Financial Markets Moving On Thin Volumes

Stock-Markets / Financial Markets 2009 Apr 13, 2009 - 07:37 AM GMTBy: PaddyPowerTrader

With today being Easter Monday, many markets across the world are closed. However the US is open, as well as the FX markets. The volume will be very thin… and that could lead to…. wild swings! So watch out.

With today being Easter Monday, many markets across the world are closed. However the US is open, as well as the FX markets. The volume will be very thin… and that could lead to…. wild swings! So watch out.

Hi it’s the Galloping Zebu with the Market Watch today as The Mole is on holidays for the week.

Today’s Market Moving Stories

- The Sunday Business Post, normally quite accurate in their reports, ran with a story that the Irish government may take a majority shareholding in AIB. This is an interesting turn of events, but we’ll have to wait until Tuesday morning to see what effect this will have on the share price. If interested, check out my December 8 piece “A Bad Bank Solution For The Irish Banks”, written long before “economist” David McWilliams or trouble-shooter Peter Bacon thought it was a good idea.

- German finance minister Peer Steinbruck said that he has devised a master plan to help struggling German banks, but was opposed to creating a single “bad bank” for problem loans saying the respective banks and their shareholders would have to take on the highest possible degree of responsibility for their own toxic assets.

- Following last week’s supplementary budget, Ireland’s deficit is forecasted to rise to 10.75% of GDP this year. Despite this, Peter Sutherland, former EU commissioner and now chairman of BP, says that Ireland’s problems are acute in nature rather than chronic. The basic strengths of the economy remain formidable.

- Japan’s Corporate Goods Price Index tumbled 2.2% in March from a year earlier. Bigger than expected, that’s the largest such drop since May 2002. The yen has been slipping in the past few days on speculation the global financial crisis is easing, spurring investors to buy higher-yielding assets financed with the Japanese currency. USDJPY is higher again this morning, holding solidly above the 100 mark.

- Billionaire investor George Soros has been giving his two cents on the recent stock market action. “It’s a bear market rally because we have not yet turned the economy around… This isn’t a financial crisis like all the other financial crises that we have experienced in our lifetime.” So where is Soros putting his billions? “I think Brazil actually, together with China, will be among the recovering countries. The outlook for Brazil is better than for most other countries.”

- The US Trade Deficit plunged to $26 Billion in February vs a consensus of $36 Billion. Imports fell 5.1%, which is a pretty hefty drop. Seems that Americans have finally quelled that binge. Remember that the deficit was over $60 billion only last year. This is pretty good news for the US Dollar, which went on a bit of a rampage.

- China is starting to get a bit serious about this whole reserve currency thing. They are now pushing for settlement of contracts in renminbi / yuan instead of US Dollars. This is similar to when Iran was saying over and over again that they no longer would settle oil contracts in US Dollars but that move never came to fruition. I wonder if it will be different with China.

The Importance Of Earnings Surprises

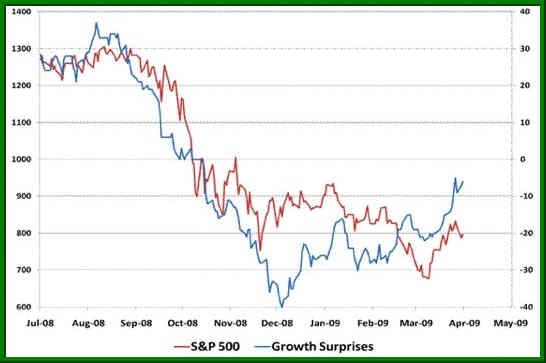

As we enter Q1 US earnings season, it’s key to note the important effect that earnings surprises have on the stock market. The graph says it all really – they are remarkably well correlated. A rising line means that economic data is generally coming in above expectations, while a falling line means that the data has disappointed. A descending line could be the result of an economy that is not expanding as quickly as economists predict or, like in 2008, it could be the result of an economy that is contracting at a faster rate than expected.

This current stock market rally seems to be centred on a view that the economy is performing less badly than expected. If true, then we should see a whole host of positive earnings surprises in the coming few weeks and the blue line should continue to tick up.

But watch out because even if the economy has bottomed, it’s very likely that the eventual recovery will prove to be uneven, causing the flow of positive surprises to be uneven. During these periods, the risks to stocks will be greatest when the market is overbought and investors have priced in high expectations of positive data surprises continuing.

The Airline Boneyard

Nearly 40 airlines around the world have gone under since the recession began, and the airlines still running have promised to ground over 1,700 planes to match dwindling demand. Turns out you can’t just keep your 747 in the garage, and thus desert salvage yards are reaping exceptional rewards. The number of commercial planes in long-term storage has jumped 29% over the last two months, to over 2,300. The image is of the Evergreen Air Centre in Arizona, where 204 jumbo jets now sit. Evergreen charges $60,000 a year to park your plane in their dirt patch. Good work if you can get it.

Nearly 40 airlines around the world have gone under since the recession began, and the airlines still running have promised to ground over 1,700 planes to match dwindling demand. Turns out you can’t just keep your 747 in the garage, and thus desert salvage yards are reaping exceptional rewards. The number of commercial planes in long-term storage has jumped 29% over the last two months, to over 2,300. The image is of the Evergreen Air Centre in Arizona, where 204 jumbo jets now sit. Evergreen charges $60,000 a year to park your plane in their dirt patch. Good work if you can get it.

Economic Data Today

Not a lot of action today on the economic data front. New Zealand Retail Sales are out later this evening. But it’s not that important to be honest as the currency has had quite muted moves in the recent past in reaction to its release.

On Tuesday we will see some big economic releases with the headliners being US PPI and Retail Sales.

And Finally… Bugs Bunny Buys Bonds

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.