Global Stock Market Performance and P/E Ratio Valuations

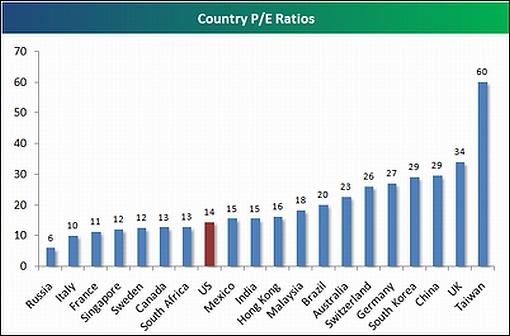

Stock-Markets / Global Stock Markets Jun 28, 2009 - 10:29 AM GMT Bespoke: Country P/E ratios “Yesterday we released a report taking a look at valuations, growth expectations, and stock market performance for more than 20 countries that have trackable ETFs. The report highlights which countries currently look the most and least attractive based on various characteristics. One simple data set highlighted was the current P/E ratios for these countries. Below is a chart showing these valuations.

Bespoke: Country P/E ratios “Yesterday we released a report taking a look at valuations, growth expectations, and stock market performance for more than 20 countries that have trackable ETFs. The report highlights which countries currently look the most and least attractive based on various characteristics. One simple data set highlighted was the current P/E ratios for these countries. Below is a chart showing these valuations.

s shown, Russia currently has the lowest P/E ratio at 6, followed by Italy (10) and France (11). At 14, the US is more attractive based on its P/E ratio than most countries. Taiwan has the highest P/E at 60, and the UK is surprisingly bad at 34. It’s valuation is worse than China’s. Germany also has a very high P/E ratio at 27.”

Source: Bespoke, June 25, 2009.

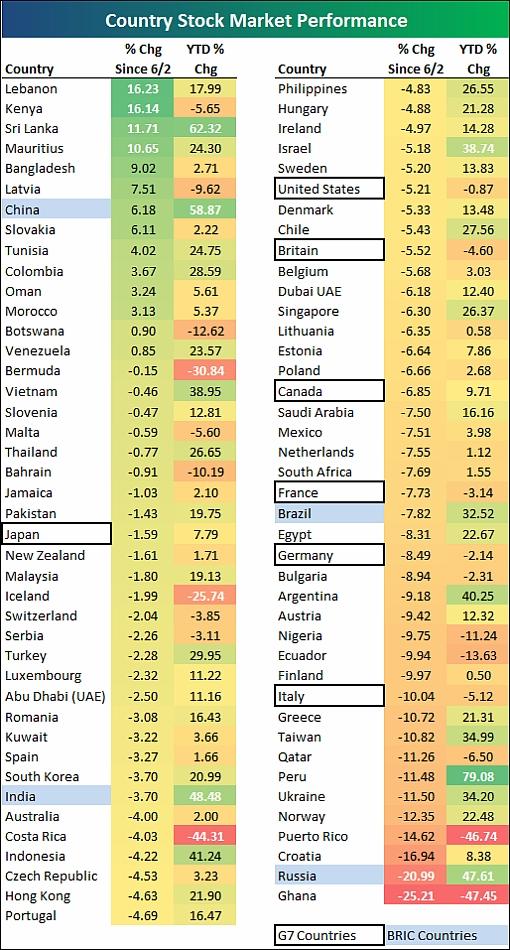

Bespoke: Country stock market performance since the recent top “Bloomberg’s World Index made a rally high on June 2. Below we highlight the stock market performance for 83 countries since June 2 and year to date.

“Since the 2nd, 14 countries have seen stock prices continue to rise, while the other 69 have seen prices fall. Lebanon, Kenya, Sri Lanka, and Mauritius are the only countries with double-digit percentage gains. The biggest country to show gains during a time when global stocks have struggled is China. China’s Shanghai Composite has rallied 6.18%. The other three BRIC countries have not fared as well. India is down 3.7%, Brazil is down 7.82%, and Russia is down a whopping 21%. Russia has been the second worst performing country during the recent downturn.

“Looking at G7 countries, Japan has held up the best since June 2 with a decline of 1.59%. The US has been the second best at -5.21%, followed by the UK, Canada, France, Germany, and then Italy.”

Source: Bespoke, June 23, 2009.

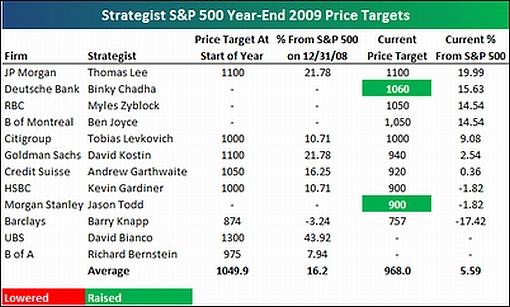

Bespoke: Two strategists up their 2009 price targets “Each week Bloomberg surveys Wall Street strategists for their year-end S&P 500 price targets. Since we last updated our table highlighting the various price targets a few weeks ago, two firms have upped their year-end numbers. Deutsche Bank’s Binky Chadha upped his price target from 900 to 1,060, while Morgan Stanley’s Jason Todd upped his from 825 to 900. The average year-end target for the S&P 500 is now 968, which is 5.59% above the index’s current level.”

Source: Bespoke, June 25, 2009.

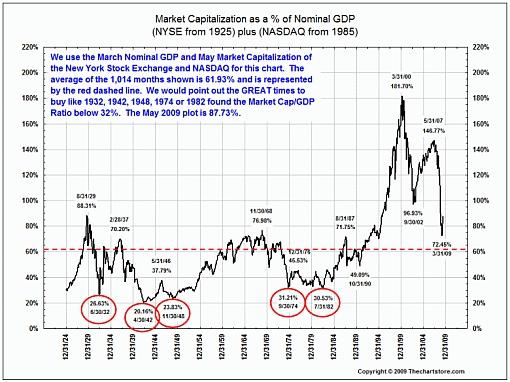

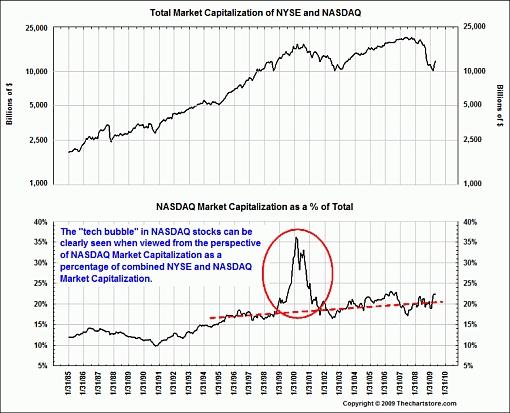

Barry Ritholtz (The Big Picture): Market capitalization as a percentage of GDP “Another interesting pair of charts from Ron Griess of The Chart Store. These two look at NYSE and NASDAQ relative to nominal GDP.”

Source: Barry Ritholtz, The Big Picture, June 24, 2009.

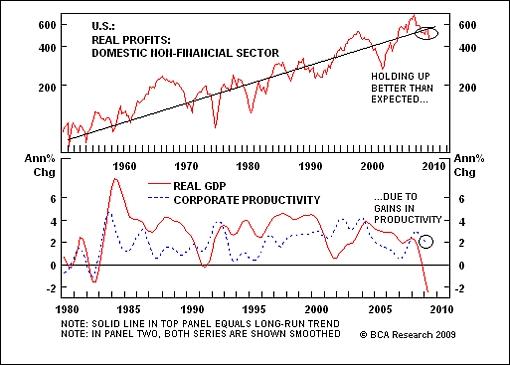

BCA Research: The outlook for corporate earnings “The resiliency of non-financial margins to the economic downturn largely reflects the better-than-normal cyclical performance of productivity.

“A recent from BCA’s monthly publication argues that S&P earnings are not always the best measure of the corporate sector’s underlying performance. Earnings reported in the national income and product accounts (NIPA) exclude capital gains and losses and do not reflect income from current production. Real domestic non-financial profits have grown at an annual pace of 4.4% since 1993, based on the NIPA measure.

“The recent profit recession has pushed real profits below its long-term time trend. Remarkably though, domestic non-financial profits have held up better than expected. The resilience of profits in the past year does not reflect stronger-than-expected sales. Instead, the surprise has been how well margins have held up as a result of healthy gains in productivity. Indeed, productivity growth has not shown its usual contraction in the face of a steep decline in output. Firms have been extremely aggressive in terms of shedding labor and cutting costs.

“The big question is whether productivity growth will continue to hold up, allowing margins to remain at historically elevated levels. We are reasonably optimistic on this score. Other key elements in the outlook are the prospects for earnings in the financial sector and from overseas subsidiaries.”

Source: BCA Research, June 22, 2009.

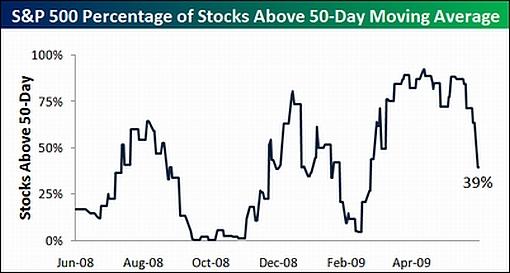

Bespoke: Breadth gets bad “Heading into today [Wednesday], the percentage of stocks in the S&P 500 trading above their 50-days took a major turn for the worse. After trading above the 50% level for a few months, this breadth indicator dropped all the way down to 39%. And the drop was even worse for certain sectors. In the Energy sector, just 13% of stocks are above their 50-days after being near 100% just a couple of weeks ago. Industrials dropped down to 21%, Consumer Discretionary dropped to 23%, and Financials, Materials, and Telecom dropped to the low 30s. Consumer Staples, Health Care, and Utilities (all defensives) are the only sectors with a breadth reading above 50%. Talk about a quick pullback.”

Source: Bespoke, June 24, 2009.

Yahoo Finance, Tech Ticker: Harrison - “animal spirits” could boost S&P to 950, the “most important level of the year” “With the ‘animal spirits’ alive at quarter’s end, the S&P 500 has a window to make a run at 950, ‘the most important level of the year’, according to Todd Harrison, CEO of Minyanville.com.

“Why is 950 so critical? It’s the upper band of the 875-950 trading range the index has been in since early May and just below the index’s post-March high of 956 (intraday on June 11). It’s also ‘confluence of [technical] trend lines’, says Harrison.”

Source: Yahoo Finance, Tech Ticker, June 26, 2009.

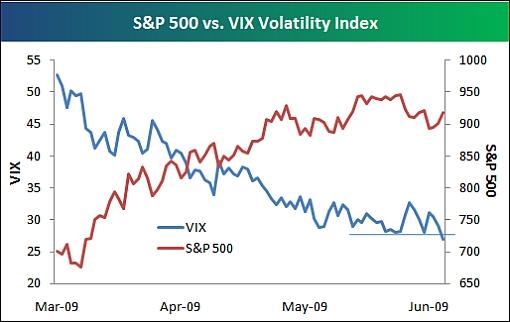

Bespoke: VIX makes a new short-term low “Yesterday’s equity market rally sent the VIX volatility index to a new short-term low of 26.36. While the VIX made a new low, the S&P 500 still has a ways to go before taking out its recent highs. Hopefully the VIX is a leading indicator that the rally is set to continue.”

Source: Bespoke, June 26, 2009.

David Fuller (Fullermoney): Correction is underway “Investors are emotional, participating in the crowd’s manic / depressive mood swings. Consequently financial markets are vastly more volatile than actual changes in the underlying economic conditions.

“Arguably, stock markets overshot on the downside in October and November 2008 and again in March 2009, when stimulus packages were still being announced. This was certainly the Fullermoney view.

“Subsequently, the pendulum of sentiment has predictably swung away from extreme pessimism as stock markets rebounded. Although still a long way from euphoria, equities have arguably run ahead of the economic recovery to date. Consequently we remain cautious for the short to intermediate term.

“Most technical evidence shows that a reaction and consolidation is underway. This could easily turn into a medium-term correction, including base formation extension for the many OECD laggards. Technically, they have yet to confirm that the March 2009 lows will hold, as we have mentioned on a number of occasions.

“Based on our behavioural technical analysis and the leadership of stronger markets, including Fullermoney themes, we think that lagging OECD stock markets, not least the USA, will eventually provide positive confirmation that a new bull market is underway.

“Now that most uptrends for OECD stock markets since March have been broken, the current reactions or corrections need to find support above the lows. Ideally, they would retain over half the gains seen to date although this is not critical. More importantly, following a reaction low which is above the March trough, the next rally should carry to new recovery highs and above the lagging 200-day MAs which also need to turn upwards.

“A timetable for all this is difficult to estimate but I would hope to see positive confirmation for lagging OECD stock markets by 4Q 2009 or 1Q 2010. The higher-beta Fullermoney themes might cause them to underperform during a correction but I would expect them once again to provide upside leadership thereafter, justified by their superior fundamental background.”

Source: David Fuller, Fullermoney, June 23, 2009.

Financial Times: Apres le rally, look to Asia and to gold “Hold on equity investors - and look to Asia, if some are to be believed. There is general unease among investors ahead of this week’s FOMC meeting. But that amounts to mere surface jitters compared to more substantial concerns about the approaching end of the ‘bear market rally’ - or whatever you want to call the recent upward trajectory of equities in markets around the world.

“Indeed, the prediction de jour among pundits is an end to what CLSA’s Christopher Wood calls the ‘global equity counter trend rally’. But, warns Wood in his latest Greed & Fear newsletter, don’t ‘bet aggressively’ on this view in terms of shorting markets on a leveraged basis, since the base case remains that the rally peters out later this summer with a S&P 500 target range of 1,000-1,050.

“Still, if Wall Street correlated equities are to correct, the sell-off is likely to take the form it did last summer, being led by a decline in oil and related commodities, a rally in the dollar and in US government bonds. In this sense, he notes, renewed confirmation of deflationary pressures in the west ’still has the ability to unnerve equity investors’.

“In Wood’s view, dollar debasement or debt default - ‘or some ugly combination of the two’ - cannot be ruled out in the medium term while ownership of gold remains an essential form of insurance, to ‘hedge the systemic risks caused by the panicky response of Western policy makers to growing deflationary pressure’.

“Understandably, Wood - CLSA’s Asian equity strategist - sees Asia and emerging market asset prices as the biggest beneficiaries of monetary easing in the west. There is, he says reassuringly, a real possibility that Asia can ‘enjoy an asset bubble before the Western fiat paper currency system finally implodes’.

“That said, Asian stock markets will still be correlated the next time Wall Street corrects meaningfully, he warns. The hope this time, however, is that ‘Asia will be considerably more resilient on the downside’ than it was in 2008 given the clear evidence of domestic demand resilience in China and India.”

Click here for the full article.

Source: Gwen Robinson, Financial Times, June 22, 2009.

MoneyNews: Samuelson - dollar disaster on the way “Nobel laureate Paul Samuelson, whose introductory economics text was used by college students from the 1960s to the 1980s, sees dark days ahead for the dollar.

“While he approves of the Federal Reserve’s massive easing, the MIT economist tells The Atlantic magazine, ‘I don’t want you to think that I think everything for the next 15 years will be cozy.’

“‘I think it’s almost inevitable that, with a billion people in China wide awake for the first time, and a billion people in India, there’s going to be some kind of a terrible run against the dollar,’ Samuelson says.

“‘I doubt it can stay orderly, because all of our own hedge funds will be right in the vanguard of the operation. And it will be hard to imagine that wouldn’t create different kind of meltdown.’

“Still, on the fiscal side of the ledger, Samuelson says more stimulus is necessary. ‘One shot spending gives you only one-shot response,’ he says.

“‘It’s got to be sustained. The way we got out of the 1929 Great Depression in the US, and this happened not only in the US but also in Germany and each place in which there was almost a third unemployed, was heavy deficit spending.’

Source: Dan Weil, MoneyNews, June 22, 2009.

Forbes: IMF says dollar adjustment might be needed “An increase in exports is needed for a sustained recovery in the United States and this may require an adjustment in the value of the US dollar, IMF chief economist Olivier Blanchard said on Monday.

“‘For the US, it is absolutely no question that a sustained recovery has to come from a large increase in exports, that may not be very easy to do. This may require fairly substantial adjustments in the dollar,’ he told a conference.”

Source: Forbes, June 22, 2009.

BusinessWire: World Gold Council welcomes clarity regarding IMF gold sales “World Gold Council welcomes the news that the US Congress has passed the Military Supplemental Bill thereby finalising the process allowing the IMF to sell 403.3 tonnes of gold in a manner that will have no impact on the smooth running of the international gold market.

“This process began with the Crockett Report in 2007, which recommended that the IMF adopt a new income model, including the establishment of an endowment, funded by the proceeds of limited and structured gold sales. More recently at the G-20 Leaders Summit in April of this year, heads of state proposed to use additional resources from the gold sales to provide an extra US $4 billion for poor and indebted countries over the next 2-3 years. This will not impact either the total level or the manner of the gold sales.

“The IMF has stated publicly that its gold sales should be coordinated with current and future Central Bank Gold Agreements (CBGA), whereby signatories have agreed to limit their gold sales to no more than 500 metric tons annually.

“Aram Shishmanian, CEO, World Gold Council, said: ‘We are pleased to see that the IMF’s plan to sell gold in a structured and non-disruptive manner has gone through due political process without problem, which is a credit to the responsible behaviour of all parties involved in the process. These sales will not constitute any net addition to the amount of gold the market is already expecting from official sector sources as a whole, and therefore we anticipate zero market impact.’”

Source: BusinessWire, June 19, 2009.

MoneyNews: Roubini - oil, gold overvalued “Some experts, such as investor Jim Rogers, say commodities are off to the races. New York University economist Nouriel Roubini begs to differ.

“He says the recent rally that has taken oil to an eight-month high of $73 a barrel and gold to $935 an ounce has gone too far.

“‘The oil price gain is ‘too high too soon’, Roubini told the Reuters Investment Outlook Summit in New York.

“And if speculators insist on pushing the price toward $100, the move would create an ‘economic shock’ just like last year’s spike to $147, he says.

“That jump added to worries about recession, which ultimately sent the price back down below $40.

“Roubini stresses that the economy continues to face deflationary risks. The consumer price index dropped 1.3% in the year through May, the largest drop in 59 years.

“‘For the next two years, deflationary pressure is going to be dominant,’ Roubini says. ‘It is going to become a time bomb down the line if and when we keep monetizing large deficits.’

“‘It may be too soon to hedge with gold,’ he says. ‘Unless we have high inflation, or … other risks like depression, gold looks toppy.’”

Source: Dan Weil, MoneyNews, June 22, 2009.

Bill King (The King Report): Crude oil versus natural gas “The popular natural gas-oil spread is a green shoots indicator. Industrial demand drives natural gas. China cannot stockpile natural gas. Ergo the spread between natural gas and oil shows no green shoots but inflation. This has vexed numerous wise guys who have playing for natural gas to tighten with oil.”

Source: Bill King, The King Report, June 22, 2009.

Bloomberg: Japan export slump deepens, casting doubt on recovery “Japan’s export slump deepened in May, casting doubt on the nation’s growth prospects as the economy struggles to emerge from its worst postwar recession.

“Shipments abroad dropped 40.9% from a year earlier, more than April’s 39.1% decline, the Finance Ministry said today in Tokyo. The median estimate of economists surveyed was for a 39.3% decrease. From a month earlier, exports fell 0.3%, the first deterioration since February.

“Declines in shipments to Asia accelerated for the first time since January, damping hopes that demand from the region will spur a recovery in the world’s second-largest economy. A worldwide stock market rally stalled this month on concern that the global recession will deepen.

“‘Final demand just isn’t picking up and it’s still hard to expect a very strong economic recovery,’ said Azusa Kato, an economist at BNP Paribas in Tokyo. Kato said the economy will ‘barely expand’ in 2010 once the effect of Japan’s own economic stimulus measures fades.”

Source: Jason Clenfield, Bloomberg, June 24, 2009.

Irish Times: Economy to shrink by 13.5%, says bleak IMF assessment “The Irish banks face losses of €35 billion to the end of 2010, the economy will shrink by 13.5% from 2008 to 2010 and unemployment will climb to 15.5% next year, according to a bleak assessment by the International Monetary Fund (IMF).

“The global financial watchdog’s annual report on Ireland offers a gloomy picture of the State’s economic prospects, predicting only a ‘modestly-paced recovery’ after further contraction next year.

“The report identifies bank restructuring, restored competitiveness and fiscal consolidation as critical to ensuring that the economy recovers and acknowledges the Government’s actions to address these priorities.

“‘The proposed National Asset Management Agency (Nama) is potentially the right mechanism to separate the good from the bad assets. Its success requires a comprehensive and realistic assessment of impaired assets,’ says the report.

“The Government responded to the IMF’s estimate of the losses facing the Irish banks, which equate to 20% of Ireland’s gross domestic product, saying the ‘vast majority’ of the losses would be absorbed by the banks’ own risk capital and operating profits.

“The IMF said it might be easier to price toxic bank assets moving to the State’s ‘bad bank’ Nama, if the banks were temporarily nationalised. ‘An advantage would be that prices at which these assets are transferred would become less of an issue,’ said the IMF, adding that such a move could also be used as a step towards mergers and the restructuring of the banking sector.

“Predicting that the budget deficit for 2009 could reach 12%, the IMF notes the policy dilemma facing the Government.

“The fund calls for further cuts in public sector pay and employment, and a shift away from universal social welfare benefits towards assistance targeted at the most vulnerable.

“‘Reducing fiscal deficits is needed to maintain credibility with markets but deepens the economic contraction,’ says the IMF. ‘Expenditure reduction, as distinct from raising taxes, is the superior approach to fiscal consolidation but, unless carefully managed and prioritised, risks hurting the most vulnerable.’”

Source: Denis Staunton and Simon Carswell, Irish Times, June 25, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.