.

Serious delinquencies on prime loans, which account for two-thirds of all U.S. mortgages, rose to 661,914 in the first quarter from 250,986 a year earlier, according to the report. Overall, mortgages 60 days or more past due rose 88 percent from last year, the report said.

“Serious delinquencies are a leading indicator of increased foreclosure actions in the future,” the report said.

The data shows 5.9 percent of the 21.8 million Fannie Mae and Freddie Mac loans serviced by national banks or thrifts were at least days 30 days late, in foreclosure or subject to bankruptcy, compared with 3.2 percent a year earlier.

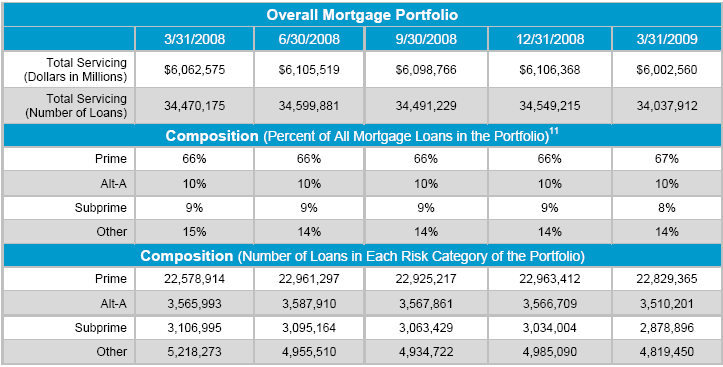

The report covers the performance of 34 million loans totaling $6 trillion, the agencies said.

Mortgage Metrics Report for First Quarter 2009

Inquiring minds are digging into the OCC and OTS Release Mortgage Metrics Summary for First Quarter 2009.

The report, based on data from loan servicing companies that manage 64 percent of all first-lien U.S. mortgages, shows:

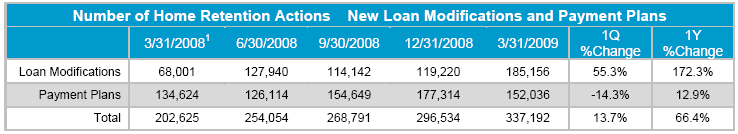

- The number of loan modifications significantly increased. During the quarter, servicers implemented 185,156 new loan modifications, up 55 percent from the previous quarter and 172 percent from the first quarter of 2008.

- The proportion of payment-reducing modifications also increased. More than half of the modifications in the first quarter of 2009 resulted in lower monthly principal and interest payments, as servicers focused on achieving more sustainable mortgage payments. Modifications that reduced monthly payments by 20 percent or more jumped 19 percent from the previous quarter, to 29 percent of all modifications. By contrast, actions that resulted in increased payments constituted only 19 percent of modifications, a drop of 25 percent from the previous quarter.

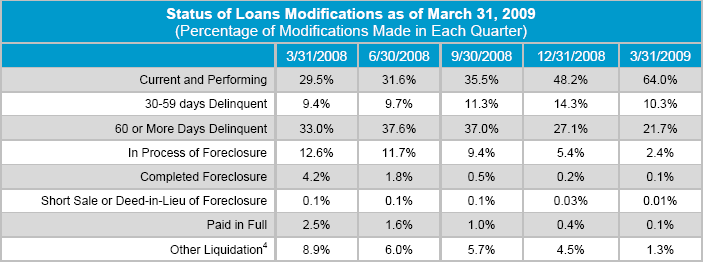

- Modifications that reduce payments have lower delinquency rates over time. Although delinquencies on modified loans increased each month following modification, delinquency rates were considerably lower for mortgages in which monthly payments were reduced. Six months after modification, only 24 percent of the mortgages that had monthly payments reduced by 20 percent or more were 60 or more days past due, compared with 54 percent of mortgages with monthly payments left unchanged, and 50 percent with higher monthly payments.

- Seriously delinquent mortgages increased. Seriously delinquent mortgages (60 or more days past due or involving delinquent bankrupt borrowers) increased as economic pressures continued to weigh on homeowners. Prime mortgages, which represented two-thirds of all mortgages in the portfolio, had the highest percentage increase in serious delinquencies, climbing by more than 20 percent from the prior quarter to 2.9 percent of all prime mortgages.

- Foreclosures in process increased. Foreclosures in process also increased during the quarter to 844,389, or about 2.5 percent of all serviced loans, as moratoriums on foreclosures expired during the first quarter. This increase represented a 22 percent jump from the previous quarter and a 73 percent rise from the first quarter of 2008.

Data also showed a continuing emphasis on preventing avoidable foreclosures to keep families in homes and mitigate losses, as servicers continued to implement more home retention actions (loan modifications and payment plans) than home forfeiture actions (foreclosures, short sales, and deed-in-lieu-of-foreclosure actions). Prime borrowers received about twice as many home retention actions as home forfeiture actions, while subprime borrowers received more than seven times as many.

The report covers the performance of 34 million loans totaling more than $6 trillion in principal balances from the beginning of 2008 through the end of the first quarter of 2009. The impact of the increase in modifications, particularly those with reduced monthly payments, will be seen only in future data.

OCC and OTS Mortgage Metrics Report

Inquiring minds are also digging into the 42 page OCC and OTS Mortgage Metrics Report

Home Retention Actions: Loan Modifications and Payment Plans

Increased emphasis on loan modifications drove an overall increase in home retention actions, as shown in the table below. Newly initiated loan modifications reached 185,156 during the quarter— rising by 55.3 percent from the previous quarter and 172.3 percent from the first quarter of 2008. The impact of this increase in modifications on reducing foreclosures and enabling borrowers to remain current on their loans will only be seen in future data. Likewise, modification data through the first quarter do not reflect the impact of the Administration’s “Making Home Affordable” program, which was announced in March and began to be implemented after this reporting period.

Modifications during the first quarter of 2009 resulted in lower monthly principal and interest payments on 54.1 percent of all modified loans, as servicers focused on achieving more sustainable mortgage payments. The percentage of modifications that reduced payments by 20 percent or more increased to 29.3 percent of all modifications made in the first quarter of 2009, up 19.2 percent from the previous quarter. Modifications that increased monthly payments declined to 18.5 percent of all modifications during the quarter, down from 25 percent in the fourth quarter and 33.5 percent in the third quarter. Actions that left payments unchanged increased slightly to 27.3 percent.

New to this report are data on the types of actions taken to modify loans. Nearly two-thirds of modifications were “combination modifications” that involved two or more changes to the terms of the loan. Capitalization of delinquent interest, fees, and advances, combined with interest rate reductions and extended maturities were the predominant combination of modifications made during the first quarter. Interest rate and payment freezes, principal reductions, and principal deferrals were less prevalent. Of the 185,156 mortgages that were modified in the first quarter of 2009, 70.2 percent included a capitalization of missed payments and fees, 63.2 percent reduced the interest rate, and 25.1 included an extended term. By comparison, 12.6 percent of the mortgages received modifications that froze the interest rate, 1.8 percent included a reduction of principal, and 1.1 percent included a deferral of principal.

Status of Loans Modifications as of March 31, 2009

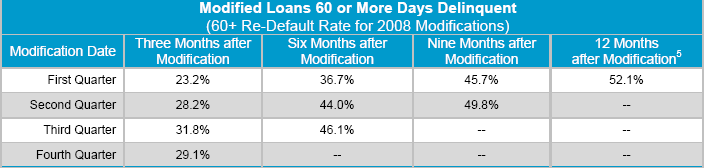

Re-Default Rate for 2008 Modifications

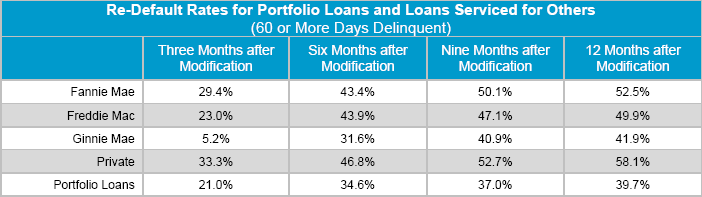

Re-Default Rates for Portfolio Loans and Loans Serviced for Others

Overall Mortgage Portfolio

Portfolio Composition

(Percent of All Mortgage Loans in the Portfolio) First Quarter 2009

Damning Report

This is a damning report on the success (or lack thereof) of the mortgage foreclosure workout programs to date. Redefault rates are near 50% after Fannie/Freddie loan modifications. Of course Fannie and Freddie can grant bigger loan mods (and probably will), but taxpayers will have to eat the cost.

Private loan mods are redefaulting at a stunning 58.1% rate 12 months after modification. Can those people redeafulting can afford ANY payment? Even if they can, the incentives to walk away are enormous.

Certainly those out of a job are unlikely to be able to afford any payment, and the unemployment rate is soaring.

Prime Loan Math in Dollars

Moreover note that 67% of loans are "Prime Loans". Prime mortgages 60 days or more past due climbed to 2.9 percent of such loans through March 31 from 1.1 percent at the same point in 2008 according to the report.

Total Servicing is $6 Trillion. $4 Trillion of that is "prime". 2.9% of that is 60 days late or worse. 2.9% of $4 Trillion is $116 billion. And that ignores the problem in Alt-A and Pay Option ARMs.

Prime Loan Math in Units

There are 22.8 million prime loans. 2.9% of that is 661,200. That's a lot of potential housing supply.

Jobs Are The Key

Unless the job market quickly improves, expect those numbers to soar. Here's a hint: the job market is unlikely to significantly recover for years.

This was a very damning report on the state of housing.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.