The Bush Doctrine, Economic Warfare and Your Investment Portfolio

Politics / Market Manipulation Jun 12, 2009 - 12:57 PM GMTBy: Rob_Kirby

Let us be clear, that in the aftermath of 9/11, American policy vis-à-vis its relations with the rest of the world changed forever under the aegis of the Bush Doctrine:

Let us be clear, that in the aftermath of 9/11, American policy vis-à-vis its relations with the rest of the world changed forever under the aegis of the Bush Doctrine:

The Bush Doctrine is a phrase used to describe various related foreign policy principles of former United States president George W. Bush. The phrase initially described the policy that the United States had the right to secure itself from countries that harbor or give aid to terrorist groups, which was used to justify the 2001 Invasion of Afghanistan.

Later it came to include additional elements, including the controversial policy of preventive war, which held that the United States should depose foreign regimes that represented a potential or perceived threat to the security of the United States, even if that threat was not immediate; a policy of spreading democracy around the world, especially in the Middle East, as a strategy for combating terrorism; and a willingness to pursue U.S. military interests in a unilateral way. Some of these policies were codified in a National Security Council text entitled the National Security Strategy of the United States published on September 20, 2002.

In a military sense, we are all familiar with and can visibly recognize the physical manifestations of the implementation of the Bush Doctrine through the occupation of both Iraq and Afghanistan. But what about warfare from an economic perspective?:

Economic warfare can win terror war: Ronald Reagan personally crafted a security-minded economic strategy that toppled the Soviet Union—a blueprint George W. Bush could use to defeat terrorists

Nov 12, 2002 by J. Michael Waller

Al-Qaeda recently announced economic warfare against the United States and other Western countries. U.S. intelligence expects years of attacks on the economic infrastructure of the civilized world. For its part, the United States has an arsenal of economic weapons for this war, but critics fear it may have forgotten how to use them strategically--an important point, because proponents believe that strategic economic warfare thoughtfully applied by the United States could save innocent lives and avoid military conflict while achieving the same objectives as an all-out bombing or invasion.

Lessons of successful economic-warfare operations that hastened the collapse of the Soviet Union, veteran practitioners tell INSIGHT, are valuable guideposts to help the Bush administration develop an integrated economic-warfare strategy.

Many weapons in the economic arsenal already are in play in the war on terrorism. The United States and other governments are going after bank accounts and electronic money transfers of terrorists and their sponsors, seizing assets and running a spectrum of policy options from covert "black operations" against terrorist financiers to full-scale embargoes against terrorist regimes. U.S. dominance of information technology and space for orbital satellite communications gives Washington immense superiority over any other world power.

The Department of Defense (DOD) defines economic warfare as the "aggressive use of economic means to achieve national objectives." Economic warfare can range from blockades and sanctions to physical attacks on an enemy's agricultural or industrial production, workforce and distribution systems to disruption of financial transactions and information networks. The concept dates to antiquity, from the plagues that destroyed the Egyptian pharaoh's crops, as reported in the Book of Exodus, to the enemy who sowed weeds on top of his neighbor's wheat in the New Testament……..

National Objectives or National Security, [take your pick]

On June 11, 2009 – Bank of America CEO, Ken Lewis, gave sworn testimony to law makers on Capitol Hill describing how regulators, [Fed Chairman] Ben Bernanke and [then Treasury Secretary] Hank Paulson “threatened” him to keep mum and not disclose material adverse financial changes [MAC] in Merrill Lynch’s financial position to B of A shareholders, prior to B of A acquiring Merrill in the fall of 2008:

Watch and Listen to Lewis testimony on C-Span here.

If you listen to Lewis’ testimony, as we did, you will hear him interact with law makers and hear references to the [then] successful merger of B of A and Merrill being ushered along in the name of “not wanting to disclose” as well as “not spooking the Capital Markets”. Sounds a lot like a “hush-and-rush” in the name of National Security, ehhh?

Speaking of Obscured Motives and Actions..

It was first reported by Dawn Kopecki back in early 2006 [2 ½ years prior to the B of A / Merrill incident] when she reported in BusinessWeek Online in a piece titled, Intelligence Czar Can Waive SEC Rules,

"President George W. Bush has bestowed on his [then] intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye."

What this means folks, if institutions like J.P. Morgan are deemed to be integral to U.S. National Security - they could be "legally" excused from reporting their true financial condition.

The entry in the Federal Register is described as follows:

The memo Bush signed on May 5, which was published seven days later in the Federal Register, had the unrevealing title "Assignment of Function Relating to Granting of Authority for Issuance of Certain Directives: Memorandum for the Director of National Intelligence." In the document, Bush addressed Negroponte, saying: "I hereby assign to you the function of the President under section 13(b)(3)(A) of the Securities Exchange Act of 1934, as amended."

A trip to the statute books showed that the amended version of the 1934 act states that "with respect to matters concerning the national security of the United States," the President or the head of an Executive Branch agency may exempt companies from certain critical legal obligations. These obligations include keeping accurate "books, records, and accounts" and maintaining "a system of internal accounting controls sufficient" to ensure the propriety of financial transactions and the preparation of financial statements in compliance with "generally accepted accounting principles."

Given what we now know has occurred – isn’t anyone curious as to which institutions might have been granted a pass in the action referenced above?

We’ve included a link to the C-Span coverage of the Lewis testimony in this article but we originally watched it “live” on Bloomberg Financial TV. We took special note of Bloomberg’s live coverage and how they preemptively “cut away” from, and for the entirety of Rep. Dennis Kucinich’s [D - OH] questioning of Lewis – to give an update on the auction results of a 30 year bond auction. Not surprisingly and predictably, the Kucinich questioning was, HANDS DOWN - the most direct and indicting exchange of all Mr. Lewis’s testimony.

Mr. Kucinich’s questioning of Mr. Lewis implied that the party with the UGLIEST and most ADVERSE financial position was B of A itself – not Merrill – and that Ken Lewis, threatened invoking the ‘MAC clause’ to extort more tax-payer’s-money / support for B of A’s own increasingly dilapidated financial position. The record is clear that ole Kenny and B of A did, in fact, get their additional dollars. It makes you wonder if ole Kenny might have dug himself his own grave, ehhh?

The Kucinich questioning / testimony begins at the 19:00 minute mark of the C-Span piece linked above.

Getting the Upper Hand in Rigged Markets

Because criminal shenanigans like those chronicled above have become such common practice in our ‘rigged’ capital markets [take note of how the price of gold “took off” when the ‘damning’ Ken Lewis testimony began this morning at 10:13 a.m.], we have prepared a special report for subscribers outlining steps that investors can take to help insulate their own investment portfolios from these and other despicable acts.The United States has long practiced covert, economic warfare even though this fact is seldom, if ever, mentioned in the mainstream press:

Blurring the lines between military and civilian Psychological Operations is nothing new. In 1989, US forces in Panama blasted Guns N' Roses' "Welcome to the Jungle" into the Vatican Embassy during negotiations for the handover of General Manuel Noriega, and from 1998-1999, US military PSYOP personnel interned at both CNN and NPR.

It is this fascist – leaning “Pollyanna Creep” – a long drawn out merger of corporate / media / government which have blurred the lines between regulator and the regulated.Understanding Exactly Who You Are Playing / Betting Against

In recent years the not so invisible hands of government and monetary elites have increasingly been exerting their influence in our formerly “free” markets through the veiled actions of the President’s Working Group on Financial Markets [aka the Plunge Protection Team or PPT] in futile, vain efforts [in the long rate] to ‘rig’ outcomes in financial markets that are consistent with public perception of confidence in irredeemable fiat money. Sometimes the defense of the currency revolves around carefully crafted disinformation campaigns by people in high places – like Ben Bernanke’s recent pronouncements about the Output Gap before lawmakers on Capitol Hill:

BERNANKE ON INFLATION EXPECTATIONS

"I think I would note that you look around for evidence of inflation, inflation expectations, you're not going to find very much.

If you look, for example, at surveys of consumers, if you look at the forecasts of professional forecasters, if you look at the spreads between indexed and non-indexed bonds, all of those things are quite consistent with inflation remaining stable and well within the bounds that the Federal Reserve believes is consistent with price stability." "What we're seeing in the markets is that prices, manufacturing goods, for example, and wages in nominal terms are not showing any signs of a wage-price spiral……..

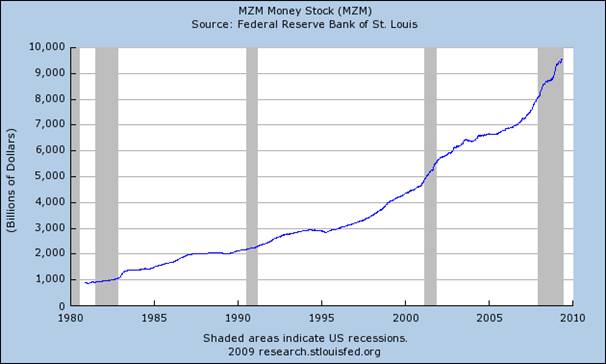

What makes Mr. Bernanke’s Fed speak so disingenuous is his alluding to inflation being an outcome of wage pressures, which have been engineered to be benign through outsourcing of jobs and sieve-like porous border with a low wage country [Mexico] on the southern flank. Take note how the ‘higher wage’ northern border [Canada] has always been empirically, relatively, “well guarded”. Prattle about these “engineered outcomes” is misdirection anyway - owing to the fact that INFLATION IS AND ALWAYS HAS BEEN A MONETARY EVENT – and here’s what the Fed has been doing to the money supply:source: St. Louis Fed

Historically on the inflation front, the Fed has only had to concern itself with Dollars held Domestically. This meant that the Fed – at any given time in a Domestic sense – could counter-act any Domestically created money-glut by tightening domestic credit, thereby, reducing the domestic velocity [turn-over] of fiat money – hence – inflationary pressures at home.

What has now occurred – IN THE GLOBALIZED ECONOMY – the Federal Reserve has acted in their customary way in the wake of their own reckless monetary excess, by restricting the creation of “new” fiat credit [the CREDIT CRUNCH WE ARE NOW EXPERIENCING]. The problem for the Fed is that the Chinese have “OVERTURNED” or “trumped” Fed policy [by virtue of the staggering amount of Dollars they hold arising from their Balance of Trade Surplus] by extending Dollar Reserve Derived credit to spur demand [increasing foreign velocity of U.S. Dollars] – which has, in turn, led to GLOBAL INFLATION.Effectively, the U.S. Federal Reserve has lost a significant amount of control of their own financial house and puts their current policies of money printing [aka inflation] at odds with their biggest creditor – CHINA.

The inaccurate, polluted, interventionist and often baseless revisionist economic accounts increasingly served up by the Private Federal Reserve [which is no more Federal than Federal Express and has no reserves], has understandably led to the Fed having an IMAGE PROBLEM:

Lousy Wizards, Curtains to Free Markets and Dogs Barking At the Moon

Fed Intends to Hire Lobbyist in Campaign to Buttress Its Image

June 5 (Bloomberg) -- The Federal Reserve intends to hire a veteran lobbyist as it seeks to counter skepticism in Congress about the central bank’s growing power over the U.S. financial system, people familiar with the matter said.

Linda Robertson currently handles government, community and public affairs at Johns Hopkins University in Baltimore, and headed the Washington lobbying office of Enron Corp., the energy trading company that collapsed in 2002 after an accounting scandal. She was also an adviser to all three of the Clinton administration’s Treasury secretaries.

Robertson would help the Fed manage relations with lawmakers seeking greater oversight of a central bank that has used emergency powers to prevent Wall Street’s demise. While she wasn’t tied to Enron’s fraud, her association with the firm may raise questions, analysts said.

“Some members of Congress think there are votes in attacking the Fed” after it “unnecessarily and unwisely entangled monetary policy with fiscal policy,” said former St. Louis Fed President William Poole. “The Fed is going to have a tricky time of unwinding what has been done” and will need to “keep in touch with members of Congress more thoroughly,” said Poole, now senior fellow with the Cato Institute in Washington.

Robertson served under Treasury Secretaries Lawrence Summers, Robert Rubin and Lloyd Bentsen. She didn’t return calls seeking comment.

Summers Tie

Summers now heads the White House National Economic Council. Along with Treasury Secretary Timothy Geithner, he is leading Obama administration efforts to broaden the economic rescue and overhaul financial regulation. He has been mentioned as a possible successor to Fed Chairman Ben S. Bernanke should Bernanke not be renominated when his term ends in January.

With the U.S. Dollar still being the world’s reserve currency – and in light of the money printing spendthrifts that manage it, it is a constant up-hill battle [or psychological warfare, take your pick?] for integrated elites to make believers in their Public Theater of Operation< [that would be all of us]. This has been achieved by “engineering” - through Fed appointed proxies or agents, like J.P. Morgan-Chase and others, shorting gold futures [derivatives] to suppress the price of gold and other strategic, inflation-bell-weather commodity prices.

It is “us” – we, the grass roots folks, who are increasingly becoming more educated / empowered through knowledge gained and shared - through the “free internet”. This poses a threat to these strategically and sometimes recklessly engineered / manufactured market manipulations. Accordingly, the establishment views the internet as an enemy "weapons system":

“…a 2003 Pentagon document called Information Operations Roadmap detailed the US military's approach to exploiting information in order to "keep pace with warfighter needs and support defense transformation." Personally approved by former Defense Secretary Rumsfeld, the document was declassified in 2006 and covers everything from the Pentagon's plans for Computer Network Attack ("We Must Fight the Net") to beefing up the use of Psychological Operations ("We Must Improve PSYOP") to manipulating information through means including: "Radio/ TV/Print/ Web media designed to directly modify behavior and distributed in theater supporting military endeavors in semi or non-permissive environment."

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.