Stock Market Summer Crash or Consolidation?

News_Letter / Financial Markets 2009 Jun 20, 2009 - 07:11 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

June 20th, 2009 Issue #47 Vol. 3

Featured Analysis of the Week

|

|

|

|

|

This plane can’t fly Dear Reader, This airplane costs $22 billion to design. It costs $2.1 billion to build each new copy. It is, by far, the world’s most expensive aircraft. And yet, this plane can’t fly. On its own, it would crash. But here's the interesting thing... The only thing keeping this plane airborne is a technology that can also predict stock price movements… down to the penny… as much as two years out. Keith Fitz-Gerald made this amazing discovery over 10 years ago and spent the next decade figuring out how to make money with it. He tells his story here… Sincerely, Publisher P.S. How accurate is this technology? Thus far, Keith has picked only winners-an unheard of 100% win record. He shows you how to do the same. READ GEIGER REPORT |

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. The Bankers Are Scared, Are You? |

By:Gary North

"What, me worry?"

From its beginning in 1954, the official representative of Mad Magazine has been Alfred E. Newman. He is a dim-witted looking fellow, always smiling. His slogan is, "What, me worry?"

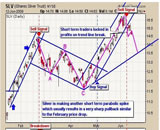

| 2. Stocks Bear Market Rally is Over |

By: Adam_Brochert

Done. Finito. Put a fork in it. Be short or be out of the way if you're an intermediate-term trader. Forget commodities and forget inflation. The next bear leg down in the stock and commodities market is here. Yes, it is possible that there could be an up day in stocks and commodities tomorrow, but I believe the intermediate-term top for the stock market is in and that a full on resumption of the bear market has begun.

| 3. The Coming Stock Market Crash: Time to Review |

By: Brian_Bloom

Yesterday this analyst had the bizarre experience of watching two consecutive and conflicting items on the evening Television news:

1. A well respected economic forecasting organization is expecting Australian domestic real estate prices to rise by around 19% over the coming three years.

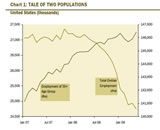

| 4. Stock Market Rally On Borrowed Money Living on Borrowed Time? |

By: Anthony_Cherniawski

Consumer Sentiment is on the rise - Confidence among U.S. consumers rose this month for a fourth straight time, reflecting signs that the worst recession in at least five decades may end this year. The Reuters/University of Michigan preliminary index of consumer sentiment increased to 69, the highest level in nine months, from 68.7 in May.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. De-Dollarization, Dismantling America’s Financial-Military Empire |

By: Michael Hudson

The Yekaterinburg Turning Point - The city of Yakaterinburg, Russia’s largest east of the Urals, may become known not only as the death place of the tsars but of American hegemony too – and not only where US U-2 pilot Gary Powers was shot down in 1960, but where the US-centered international financial order was brought to ground.

| 6. How long Can the U.S. Dollar Last as the World’s Reserve Currency? |

By: Bob Chapman

The big question is how long can the dollar last as the world’s reserve currency? Needless to say, that is not an easy question to answer. We recently called the top on the dollar at 89.50 on the USDX. The USDX is six currencies versus the dollar on a weighted basis. More than a year ago the dollar hit a low on the USDX at 71.18.

| 7. China’s Got a New Currency… and It Sure AIN’T the Dollar |

By: Graham_Summers

China is the US’s largest creditor. All told, the People’s Republic has $700+ billion in US Treasuries. However, if you account for other dollar denominated investments, China is believed to have 70% of its $1.7 trillion in foreign reserves sitting in green backs.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

To access the Newsletter archive this link

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.