G2: A Tale of Two Countries, U.S. and China Stock Markets

Stock-Markets / Global Stock Markets Jun 21, 2009 - 07:20 PM GMTBy: Richard_Shaw

The United States and China are referred to now as the G2; whose twists and turns dominate world economic dialogue, and perhaps outcomes. They are a study in contrasts economically, politically, demographically, socially, in terms of national balance sheet, GDP growth, government roles in business, and more. A side-by-side comparison of the charts for two proxy funds (SPY and FXI) is also a study in contrasts.

The United States and China are referred to now as the G2; whose twists and turns dominate world economic dialogue, and perhaps outcomes. They are a study in contrasts economically, politically, demographically, socially, in terms of national balance sheet, GDP growth, government roles in business, and more. A side-by-side comparison of the charts for two proxy funds (SPY and FXI) is also a study in contrasts.

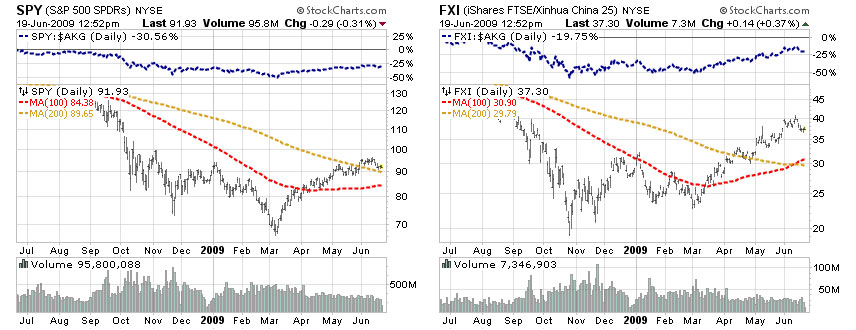

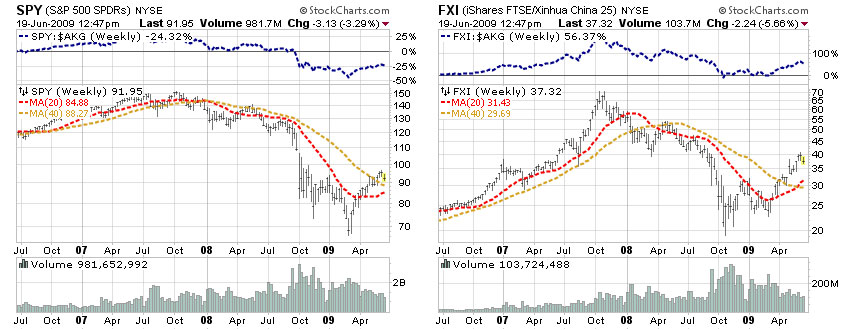

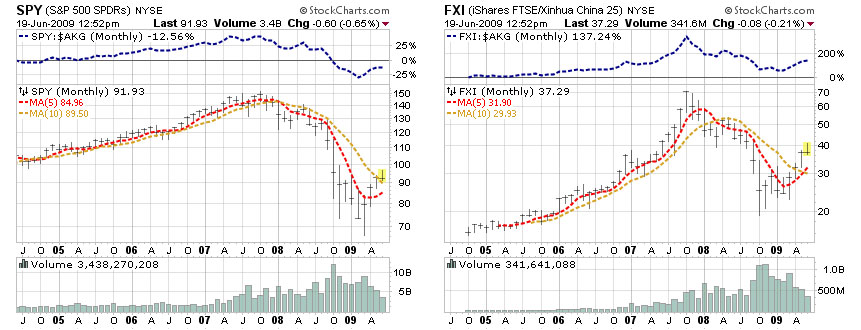

The charts below show the OHLC prices and two simple moving averages (middle panel), a percentage return comparison between the fund and the the US aggregate bond index (upper panel), and the share volume traded (lower panel).

1-Year Daily with 200-day and 100-day averages

3-Years Weekly with 40-week and 20-week averages

5-Years Monthly with 5-month and 10-month averages

China is more interesting as an equity investment for now.

There are concerns in the US that the rally may have gone too far too fast without adequate fundamental support (and may have already exhausted itself).

There are concerns in some quarters that China’s stock market may be even more ahead of itself, because of government stimulated production that is not matched by export growth, and perhaps not by internal consumption.

Both country funds are showing discomforting divergences with prices rising and volumes falling over recent weeks. However, China has exhibited important trend oriented moving average cross-overs which may indicate a continuing ownership opportunity, tempered by the short-term risk that a retracement in the US stock market would drag most other country stock indexes down with it.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.