Credit Card Crisis as Huge Losses Cause Lending to Stop

Interest-Rates / Credit Crisis 2009 May 13, 2009 - 03:02 AM GMTBy: Mike_Shedlock

The credit card industry is in huge stress and things are about to get worse. Please consider Advanta Halts Credit-Card Lending Amid Surging Losses.

The credit card industry is in huge stress and things are about to get worse. Please consider Advanta Halts Credit-Card Lending Amid Surging Losses.

Advanta Corp., the issuer of credit cards for small businesses, will shut down accounts for its 1 million customers next month and seek to pay off securitized debtholders early as the recession pushes defaults higher.

Lending will cease June 10 as part of a plan to preserve capital after uncollectible debt reached 20 percent on some cards as of March 31, the Spring House, Pennsylvania-based firm said yesterday in a statement. Advanta will use as much as $1.4 billion to pay investors as little as 65 cents on the dollar to buy back securitized credit-card loans. That would be the first so-called early amortization of a trust since 2003, according to JPMorgan Chase & Co. analyst Christopher Flanagan.

“Early-amortization has been viewed as a catastrophic event for issuers,” Scott Valentin, an analyst at Friedman Billings Ramsey & Co., said today in a research note. “Given that all credit-card accounts in the trust will be shut down to future use, we expect losses to increase as the cards have substantially less utility to cardholders.”

The company plans to use up to $1.4 billion to make cash offers to trust investors at a price of 65 percent and 75 percent of the debt’s face value. While the company has “no indication” if investors will accept that offer, the price is “relatively consistent with recent trading levels of the bonds,” Browne said.

“They’re hoping they can stay alive barely until the environment changes,” said David Robertson, president of the Nilson Report, the Carpinteria, California-based industry newsletter. This is “a big sign that the credit-card industry has problems that are going to be around for several years.”

Advanta was the 11th-biggest U.S. credit-card issuer at the end of 2008 with about $5 billion in outstanding balances, and the only major lender focused on small business borrowers, Robertson said.

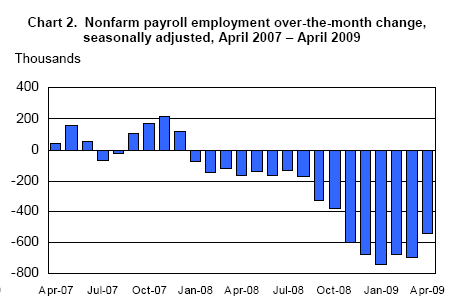

With the economy shedding jobs at an unprecedented rate, consumers and small businesses are under extreme stress. Please consider the following chart.

Economy losing 500,000+ jobs for six consecutive months

For more details on jobs, please see Jobs Contract 16th Straight Month; Unemployment Rate Soars to 8.9%.

Even if losses improve to 200,000-300,000 stress will continue to build on card issuers that hold (as opposed to just process) credit card debt. Visa and Mastercard do not hold credit card debt.

Small Business Defaults

Small businesses are in stress and that is what has affected Advanta most.

ADP, the country's largest payroll processor breaks down job losses by small (1-49 employees), medium (50-499), and large (500+) sized businesses.

ADP Small Business Report

• Total small business employment: -183,000 vs. -284,000 last month.

• Total medium business employment: -231,000 vs. -330,000 last month.

• Total large business employment: -77,000 vs. -128,000 last month.

See ADP Reports April Nonfarm Private Employment Decreased 491,000 for more details.

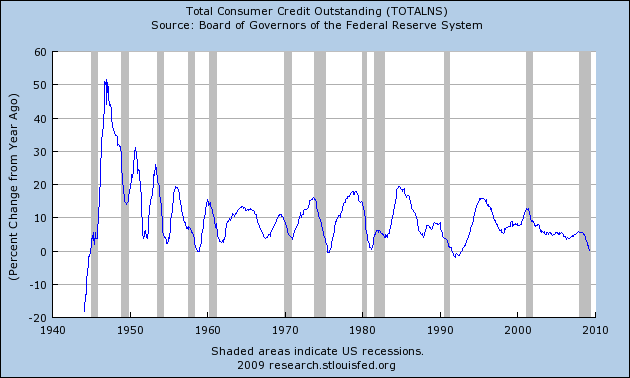

Credit Growth Plunges

Households are cutting back purchases and banks and lenders are curtailing credit as the following chart shows.

Total Consumer Credit Outstanding % Growth

As a sign of consumer retrenchment, banks willingness to extend loans, and rising defaults, we are about to see the first contraction in consumer credit since the early 1990's.

Please see Consumer Credit Plunges Record $11.1 Billion for more details.

Credit Card Lending Goes Full Cycle

In Credit Card Lending Goes Full Cycle I posted an Email from "Scott" who who was denied a credit card from Capital One, on the basis of "worsening economic conditions" in his area. "Scott" says he has a FICO score of 800.

Redlining is back. Capital One admitted it did not even do a credit check on Scott.

A couple more interesting Emails have come in recently. Here is one of them. Jeremy writes:

Mike,

I am from Wisconsin, and had a similar situation as Scott. Our corner gas was a Phillips 66, and had the credit card for the rewards for free gas. Since Phillips 66 is moving their ops out of the Midwest, so they are all switching to British Petroleum (BP). I canceled my credit card, since no more rewards and applied for a BP credit card/Chase. I was denied because they would lose money on me. I questioned the rep and asked for an explanation. She said I was denied credit "because I don't carry a balance". My fico score is 817.

Best Wishes,

JeremyGiven there is no economic driver for jobs, credit card losses will continue to soar. Things will get much worse before they get any better.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.