Stock & Commodities Markets Profit Taking After Strong 3 Month Advances

Stock-Markets / Financial Markets 2009 Jun 21, 2009 - 10:24 AM GMT Caution last week crept back into investors' vocabulary for the first time in more than three months as they faced up to President Barack Obama's plan to reform the US financial market regulations, weighed the prospects of a global economic recovery and whether the "green shoots" needed more monetary water, and also started pondering the second-quarter earnings season.

Caution last week crept back into investors' vocabulary for the first time in more than three months as they faced up to President Barack Obama's plan to reform the US financial market regulations, weighed the prospects of a global economic recovery and whether the "green shoots" needed more monetary water, and also started pondering the second-quarter earnings season.

As risk-taking moderated, profit-taking on equities and commodities set in after a colossal advance since early March. Government bonds rallied further, high-yield corporate bonds met selling pressure, spreads on credit derivative indices widened, and the US dollar marked time. "We could be seeing one of those occasional 'all-change signals' in short-term trends," said Fullermoney editor David Fuller from across the pond.

From his new abode at Gluskin Sheff & Associates, David Rosenberg said: "Post-credit collapse and asset deflation cycles are always gripped with fragility; the intermittent beta trades and flashy rallies only serve to tell us that nothing moves in a straight line. In the meantime, the incoming data do suggest that recession pressures are subsiding, but it is difficult to see what the sources of recovery are going to be outside of government spending."

Source: Gary Varvel

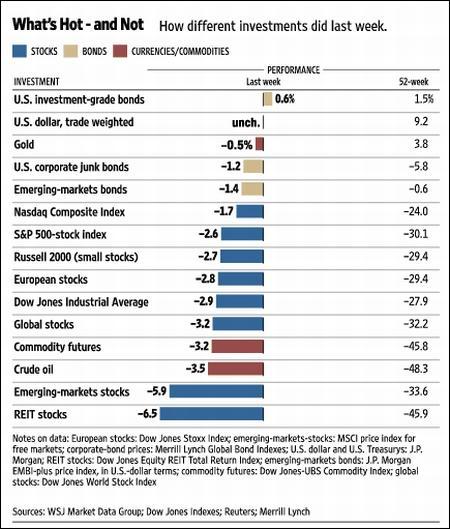

The week's performance of the major asset classes is summarized by the chart below. Not shown, the entire precious metals complex was again out of favor with investors, with gold bullion's (-0.5%) high-beta cousins - platinum (-3.7%) and silver (-4.1%) - being sold off by cautious investors.

Source: StockCharts.com

The US dollar ended the week virtually unchanged after Russian President Dmitry Medvedev told a regional summit on Tuesday that new reserve currencies, in addition to the dollar, were needed to stabilize the global financial situation. Meanwhile Brazil, Russia, India and China went on the biggest dollar-buying binge in eight months during May, adding $60 billion to their reserves, as cited by MoneyNews (via Bloomberg).

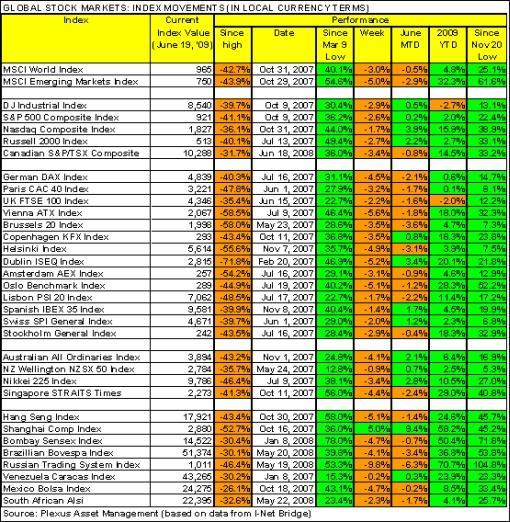

Many stock markets on Monday registered their worst single-session losses in a month. Mature markets perked up towards the end of the week, but emerging markets, in a number of instances, were down for all five trading days. After a four-week winning streak, the MSCI World Index (-3.0%) and the MSCI Emerging Markets Index (-5.0%) closed the week at their lowest levels since the last week of May.

Facing lackluster volume, the major US indices all ended the week in the red, but less so than most European and emerging bourses, as seen from the movements of the indices: S&P 500 Index (-2.6%, YTD +2.0%), Dow Jones Industrial Index (-2.9%, YTD -2.7%), Nasdaq Composite Index (-1.7%, YTD +15.9%) and Russell 2000 Index (-2.7%, YTD +2.7%).

To put the decline in context, the biggest pullback in the S&P 500 since the March 9 low happened in late March when the Index dropped by 5.9% over the course of two days. The most recent decline took the Index down by 5.0% between May 8-15. The S&P 500 is currently a more modest 2.7% off its high of June 12.

After climbing into the black for the year to date in the prior week, the Dow fell back to -2.7% last week - the only major US index in the red for 2009 - and, along with the FTSE 100 Index (-2.0%), one of the few global indices in this unenviable position.

Click here or on the table below for a larger image.

As far as non-US markets are concerned, returns ranged from top performers - mostly African countries - Sri Lanka (+10.7%), Kenya (+9.5%), Namibia (+8.5%), Uganda (+7.3) and Côted'Ivoire (+5.0%), to Russia (-9.8%), Qatar (-9.8%), Argentina (-8.4%), Ukraine (-6.9%) and Finland (-6.8%), which experienced headwinds.

In a bullish move, the Shanghai Composite Index - one of the leading markets in the advance over the last few months - bucked the downtrend with a gain of 5.0%. However, the Russian Trading System Index - the top-performer for the year to date (+70.7%) and since the November 20 lows (+104.8%), succumbed to profit-taking, losing 9.8% on the week. Also, the Bombay Sensex 30 Index (-4.7%) declined after rising for 14 consecutive weeks. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the leaders for the week included offshore "short" funds such as ProShares Short MSCI Emerging Markets (EUM) (+7.4%) and ProShares Short MSCI EAFE (Europe, Australia, Far East) (EFZ) (+3.3%). On the other side of the performance spectrum, losers centered in the energy sector, including Market Vectors Coal (KOL) (-13.4%) and iShares Dow Jones US Oil Equipment & Services (IEZ) (-11.6%).

In a white paper released on Tuesday night, the Obama administration detailed a number of proposals to overhaul the US system of financial regulations in an effort to restrain the reckless risk-taking that triggered the economic crisis.

The quote du jour this week is related to this regulatory reform and comes from Barry Ritholtz, editor of The Big Picture blog and author of Bailout Nation, a newly published and must-read book, who remarked: "The Federal Reserve, despite its role in causing the crisis, gets MORE authority. Under Greenspan, the Fed did a terrible job of overseeing banking, maintaining lending standards, etc. Why they should be rewarded for this failure with more responsibility is hard to fathom. It is yet another example of rewarding the incompetent."

Ritholtz offers a better solution: "Have the Fed set monetary policy. They should provide advice to someone else - like the FDIC (Federal Deposit Insurance Corporation) - who hasn't shown gross incompetence."

Other news is that the US Treasury is planning to revamp securitization with new rules designed to reduce the incentive for lenders to originate bad loans and flip them on to investors. The aim is to restore confidence in and revitalize securitized markets, which financed more than half of all credit in the US in the years immediately prior to the credit crisis.

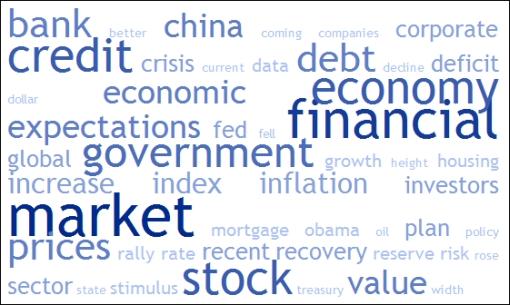

Next, a quick textual analysis of my week's reading. No surprises here, with all the usual suspects such as "market", "financial", "credit", "economy", "stock", "banks" and "China" featuring prominently.

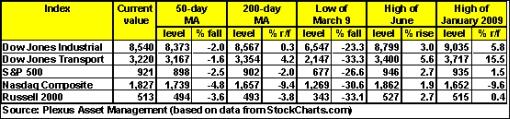

Back to the stock markets: an analysis of the moving averages of the major US indices shows the S&P 500, the Nasdaq Composite and the Russell 2000 trading above their 50- and 200-day moving averages, albeit marginally so in the case of the S&P 500. On the other hand, the Dow Industrial and Dow Transportation are below the key 200-day line, but still a few points above the 50-day average. Only the Nasdaq Composite trades above its January peak. The levels from where the rally commenced on March 9 should hold in order for base formations to remain in force.

Click here or on the table below for a larger image.

Not only are the indices very close to important moving average support levels, but a short-term oscillator such as the rate-of-change (momentum) indicator is on the verge of giving a selling signal, i.e. crossing through the zero line in the bottom section of the S&P 500 chart below. Also note the negative divergence between the Index and the ROC line - typically a warning sign that a near-term trend change will take place.

Source: StockCharts.com

The Bullish Percent Index shows the percentage of stocks that are currently in bullish mode as a result of point-and-figure buy signals. With the figure at 64.8%, this indicator conveys the message that the majority of stocks are in uptrends, but the line has turned down and the chart has the appearance of at least a short-term top.

Source: StockCharts.com

Richard Russell, veteran writer of the daily Dow Theory Letters, commented on Monday: "I'm of the opinion that this bear market rally is in the process of topping out. When a counter-trend rally tops out within an ongoing primary bear market, the odds are that the stock market will break to new lows during the period ahead. That means that the stock market will break below its March 9 lows in coming weeks. A violation of the March 9 lows would be a shocker to most investors, and it would be a forecast of an even worse economy coming up."

For more about key levels and the most likely short-term direction of the S&P 500, Adam Hewison of INO.com prepared another of his popular technical analyses. Click here to access the short presentation. (The analysis was done on Tuesday, but is still as relevant today as it was a few days ago.)

Turning to equity valuation levels, economist and strategist David Rosenberg, said: "The notion that we had moved to Armageddon lows in equities does not seem to hold water. After all, the forward P/E multiple on the S&P 500 at the lows was 11.7x. That was not a multi-decade low or some massive standard-deviation figure - we were actually lower than that at the October 1990 lows when the multiple was 10.5x and frankly, coming off the 1987 collapse, the forward P/E had compressed to 9.8x.

"As it now stands, the multiple is back very close to where it was at the October 2007 market high when the multiple had expanded to 15.0x. The range on the forward P/E over the last quarter-century is between 9.8x and 21.8x (excluding the tech bubble), so at 14.5x currently, it is hardly the case that this market can be viewed as a bargain. On a trailing earnings basis, the P/E multiple has actually widened, from 17.0x at the lows to 23.3x currently, a huge multiple expansion."

Nouriel Roubini, professor at NYU's Stern School and Chairman of RGE Monitor, shares the view that the stock market rally is long in the tooth. According to Yahoo, Tech Ticker, he pointed to three factors that would lead to a correction in the near future: (1) Volatility and uncertainty would increase; (2) Corporate earnings would disappoint; and (3) The global financial system still faced serious problems.However, Roubini was not convinced that the market would retest the rally lows.

Taking an opposite stance, Mario Gabelli, chief investment officer at Gamco Investors, sees rosy times ahead for the economy and stock market, as reported by MoneyNews. He noted that the Dow Jones Industrial Average was now at 8,500. "Twelve years ago it was 8,500 ... In 10 years, 8,500 will look like a bargain, and it's a bargain today. The best way to make money in the coming bull market is 'plain old stock picking'," said Gabelli.

In my opinion, it seems as if the spring rally has probably exhausted itself. It is difficult to envisage how much of a pullback we might see, but I maintain that it will still be part of a bottoming process. I would nevertheless assume a defensive position, as a bigger and longer correction than what many pundits are expecting cannot be excluded.

For more discussion on the direction of stock markets, also see my recent posts "Gold, gold, you're making me old", "Albert Edwards: Expect new equity lows in H2, China is global Achilles' heel", "Video-o-rama: Regulatory reform dominates debate", "Stock markets: retreat in store?", "The recession in historical context", "Technical talk: S&P 500 turning down from 950 again" and "Have stock markets run away from reality?". (And do make a point of listening to Donald Coxe's webcast of June 19, which can be accessed from the sidebar of the Investment Postcards site.)

Economy

"Global business sentiment is much improved during the past three months. Most notable is the optimism regarding the economic outlook toward the end of this year. Assessments of current business conditions and the strength of sales have also measurably improved," said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com. However, confidence is still weak and fragile, consistent with an ongoing global recession.

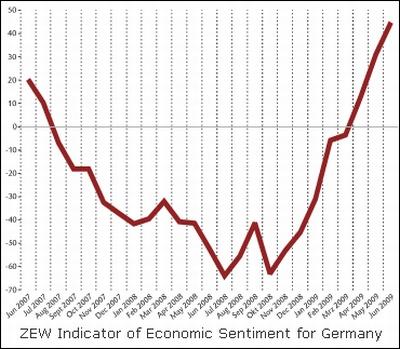

Although the European Central Bank (ECB) has warned that Eurozone banks face additional losses of more than $283 billion this year and next, German investor confidence, as measured by the ZEW Economic Sentiment Index, rose to a three-year high in June. The improvement suggests that investors are more confident that the worst of the financial crisis and recession has passed. However, the ZEW Current Situation Index remained around its six-year low in June, indicating that the German economy remains in recession.

Source: ZEW

"'Green shoots' is no longer the favorite phrase among policymakers. During last weekend's meeting of Group of Eight (G8) finance ministers, the message shifted to emphasize that it was far too early to sound the all-clear for the world economy," writes the Financial Times.

"I don't think we're at a point yet where we can say we have a recovery in place," said Tim Geithner, US Treasury secretary, and continued this theme a day later by saying "it is early still" and "we have a way to go". Britain's finance minister, Alistair Darling, said "we're not there yet", and the IMF's Dominique Strauss-Kahn said "the recovery is weak".

Focusing on the country that seems to have cruised best through the economic malaise, the World Bank raised its forecast for China's 2009 gross domestic product growth to 7.2% (from 6.5% three months ago), saying the apparent success of the government's stimulus package had improved the outlook from March, as reported by the Financial Times. The bank estimates a full six percentage points of this year's 7.2% GDP growth will come from investment and spending either carried out by the government or directly influenced by it.

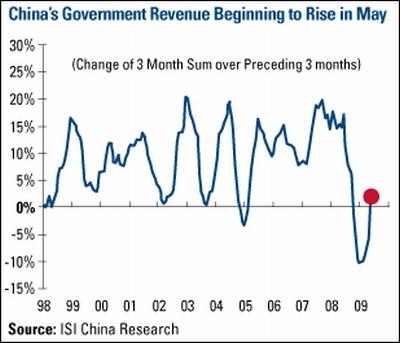

According to US Global Funds, another validation of China's economic recovery is provided by the recent growth in government revenue, thanks to rising business tax receipts. "Going forward, a virtuous cycle may set in when improving private sector activity encourages corporate expansion, which in turn benefits employment, income growth, and consumption."

Source: US Global Funds - Weekly Investor Alert, June 19, 2009.

However, Albert Edwards, global strategist at Société Générale, said (via the Financial Times): "I believe the bullish group-think on China is just as vulnerable to massive disappointment as any other extreme or bubble nonsense I have seen over the last two decades. The fall to earth will be equally as shocking."

In the world's second largest economy, the Bank of Japan opted not to make any changes to its monetary policy, stating that economic conditions in Japan "have begun to stop worsening".

A snapshot of the week's US economic data is provided below. (Click on the dates to see Northern Trust's assessment of the various data releases.)

June 19

• June 23-24 FOMC meeting - coast is not clear yet, minor modifications of April statement likely

June 18

• Index of Leading Indicators suggests worst is over

• Continuing Claims post large decline

• Philadelphia Fed Survey points to improving factory conditions

June 17

• Subdued inflation data leave room for Fed

• Significant improvement in current account deficit

June 16

• Housing Starts - turning the corner?

• Factory Production and Operating Rate remain problematic

• Higher prices for energy and tobacco lift overall Wholesale Price Index

Also, Reuters reported that US credit card defaults rose to record highs in May, soaring to 12.5% from 10.5% in April in the case of Bank of America. This is yet another sign that consumers remain under severe stress.

Summarizing the outlook for the US economy, Asha Bangalore (Northern Trust) said: "For all purposes, although the nature of incoming economic data and current financial market conditions indicate that the worst is behind us, real GDP in the second quarter is projected to decline again. The headline reading of real GDP should show a noticeably smaller drop in the second quarter compared with the 5.7% drop in the first quarter.

"There is mixed opinion in the marketplace about the third-quarter performance of the economy. We expect the economy to gather steam only by the final three months of 2009. The FOMC's projections show a decline of real GDP growth (Q4-to-Q4 basis) in 2009 to range between -2.0% and -1.3%. The bottom line is that the Federal funds rate will hold unchanged for several months ahead."

Week's economic reports

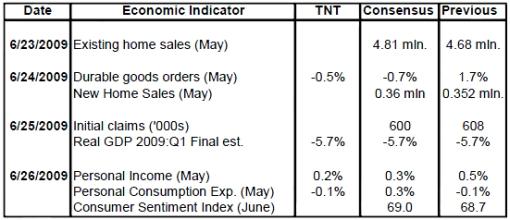

In addition to an interest rate announcement by the Federal Open Market Committee (FOMC) (Wednesday, June 24), the US economic highlights for the week include the following:

Source: Northern Trust

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, June 19, 2009.

"The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity. Both bring a permanent ruin. But both are the refuge of political and economic opportunists," said Ernest Hemingway.

In these troubled times, let's hope the news items and quotes from market commentators included in the "Words from the Wise" review will help Investment Postcards readers to spot the opportunities and invest wisely.

For short comments - maximum 140 characters - on topical economic and market issues, web links and graphs, you can also follow me on Twitter by clicking here.

Happy Father's Day to all, and enjoy the longest summer's day of the year (in the northern hemisphere)!

That's the way it looks from Cape Town in the heart of winter (that I will shortly be leaving behind for a two-week visit to Slovenia and Switzerland).

Simon Johnson (The Baseline Scenario): Where are we now?

"1. Financial markets have stabilized - largely because people believe that the government will not allow Citigroup to fail. We have effectively nationalized any banking system losses, but we'll let bank executives enjoy the full benefits of the upside. How much shareholders participate remains to be seen; there will be no effective reining in of insider compensation.

"2. The real economy begins to bottom out, although unemployment will not peak for a while and could stay high for several years. Longer term growth prospects remain uncertain - has consumer behavior really changed; if finance doesn't drive growth, what will; is the budget deficit under control or not (note: most of the guarantees extended to banks and other financial institutions are not scored in the budget)?

"3. More broadly, there is sophisticated window dressing in the pipeline but no real reform on any issue central to (a) how the banking system operates, or (b) more broadly, how hubris in finance led us into this crisis. The financial sector lobbies appear stronger than ever. The administration ducked the early fights that set the tone (credit cards, bankruptcy, even cap and trade); it's hard to see them making much progress on anything - with the possible exception of healthcare.

"4. The consensus from conventional macroeconomics is that there can't be significant inflation with unemployment so high, and the Fed will not tighten before late 2010. The financial markets beg to differ - presumably worrying, in part, about easy credit leading to dollar depreciation, higher import prices, and potential commodity price inflation worldwide. In all recent showdowns with standard macro models recently, the markets' view of reality has prevailed. My advice: pay close attention to oil prices.

"5. Emerging markets are increasingly viewed as having 'decoupled' from the US/European malaise. This idea was wrong in early 2008, when it gained consensus status; this time around, it is probably setting us up for a new bubble - based on a 'carry trade' that now runs out of the US. The 'appetite for risk' among investors is up sharply. The G7/G8/G20 is back to being irrelevant or merely cheerleaders for the financial sector."

Source: Simon Johnson, The Baseline Scenario: June 13, 2009.

The Washington Post: Obama blueprint deepens Federal role in markets

"The Obama administration last night detailed a series of proposals to involve the government more deeply in private markets, from helping to steer borrowers into affordable mortgage loans to imposing new limits on the largest financial companies, in a sweeping effort to curb the kinds of reckless risk-taking that sparked the economic crisis.

"The plan seeks to overhaul the nation's outdated system of financial regulations. Senior officials debated using a bulldozer to clear the way for fundamental reforms but decided instead to build within the shell of the existing system, offering what amounts to an architect's blueprint for modernizing a creaky old building.

"The White House makes its case for this approach in an 85-page white paper that describes the roots of the crisis. Gaps in regulation allowed companies to make loans many borrowers could not afford. Funding came from new kinds of investments that were poorly understood by regulators. Big firms paid employees massive bonuses, while setting aside little money to absorb potential losses.

"'While this crisis had many causes, it is clear now that the government could have done more to prevent many of these problems from growing out of control and threatening the stability of our financial system,' the white paper says.

"The plan is built around five key points, according to a briefing last night by senior administration officials and a copy of the white paper obtained by The Washington Post.

"The proposals would greatly increase the power of the Federal Reserve, creating stronger and more consistent oversight of the largest financial firms.

"It also asks Congress to authorize the government for the first time to dismantle large firms that fall into trouble, avoiding a chaotic collapse that could disrupt the economy.

"Federal oversight would be extended to dark corners of the financial markets, imposing new rules on trading in complex derivatives and securities built from mortgage loans.

"The government would create a new agency to protect consumers of mortgages, credit cards and other financial products.

"And the administration would increase its coordination with other nations to prevent businesses from migrating to less regulated venues.

"Congressional leaders say they hope to pass some version of the plan by year's end."

Source: Binyamin Appelbaum and David Cho, The Washington Post, June 17, 2009.

CNBC: Sheila Bair on the regulation revamp

"The White House this week unveiled a new financial regulatory framework, and FDIC Chair Sheila Bair shares her outlook on the new policy initiatives with CNBC."

Source: CNBC, June 19, 2009.

Barry Ritholtz (The Big Picture): Obama reform plan fails to fix what is broken

"So much for 'not letting a crisis go to waste'.

"The initial read on the Obama Regulatory plan was an enormous disappointment. Both supporters and critics who expected him to take a hard turn to the Left have been left either surprised or disappointed, depending upon their leanings.

"To the pragmatic center, including your humble blogger, what stands out is the number of half measures and omitted actions that were viewed as necessary to prevent a replay.

"Some very obvious omissions from the plan include:

"1) No major changes for the ratings agencies!

"This is a giant WTF from the White House. It implies that the team in charge STILL does not understand how the problem occurred.

"The ratings agencies are not the only bad actors, but they are a BUT FOR - but for the rating agencies putting a triple A on junk paper, many funds could not have purchased them, the number of mortgages securitized would have been much less, the insatiable demand on Wall Street for mortgage paper would have also been much lower.

"Why is this important? If mortgage originators couldn't sell a mass amount of loans, they would not have had the need to give a mortgage to anyone who could fog a mirror - and that means no Liar Loans, no NINJA loans, and no huge subprime debacle.

"Better Solution: Take apart the ratings oligopoly! Eliminate the Pay-for-Play/Payola structure. Strip Moody's S&P and Fitch from their uniquely protected status - they have proven they are neither worthy nor competent. Open up ratings to competition - including open source.

"2) Turn derivatives into ordinary financial products: The Obama team does a series of minor steps for derivatives, but they don't go far enough.

"Better Solution: Force derivatives to be traded like option/stocks, etc. (including custom one-off derivatives). Trade them only on exchanges, full disclosure of counter-parties, transparency and disclosure of open interest, trades, etc. REQUIRE RESERVES LIKE ANY OTHER INSURANCE PRODUCT.

"3) 'If they are too big to fail, make them smaller.'

"That is the famous quote from Nixon Treasury Secretary George Shultz, and it applies to the banks as well as insurers, Fannie & Freddie, etc.

"We have a situation where 65% of the depository assets are held by a handful of huge banks - most of whom are less than stable. The remaining 35% is held by the nearly 7,000 small and regional banks that are stable, liquid, solvent and well run.

"Better Solution: Have real competition in the banking sector. Limit the size for the behemoths to 5% or even 2% of total US deposits. Break up the biggest banks (JPM, Citi, Bank of America).

"4) The Federal Reserve, despite its role in causing the crisis, gets MORE authority.

"Under Greenspan, the Fed did a terrible job of overseeing banking, maintaining lending standards, etc. Why they should be rewarded for this failure with more responsibility is hard to fathom. It is yet another example of rewarding the incompetent.

"Better Solution: Have the Fed set monetary policy. They should provide advice to someone else - like the FDIC - who hasn't shown gross incompetence.

"5) Require leverage to be dialed back to its pre-2004 levels. Have we even eliminated the Bears Stearns exemption yet? This was a 2004 SEC decision to exempt five biggest banks from the mere 12-to-1 prior levels. Note that all five are either gone, acquired or turned into holding companies.

"Better Solution: 12-to-1 should be enough leverage for anyone.

"6) Restore Glass Steagall: The repeal of Glass Steagall wasn't the cause of the collapse, but it certainly contributed to the crisis being much worse.

"Better Solution: Time to (once again) separate the more speculative investment banks from the insured depository banks.

"All of which suggests that the status-quo-preserving, sacred-cow-loving, upward-failing duo of Lawrence Summers and Tim Geithner are still in control of economic policy. The more pragmatic David Axelrod and the take-no-prisoners, don't-give-a-shit-about-Wall-Street Rahm Emmanuel have yet to assert authority over the finance sector."

Source: Barry Ritholtz, The Big Picture, June 18, 2009.

Roubini (Yahoo, Tech Ticker): New regulations "go in the right direction", but not far enough

"The new Wall Street regulations announced by President Obama yesterday 'go in the right direction' but only accomplish about '75% of what needs to be done', says Nouriel Roubini, professor at NYU's Stern School and chairman of RGE Monitor."

MoneyNews: Paul Volcker - put a brake on the bailouts

"Government bailouts should be limited and a clear policy set forth defining who would have access to the government's financial safety net.

"That's what former Federal Reserve chairman Paul Volcker told a meeting of the International Institute of Finance in Beijing recently, as reported in The Wall Street Journal.

"Volcker is also chairman of President Obama's Economic Recovery Advisory Board, so his remarks on the economy may also reflect administration thinking on the subject, and may also be a forecast of reforms to come.

"'One unfortunate consequence of the massive public assistance provided both banks and nonbanks in dealing with the present crisis is that moral hazard may, I am afraid, become more deeply embedded.'

"Moral hazard is defined as an absence of incentive to protect against risk if you are insured against risk.

"Volcker, in his speech, cited as a conflict of interest among those institutions which 'engaged in substantial risk-prone proprietary trading and speculative activities.'

"Financial institutions beyond the government 'safety net' should not count on government protection, said Volcker. But they may be subject to government oversight.

"In an effort to prevent another disastrous financial crisis, the Obama administration wants to empower the Federal Reserve as a 'systemic risk regulator' with the right to seize large financial firms tottering near failure."

Source: Marc Davis, MoneyNews, June 17, 2009.

Financial Times: Treasury plans strict rules for securitisation

"The US Treasury is planning a sweeping overhaul of securitisation markets with tough new rules designed to restore confidence by reducing the incentive for lenders to originate bad loans and flip them on to investors.

"The authorities plan to force lenders to retain part of the credit risk of the loans that are bundled into securities and to end the gain-on-sale accounting rules that helped spur the boom of the markets at the heart of the financial crisis.

"The aim is to revitalise the markets for securities backed by mortgages and other assets without re-creating the systemic risks that turned boom to bust in 2007. The plan is part of a wider overhaul of regulation to be unveiled on Tuesday.

"A Treasury spokesman said that while securitisation had made credit more widely available, breaking the direct link between borrower and lender had 'led to a general erosion of lending standards, resulting in a serious market failure that fed the housing boom and deepened the housing bust'.

"Securitised markets - which financed more than half of all credit in the US in the years immediately preceeding the crisis - are essential for the US economy. Without a recovery in these markets, the flow of credit will not return to more normal levels, even if US banks overcome their problems."

Source: Krishna Guha, Tom Braithwaite, Francesco Guerrera and Aline van Duyn, Financial Times, June 15, 2009.

Bloomberg: Congress backs war-funding bill, "cash for clunkers"

"A $106 billion war-spending bill won final congressional approval after the Senate voted to retain a 'cash for clunkers' provision aimed at helping the auto industry.

"Action by the Senate today sends the measure to President Barack Obama for his signature. The Senate passed the bill on a 91 to 5 vote; the House approved the measure earlier this week.

"Senator Judd Gregg, a New Hampshire Republican, led the effort to drop a provision providing as much as $4,500 to people who trade in their vehicles for more fuel-efficient models. He said the plan, which would cost $1 billion, was a poor use of tax dollars when the government is projected to run its biggest budget deficit since 1945.

"'It is a clunker,' Gregg said of the plan. 'Why should our children and our grandchildren have to pay the bill' for the government subsidizing 'somebody to buy their car today? How fiscally irresponsible is that?' he said.

"The legislation provides more than $82 billion to fund military operations in Iraq and Afghanistan, which would bring total spending on the wars to more than $900 billion.

"Lawmakers agreed to Obama's request to include $5 billion to secure $108 billion in aid, primarily in the form of a line of credit, to the International Monetary Fund. The legislation would permit US representatives to the IMF to agree to its planned sale of 13 million ounces of gold, one-eighth of the organization's holdings, to help finance aid to poor countries.

"The bill also would provide $7.7 billion for pandemic flu programs.

"Other provisions would allow the Pentagon to transfer suspected terrorists held at the military prison at Guantanamo Bay, Cuba, to the US for trial, though not for long-term incarceration or release."

Source: Brian Faler, Bloomberg, June 18, 2009.

Financial Times: "Green shoots" wilt

"'Green shoots' is no longer the favourite phrase among policymakers. During last weekend's meeting of Group of Eight finance ministers, the message shifted to emphasise that it was far too early to sound the all-clear for the world economy.

"'I don't think we're at a point yet where we can say we have a recovery in place,' said Tim Geithner, US Treasury secretary, who continued this theme yesterday by saying 'it is early still' and 'we have a way to go'. Britain's finance minister said 'we're not there yet'. The IMF's Dominique Strauss-Kahn said 'the recovery is weak'.

"Financial markets dutifully responded to this message. It is a great example of effective jawboning - the attempt to influence by persuasion rather than by exertion of force or one's authority, although weak economic data played its part.

"Stock prices fell, bond prices rose. Perhaps most importantly, commodity prices fell too. A persistent rise in oil and other commodities could lead to a return to high inflation expectations. With the US central bank pumping billions of dollars into the economy through purchases of government bonds and mortgage debt, any need to suck that out to curb inflation fears could be messy and lead to a surge in borrowing costs.

"Though there is now a plan to come up with 'exit strategies' - the G8 has asked for an analysis of how best to handle this - policymakers are clearly showing they do not want to repeat the mistakes made by Japanese officials in the 1990s, that of pulling back economic stimulus and credit expansion too quickly. This balancing act will be needed for some time. According to Ajay Rajadhyaksha, at Barclays Capital: 'Policymakers want to see if they can buy another year or year-and-a-half without inflation expectations building up.'"

Source: Aline van Duyn, Financial Times, June 15, 2009.

SmartMoney: Red herrings - false signs of an economic rebound

"Because of the magnitude of the recent downturn, experts say some of the statistics that are widely used to track the economy are now red herrings - misleading, at best, when it comes to predicting a rebound. Here are three indicators that could lead investors astray.

What housing glut?

"Housing inventory measures the supply of unsold homes on the market. Right now it's high - a 10-month supply of homes, up from the average of about five - and conventional wisdom says the housing market won't recover until it declines. This time around, however, waiting for 'normal' could cost you. In fact, an improving economy might mean more homes on the market, not fewer. Some banks are sitting on foreclosed properties, waiting for a friendlier economic climate before putting them on the market, and many homeowners are essentially doing the same thing. Stephen Kim, senior analyst at Alpine Global Real Estate fund, thinks home-building stocks 'will rally while inventory levels are still high.'

The hidden jobless

"It seems like a no-brainer: Once more people are working, stocks should rebound. But investors who rely solely on the official unemployment rate - the percentage of workers who are jobless - could be misled. The statistic excludes so-called discouraged workers who have given up looking for a job. And the data doesn't capture companies that force employees to take pay and benefit cuts or furloughs. 'You'd get a better idea just asking people on the street if they're employed,' scoffs John Williams, founder of economic research firm Shadowstats.com. Strategists put more trust in weekly unemployment-claims data, a different figure that gives a clearer sense of companies' hiring and firing."

Inflated expectations

"Many market watchers are hoping for a modest increase in inflation, as a sign that the global economy is starting to crawl out of recession. But investors who watch the so-called core consumer price index (CPI), the most widely used gauge, might miss the first stages of a rally and lose out on run-ups in stocks of energy and raw-materials companies. Core CPI excludes the cost of food and energy, and analysts like Strategas economist Don Rissmiller think energy is where prices may surge first, as billions of stimulus dollars pumped into infrastructure projects stoke demand for metals and fuel. Investors looking for a better indicator than the CPI should watch prices for commodities like copper and oil."

Source: SmartMoney, June 18, 2009.

The Capital Spectator: A bull market in false dawns?

“Flat to a slight upside bias. That about sums up the prevailing state of inflation at the moment, based on this morning’s latest from the US Bureau of Labor Statistics.

“Seasonally adjusted consumer inflation rose 0.1% last month, up from zero the month before and a modest decrease in March. On its face, that’s good news, as it suggests that the risk of deflation, if not quite passed, is looking more and more like a shadow of its formerly threatening self. Meanwhile, inflation as a clear and present danger also remains thin as an imminent menace.

“We are in a transitory state, passing from severe danger to something less so. Anything’s possible, of course, especially in the current climate. But barring some extraordinary and largely unexpected event, we’re likely to press on through what we’ll call a pre-recovery period, when the economic numbers improve relative to the recent past yet the numbers don’t quite show the traditional bounce that typically accompanies the end of recessions.

“‘The economy seems to be out of intensive care,’ says David Shulman, senior economist at UCLA Anderson School of Management. ‘The freefall stage in dropping output and employment seems to be over, but the economy is still sick.’

“The prospect of false starts in the data looks quite high in the months ahead. The good news on one day will be reversed by bad news the next, and quite a bit of treading water at other times. The transition state that carries us from recession to growth, in short, will last longer than usual. The evidence will be particularly obvious in the lagging indicators, employment being the most conspicuous example.

“Indeed, the labor market is still shrinking and will probably continue to do so in the months ahead, perhaps followed by an extended bottoming-out period over several quarters. The economy’s capacity to create jobs is likely to come later and be more tepid than has typically been the case following the end of recessions in the post-war era.

“Extending the medical metaphor, Bruce Kasman, chief economist for JPMorgan Chase, predicts in BusinessWeek.com yesterday that ‘the economy will return to growth but not to health’.

“Last week we wrote of the ‘technical end’ of the recession and our expectation that NBER would eventually get around to declaring the downturn’s finish at, well, right about now, give or take a few months. That’s good news relative to the recent standard of economic activity. But the technical demise of the recession isn’t likely to bring easily recognizable good news on Main Street anytime soon.

“As frustrating as that outlook is, it’s even more hazardous than is generally recognized. If we’re facing an unusually long transition period, there are specific risks linked to this abnormal state of affairs. That includes figuring out how and when to adjust monetary policy to balance two conflicting forces: deflation and inflation. As the former gives way, the latter isn’t likely to suddenly pop out and yell ‘boo’. Nonetheless, the future inflation risk isn’t trivial, given the massive liquidity that’s been created of late and the historical lessons that go with fiat currencies.

“Tightening monetary policy too soon may risk choking off a nascent but weak recovery; waiting too long to raise interest rates may give inflation a solid foundation to thrive, an especially troubling thought, given the massive amount of debt incurred over the last 12 months or so.

“Overall, economic analysis faces unusually tough times in reading the incoming data and drawing reasonable conclusions about the implications for the future. As a basic example, our proprietary index of economic indicators, published in each issue of The Beta Investment Report, is currently flashing a robust sign of recovery, although this may be misleading because much of the rise has come from monetary policy and, so far, isn’t convincingly corroborated in the real economy.

“In short, interpreting the economic outlook promises to be quite difficult going forward, much more so than usual. Beware: The risk of false dawns is rising.”

Source: The Capitol Spectator, June 17, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.