United States Empire Built on False Prosperity Collapsing

Politics / Credit Crisis 2009 Apr 25, 2009 - 09:59 PM GMTBy: James_Quinn

KEEP ON ROCKIN IN THE FREE WORLD - The American Republic is 226 years old. The Roman Empire lasted 13 centuries before collapsing. The Roman emperors attempted to stave off the collapse by providing bread and circuses to the masses. Feeding Christians to lions worked only for so long. I picture Caligula “Mad Money” Cramer exhorting the masses that the worst was over and not to worry about the Vandals and the Huns. Nero “Mustard Seed” Kudlow probably saw a recovery on the horizon as Barbarians were at the gates of the city. Cleopatra “Money Honey” Bartiromo was proclaiming that the stupid masses didn’t know what was best for the system. Caesar “Glimmers of Hope” Obama was sure that if they just distributed more bread and added a few more circuses, things would improve by the Ides of March.

KEEP ON ROCKIN IN THE FREE WORLD - The American Republic is 226 years old. The Roman Empire lasted 13 centuries before collapsing. The Roman emperors attempted to stave off the collapse by providing bread and circuses to the masses. Feeding Christians to lions worked only for so long. I picture Caligula “Mad Money” Cramer exhorting the masses that the worst was over and not to worry about the Vandals and the Huns. Nero “Mustard Seed” Kudlow probably saw a recovery on the horizon as Barbarians were at the gates of the city. Cleopatra “Money Honey” Bartiromo was proclaiming that the stupid masses didn’t know what was best for the system. Caesar “Glimmers of Hope” Obama was sure that if they just distributed more bread and added a few more circuses, things would improve by the Ides of March.

The false prosperity we have been experiencing for the last thirty years has come to an abrupt conclusion in the last 18 months. The amount of wealth destroyed is beyond comprehension. Household net worth has declined by $12 trillion in a matter of months. It will take years for average Americans to restore their wealth to 2007 levels. If your investment portfolio has declined by 50%, it will need to increase by 100% to break even.

![[HouseholdNetWorthQ42008.jpg]](/images/2009/Apr/us-empire-25_image002.jpg)

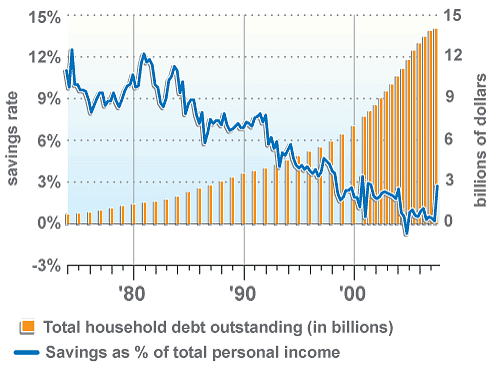

According to the Wall Street shills on CNBC, it should take at least 3 months. An honest financial advisor would tell you 10 to 15 years. Americans have no choice but to substantially increase their rate of savings. Think back to yesteryear in 1981 when the savings rate was 12%. Back then, Americans accept as a truth that hard work and a saving ethic led to long-term success. I can’t look at this chart without questioning why this happened. It always brings me back to the dreaded Baby Boomers. Their delusional belief that somehow they could borrow and spend today with real estate wealth funding their retirement came crashing down around them in the last 18 months. The bailing out of these delusional boomers with tax dollars has generated incredible anger in the country. Those who followed the rules are being compelled by the authorities to pay for the sins of those who didn’t follow the rules.

The stupendous fabric of the country is straining and in danger of yielding to the immense pressure building up in our society. I believe the actions taken by politicians and Washington bureaucrats in the last year have marked a point of no return. If we continue on the chosen path, time or accident will ultimately result in the demise of the Great American Experiment. I’m irate at the government for choosing to bailout excessive risk takers at my expense. There are millions of other Americans who feel the same way. This is why tea parties are taking place across the nation. I truly believe that every American has the right to make his or her own financial decisions. While I do not judge individuals on how they live their lives, I feel entitled to pass judgment on clusters of people whose individual decisions have negatively impacted my life. With the support of Congress, the Treasury and the Federal Reserve, these individuals are seizing my tax dollars as compensation for their idiotic behavior.

Don’t Feel Like Satan

There's colors on the street

Red, white and blue

People shufflin' their feet

People sleepin' in their shoes

But there's a warnin' sign

on the road ahead

There's a lot of people sayin'

we'd be better off dead

Don't feel like Satan,

but I am to them

So I try to forget it,

any way I can.

Keep on rockin' in the free world,

Keep on rockin' in the free world

Keep on rockin' in the free world,

Keep on rockin' in the free world.

Neil Young –Rockin in the Free World

Neil Young wrote the song Keep on Rockin in the Free World in 1989. It is an angry song and I believe its lyrics are more relevant today. Neil and a member of his band, Pancho Sampedro, were glancing at newspaper photographs of the funeral of Ayatollah Khomeini in Iran as the angry mob set American flags on fire and chanted death to America. These Iranians thought America was the great Satan. Sampedro commented, "Whatever we do, we shouldn't go near the Mideast. It's probably better we just keep on rockin' in the free world." I wish we had made this guy our Secretary of State.

When Iraq invaded Kuwait in 1991, President George Bush decided it was America’s responsibility to protect Saudi Arabia’s oil fields and liberate Kuwait from the clutches of the dictator we had previously supported. The American military crushed Sadaam Hussein’s Republican Guard and liberated Kuwait. After the Gulf War, the U.S. left 4,000 American troops in Saudi Arabia, eventually growing to 7,000 troops. These troops became a rallying point for Muslim fundamentalists, who charged the U.S. was trying to increase its influence over the Saudi royal family and the nation's oil reserves. "The presence of the U.S. forces gave a lot of fuel to the virulent, anti-American Islamic forces that certainly commanded an audience in Saudi, and in the broader Arab world," said Jamil Khoury, an Arab specialist and business consultant who teaches at the University of Chicago.

The U.S. has spent $7 trillion on Defense since 1991. Most of these funds were used to develop offensive weapons, not defensive weapons. The Heritage Foundation will argue that military spending as a percentage of GDP was only 4% in 2007, well below the 45 year average of 5.5%. This period includes the Cold War, Korean War, and Vietnam War. The 2010 budget spending will increase it to at least 5.6% of GDP.

The real question isn’t what percentage of GDP is proper it is whether $7 trillion could have been spent more intelligently. Would $4 trillion have been sufficient to defend the country? The military launched approximately 1,000 cruise missiles during the Iraq War at a cost of $1 million per missile. This was a choice to spend $1 billion blowing up bridges, water plants, and electrical facilities in Iraq rather than spending it repairing our 156,000 structurally deficient bridges, replacing our decaying water pipes, and upgrading our electrical grid. Would the $7 trillion have been better spent by private individuals? Could it have been better spent jump starting efforts to wean ourselves off Middle East oil? I don’t know the answer. But, I do know that the vast majority of the $7 trillion was borrowed from China, Japan and my grandchildren.

Kinder, Gentler, Machine Gun Hand

We got a thousand points of light

For the homeless man

We got a kinder, gentler,

Machine gun hand

We got department stores

and toilet paper

Got styrofoam boxes

for the ozone layer

Got a man of the people,

says keep hope alive

Got fuel to burn,

got roads to drive.

Keep on rockin' in the free world,

Keep on rockin' in the free world

Keep on rockin' in the free world,

Keep on rockin' in the free world.

Neil Young –Rockin in the Free World

Neil Young’s cynical view of our President, national priorities, and future was well founded. He saw the social fabric of the country ripping apart in 1989. I believe everyone has a right to live their lives as they see fit. This is America, land of the free, home of the brave. When powerful government bureaucrats choose to subsidize the conscious blunders of others through the utilization of my tax dollars, I’ve got a big problem. There are approximately 308 million people living in the United States. 75 million of these people are under 18 years old and 40 million are over 65 years old. They are generally off the hook regarding the current financial crisis. That leaves 195 million people. The 80 million Baby Boomers (the pig in the python) are at the root of most problems in our society today. As I walked from the parking garage to my office the other day I noticed a license plate on a parked BMW 335i. It read 335-4-NOW. This boomers goal in life was to move up from a $40,000 automobile to a $60,000 automobile. Very noble goal, but it reflects that the priorities for many in this country have become warped.

Approximately 12% of the U.S population (36 million people) is considered poor and are totally dependent upon the State to keep from starving. The working class makes up 40% of the population, the middle class 45%, and the ruling elite class 3%. All of these classes made dreadful mistakes in the last decade. The poor pretended to be middle class. They were able to buy $200,000 houses, lease $30,000 cars, own cell phones, get monthly cable, and eat out three times per week. Their friendly neighborhood banker loaned them the money to live this fantasy life. The working and middle class were able to buy $700,000 McMansions, go on trips to Europe, lease $50,000 cars and generally live the life of the rich and famous. A different banker in a nicer neighborhood also loaned them the money to live like rock stars. A portion of all these classes were the extremists that led us down the erroneous path to destruction..

Extreme behavior by individuals throughout our society, encouraged by banks, the government, Federal Reserve, and the mainstream media have pushed our country to the brink of disaster. Half of the households in America make less than $46,000 per year. I can guarantee you that the household incomes in the neighborhoods of West Philadelphia that I drive through to work every day are much lower than $46,000. Half the houses are boarded up, and rats are the predominant tenants. When I see a middle aged lower income woman driving an $87,000 Mercedes SUV or a young punk driving an $85,000 BMW, I know something has gone seriously off course. The auto financing companies were willing to make 7 year 0% interest loans or $400 a month leases available to these people. They did it because they were able to parcel these awful loans into a package, get it rated AAA by Moody’s and sell the toxic stench bomb to pension funds and life insurance companies. Meanwhile the deadbeats cruising around in the luxury wheels got to live the Fake American Dream for awhile.

Extremism was not relegated to only the poor. The lifestyles of the rich and famous are nauseating and revolting to the average middle class American. Watch one episode of Housewives of Orange County or New York to understand the shallowness and pretentiousness of the privileged rich. Across America there are millions of people whose sense of worth is tied to the McMansion they live in, the brand of car they drive, the school they send their kids to, and the number of electronic gadgets they can accumulate. The majority of these people can be found on the East Coast and West Coast. Wall Street and Hollywood are the Mecca for these arrogant, vain, self centered snobs. The powerful few in our society took extreme risks in the casinos of Wall Street. AIG, Goldman Sachs, Lehman Brothers, Bear Stearns, among others were inhabited by multi-millionaire gamblers. They had already socked away millions in bonuses and stock options, but their arrogance and pride led them to take even more extreme risks. They ultimately destroyed the financial system. Now they want you and I to come to their rescue, for the good of the country.

Let’s See How Far We’ve Come

Said where you going man you know the world is headed for hell

Say your goodbyes if you've got someone you can say goodbye to

I believe the world is burning to the ground

Oh well I guess we're gonna find out

Let's see how far we've come

Let's see how far we've come

How Far We’ve Come - Matchbox 20

I believe the world is burning to the ground. The United States is spending trillions per year propping up social safety nets and waging foreign wars while borrowing the funds to do so. The currency is being debased day by day and will eventually be worthless. Our current path will lead us to hell. I think I can address the anger and disillusionment of the vast majority of hard working Americans:

- The materialism and wastefulness of our society is reflected in how our minimum living standards have changed since 1970. The average household size has declined from 3.1 to 2.5, a 20% reduction. Our average home size has increased from 1,400 sq ft to 2,600 sq ft, an 86% increase. The average number of vehicles per household has increased from 1.1 to 2.3, a 109% increase. Bigger is better has been the American mantra for decades. These figures are skewed, as many people live in 6,000 sq ft McMansions and drive 4 or more cars. It is clear that millions cannot distinguish between a need and a want.

- I bought my home in 1995. The minor upgrades (finished basement, hardwoods) we’ve made over fourteen years were paid for in cash. The other major expenditures were to replace appliances that broke. When the value of the house miraculously doubled between 2000 and 2005, I opened a home equity line of credit with my Credit Union as an emergency fund. It has not been used to take vacations, buy a new car, or install a $25,000 kitchen. The extreme risk takers bought houses with 105% leverage, lied on their mortgage applications, attempted to flip multiple condos, used the appreciation in their home value to live the lifestyle of Madonna and vacationed on the French Riviera. Now the politicians running our government are using my tax dollars to insure that these extreme risk takers stay in their homes. Rewarding reckless behavior leads to more reckless behavior.

- I drive a paid for 7 year old CRV with 120,000 miles. My wife drives a paid for 9 year old Minivan with 95,000 miles. I have never been a car person. My Dad always bought used cars. I don’t see the point in spending money on a depreciating asset. My self esteem is not tied to the car I drive. I’ve owned 2 new cars in the 30 years I’ve been driving. I’ve financed my cars over four years. Every month that I don’t have to make a car payment allows me to put that money towards my kid’s college fund or my retirement account. GMAC, Chrysler Financial, and Ford Credit have been the credit drug pushers that have permitted luxury addicts all over the country to tool around in a Mercedes, BMW, or Porsche of their choice. Shockingly, lending money to subprime borrowers led to billions in losses. GMAC rationally decided in October 2008 to limit loans to people with credit scores above 700. In December the government delivered $5 billion of taxpayer TARP funds to GMAC, who then decided to again lend money to subprime borrowers with 620 credit scores. Their plan is to lose money on these loans, but make it up on volume. When you see an 18 year old punk driving a BMW, you are probably making his car payment.

- We use a credit card to pay for virtually all of our monthly expenses. 1% of the charges go into my son’s 529 college account. I have not paid an interest charge since 1990. I’m a credit card company’s worst customer. No interest income, no late charges and I’ve received maximum rewards. I’m not the average American. The average American owes $9,000 on their credit cards. In a fair world, when these people couldn’t repay their debts the bank would take a major loss and the consumer face bankruptcy with the inability to borrow for years. The top credit card issuers JP Morgan, Bank of America, Citicorp, and Capital One issued credit cards to anyone with a pulse because they just sold the package of bad debt to widows and the Chinese. Then they drank their own poisoned kool-aide. Now our clueless Treasury Secretaries (Mr. Paulson & Mr. Geithner) have shoveled $78 billion of your tax dollars to these banks so they can continue to send out 5 billion credit card solicitations per year to more deadbeats. Loaning money to people incapable of repaying you is generally not a good business practice, except in the America of today.

- Every individual in the United States has right to live any way they choose. Many have chosen to borrow and live the good life today and not worry about tomorrow. They will vote for the politician that promises them bread and circuses without requiring them to sacrifice, save for a rainy day, take responsibility for their future or exercise any self control. This is where reality and fantasy meet. People can only borrow and spend if the Federal Reserve and bankers provide the funds to do so. By creating money out of thin air and handing it out to people with no legitimate means of repaying, the bankers who run this country have put this country on the road to ruin. The government solution is to confiscate your tax dollars, give it out to bankers, who will lend it to new subprime borrowers, who will not repay these debts. They are doing this in a last ditch attempt to retain power and control.

The people of our great country must heed the words of David Walker, unless we want it to collapse into a heap of smoldering ashes.

“The US government is on a ‘burning platform’ of unsustainable policies and practices with fiscal deficits, chronic healthcare underfunding, immigration and overseas military commitments threatening a crisis if action is not taken soon. There are striking similarities between America’s current situation and the factors that brought down Rome, including declining moral values and political civility at home, an over-confident and over-extended military in foreign lands and fiscal irresponsibility by the central government.”

Let’s see how far we’ve come. I guess we’re going to find out.

If you are seeking the truth, join me at www.TheBurningPlatform.com .

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.