Swine Flu: A Follow-up on Trading the Hype

Politics / Global Pandemic May 04, 2009 - 04:37 AM GMTBy: Mike_Stathis

Last week I released a piece that no other (qualified) financial professional was willing to expose because (in my opinion) they don’t want the masses to know how event-driven media-hyped trading works. If everyone knew how the game is played, they wouldn’t be able to make the easy money. http://www.avaresearch.com/article_details-170.html

Last week I released a piece that no other (qualified) financial professional was willing to expose because (in my opinion) they don’t want the masses to know how event-driven media-hyped trading works. If everyone knew how the game is played, they wouldn’t be able to make the easy money. http://www.avaresearch.com/article_details-170.html

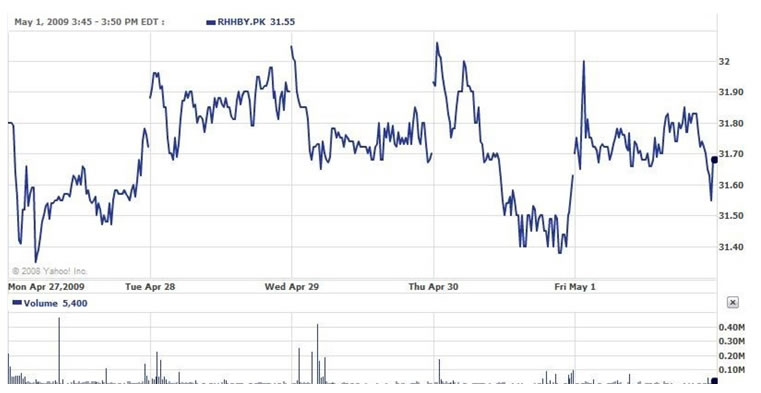

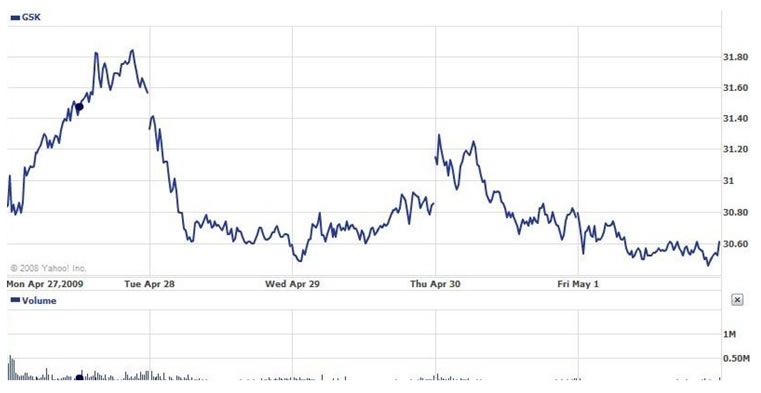

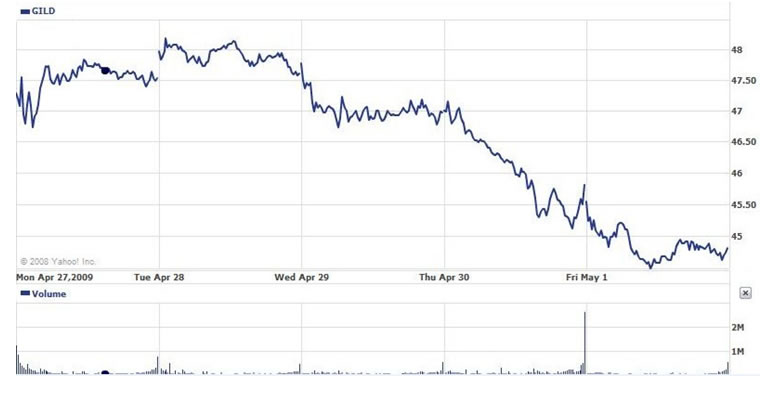

While it’s still early to know for certain whether this virus will live up to its media expectations, let’s check the results of the securities I previously discussed. Note that my earlier piece was published on April 30th. As you check the charts of each security, note the performance since that time.

While it’s still early to know for certain whether this virus will live up to its media expectations, let’s check the results of the securities I previously discussed. Note that my earlier piece was published on April 30th. As you check the charts of each security, note the performance since that time.

As you can see, since my earlier piece was published, NVAX has lost around 36% while BCRX suffered about a 15% loss up until the last couple of hours of Friday’s session. At the close it was about even where it was on April 30th.

Note my warning about Novavax (NVAX) from last week…

“The key thing to focus on here is the trading volume. As you can see, while still holding up, it appears as if it might soon show signs of dropping off. When that happens, look out below. If you’re in this stock, you’d better have stop-losses in place.” http://www.avaresearch.com/article_details-170.html

Also my initial observations as to which of these two stocks (NVAX versus BCRX) looked better….

“Upon examination of the stock price charts for BioCryst (BCRX), we see a similar situation. But there are two notable differences. First, as you can see, the recovery since Monday looks stronger than for NVAX. Also notice the new high made just after the open on Tuesday. And it managed to close higher than the previous day’s close.”

“Looking at the historical chart of BCRX, although the long-term trend mirrors that of NVAX, there are insufficient points to confirm this. In other words, the chances of the trend being broken are somewhat higher than with NVAX.” http://www.avaresearch.com/article_details-170.html

Roche is about even although it too experienced a late trading session surge on Friday. Meanwhile, GSK and GILD are considerably down, especially when you look at the relative strength.

You should also note that the volume is starting to dry up for these stocks – one of the signs I warned to watch out for.

But of course we must also note the performance of the applicable indices over the past few days in order to gauge the relative strength, or in other words, get a more accurate picture of the performance of the swine flu plays.

For NVAX and BCRX, you can look at the Russell 2000. As it turned out, the Russell was very close to even since April 30th (very slightly down). For the other stocks you can look at either the Dow or the S&P 500 Index. I go by the Dow for some very good reasons. Either way, for this exercise it doesn’t matter since both indices were up a bit since I published the earlier piece.

So are these stocks going to continue to lose steam? As I mentioned last week, you have to get a feel for the sentiment, namely what the media is saying because the media guides the sheep. As more sheep are influenced, hedge funds will come in and even buy these stocks to draw more sheep in. These effects are magnified for the small caps (NVAX and BCRX).

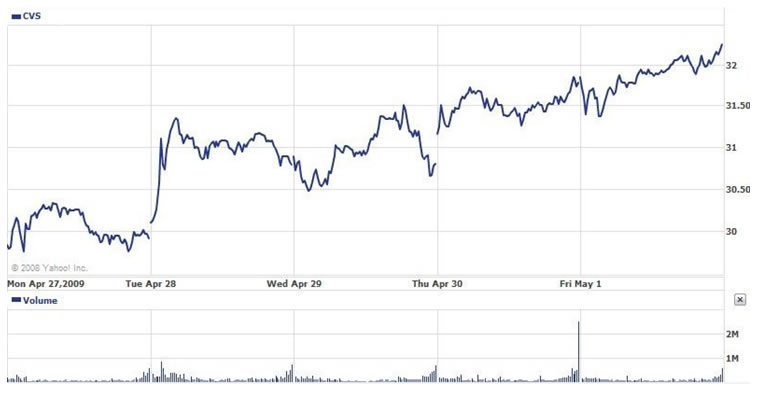

In contrast, the drugstores are looking a little better, much like I first anticipated would happen last week.

“Finally, we turn to the drugstores, thought to be the real benefactors of the swine flu hype. With millions of Americans fooled by the media panic, they’ve flocked to buy surgical masks and gloves. In many locations, supplies have run out. But you can bet it won’t be long before they restock because they know this hype isn’t likely to last long.” http://www.avaresearch.com/article_details-170.html

While WAG is about even since I wrote, CVS is up considerably. Also note that both appear to be increasing in volume. You see, no matter what happens, the drug stores will continue to sell surgical masks and gloves, meds and other related items.

In contrast, NVAX and BCRX are likely to get hammered if in fact this flu doesn’t turn pandemic or at least increase to levels that would warrant valid pandemic warnings. Without that, these two are not likely to get accelerated approval and/or new orders for untested anti-viral agents. However, I would not be surprised to see more spikes and sell-offs due to the obvious volatility.

I still haven’t changed my view from last week about any of these stocks. And I wouldn’t be a buyer of CVS or WAG, despite a good chance that they’ll continue to run up a bit because I view the market risk as a much more important factor to consider. And the market risk is quite high.

When you have a look at some of the headlines circulating in the media, it should be obvious that they are pushing this panic to the max based on the raw data. For instance, have a look at this headline from the sister station of the bubble network… “U.S. flu cases jump as labs catch up.” Without reading the article, in my opinion, the headline implies that thousands have the flu and labs are racing to find a cure! Of course this is by no means the situation. http://www.msnbc.msn.com/id/30398682/

Have a look at a live global map of confirmed swine flu cases. Once again, this is hardly a reason for the media onslaught that seems to keep getting bigger each day. After all, panic sells. http://www.msnbc.msn.com/id/30485593/

I certainly don’t know what that outcome will be, but I would be very surprised if the flu elevated to levels that approached the seasonal flu in America. Keep in mind that anywhere from 30,000 to 50,000 Americans DIE each year during the flu season.

Since I wrote the first piece last week, I ran across a nice piece by a respected physician regarding the swine flu. As you will see, we share similar views. Like me, he isn’t a pill pusher and he knows well about the dangers of an “overprescribed” America.

http://articles.mercola.com/sites/articles/archive/2009/04/29/Swine-Flu.aspx

Regardless what happens, it’s essential for traders to keep your attention on how much the media hypes this flu because it determines what the sheep will do in the stock market. And wolves always prey on sheep, and usually slaughtering them. So which would you rather be?

I want to encourage all who seek the truth and valuable guidance to follow me to my new site www.avaresearch.com (coming in a few days). You won't see me pitching gold or investments to you like others. You will continue to receive nothing but unbiased top-tier insight, education and commentaries.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.